Interactive brokers futures fees

Low commissions with no added spreads, ticket charges, platform fees, or account minimums. The below schedule of fees applies only to clients who execute futures trades with IBKR and then give them up for carrying by another broker. Execution Only Commissions, interactive brokers futures fees.

Low commissions on products across global markets No added spreads, ticket charges, platform fees, or account minimums. IBKR Lite. IBKR Pro. View commission details for more information on transaction fees, minimums and maximums. We understand your investment needs change over time.

Interactive brokers futures fees

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. After TD Ameritrade was acquired by Charles Schwab in , the integration between these two top-rated brokers is expected to conclude in late TD Ameritrade is no longer accepting new clients. As a result, this review will no longer be updated.

Singapore residents can trade CFDs except those based on underlyings traded in Singapore.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Available for US stocks, options, futures and futures options. Broker-assisted trading is available for US stocks, options, futures and futures options with minimum order size of 10, shares or contracts. To discuss how IBKR can help with your trading needs, please contact our trading desk at , or via email at optiondesk interactivebrokers. Use IBKR's trade block desk when you are away from your computer, or if you just want another set of eyes watching your orders and updating you on market changes. Enjoy direct access to the block desk with no phone queue or hold time. Commissions Trade Desk. United States. Disclosures IBKR may change these rates at any time