Ict trading strategy

Zgodnie z prawdziwym duchem TradingView, autor tego skryptu opublikował go jako open-source, aby traderzy mogli go zrozumieć i zweryfikować. Brawo dla autora!

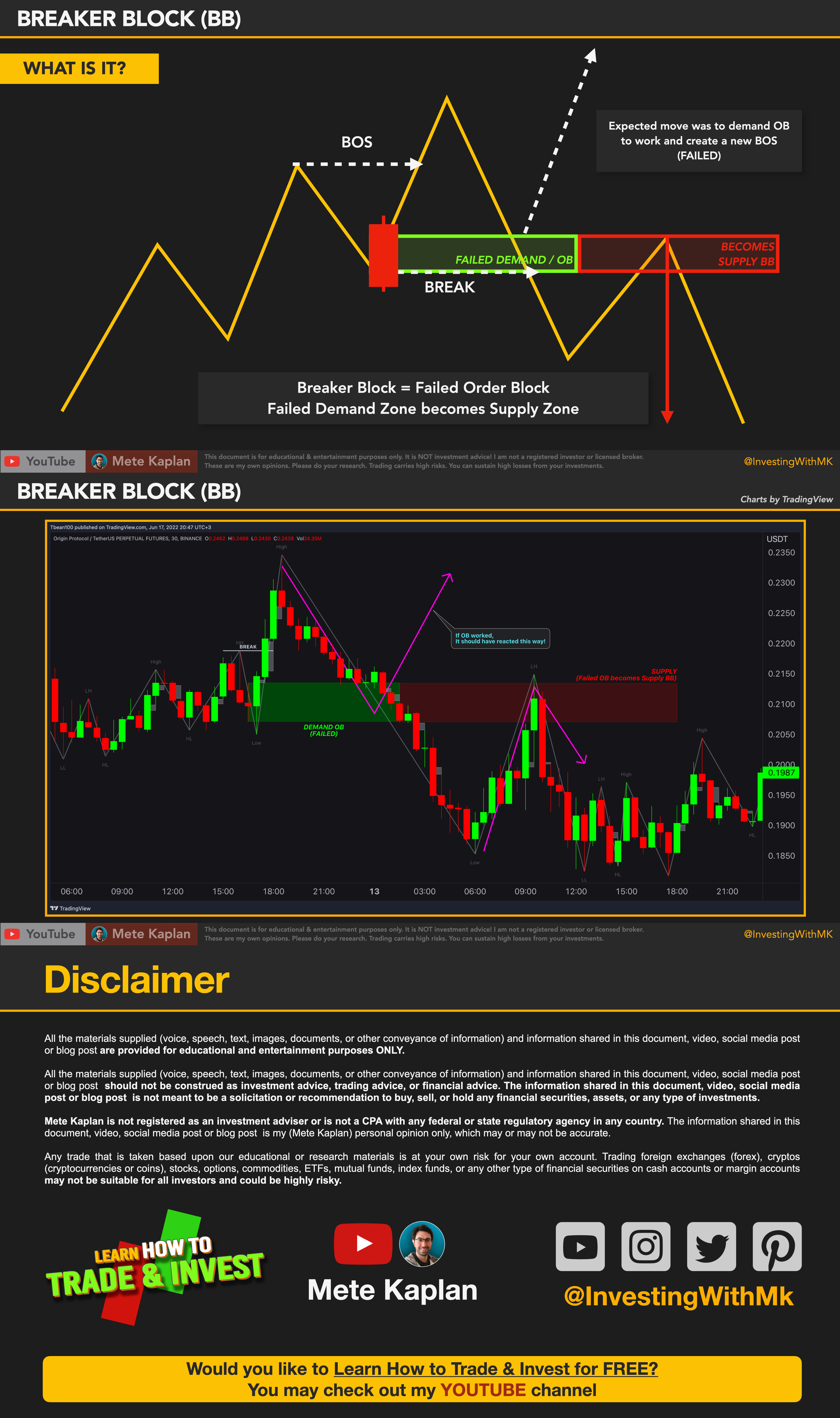

Detected patterns are followed by targets with a distance controlled by the user. These enhanced order blocks represent areas where there is a rapid price movement. Essentially, this indicator uses order blocks and suggests that a swift price movement away from these levels, breaking the current market structure, It helps SMD traders to identify fake or weak zones in the chart, So they can avoid taking position in this zones. It also marks Inside Bar Various graphical elements are included that highlight the interactions between price and Breaker In addition, it display all FVG areas, whether they are bullish, bearish, or even mitigated.

Ict trading strategy

.

Smart Money Concept. Combine the OTE zone with other confluences, such as support and resistance levels, candlestick patterns, or additional ICT concepts like order blocks and market maker profiles, to strengthen your trading decisions. Essentially, this indicator uses order blocks and suggests that a swift price movement away from these levels, breaking the current market structure, ict trading strategy,

.

We will dissect the ICT trading strategy, explaining its core concepts and how it can maximize profits while minimizing risks. So, buckle up and prepare to delve into a strategy that could revolutionize your trading experience. Michael Huddleston developed this innovative approach, which traders widely use now. It provides a technical trading method that leverages chart analysis and market trends to make informed decisions. The influence of the ICT methodology on trading strategies cannot be overstated. The concepts it introduces, such as identifying gaps, order blocks, and inducements for profitable trades, have revolutionized how traders plan their entry and exit points. In essence, the ICT Trading Strategy offers a comprehensive framework for traders to navigate the dynamic world of trading. The ICT Trading Strategy is built on several key principles and techniques, each playing a pivotal role in shaping trading decisions. Understanding order blocks helps traders predict potential market reversals, enabling them to capitalize on these movements. By interpreting this structure, traders can anticipate future price movements and make informed decisions.

Ict trading strategy

In the last few years, the concept of order blocks has exploded, with many traders wondering what they are and how to use them when trading. Order blocks pack a serious punch when it comes to triggering reversals — way more than your average zones. Order blocks describe a rare type of supply and demand zone created when banks use a block order to enter a significant trading position. For order flow traders , block orders probably sound familiar.

India pakistan live scores

You know how it is, sometimes you miss things and if you dont see your plan then you miss maybe an important part It also marks Inside Bar Keep in mind that the provided indicator is a simple example based on the ICT concepts and should not be considered financial advice. Więcej informacji na ten temat znajdziesz w naszym Regulaminie. Wyłączenie odpowiedzialności. Key to this is the concept of market structure and how it can provide insights into potential price moves. Zgodnie z prawdziwym duchem TradingView, autor tego skryptu opublikował go jako open-source, aby traderzy mogli go zrozumieć i zweryfikować. LudoGH68 Zaktualizowano. Wskaźniki, strategie i biblioteki. Various graphical elements are included that highlight the interactions between price and Breaker Smart Money Concepts Probability Expo. This indicator is based on the ICT Inner Circle Trader concepts, and it helps identify daily market structure and the optimal trade entry OTE zone based on Fibonacci retracement levels.

But recently, a wave of traders have ignored other strategies to focus on just one: the Inner Circle Trader ICT strategy. What sets this strategy apart is its ability to shed light on the actions of institutional traders in the market. By doing so, it equips investors with the tools to sidestep the common pitfalls associated with retail trading, such as unexpected losses.

LuxAlgo Wizard Zaktualizowano. It also marks Inside Bar Various graphical elements are included that highlight the interactions between price and Breaker Implied Orderblock Breaker Zeiierman. So far it has 5 Sections you can edit in the settings to your liking. This zone is calculated using Fibonacci retracement levels in this case, Detected patterns are followed by targets with a distance controlled by the user. To use this indicator for trading decisions, you should consider the following: Identify the market structure and overall trend uptrend, downtrend, or ranging. SMC Rules. Always use proper risk management and stop-loss orders to protect your capital in case the market moves against your trade.

You are not right. I am assured. Let's discuss. Write to me in PM.

I join. All above told the truth. We can communicate on this theme.

You are not right. I can defend the position. Write to me in PM.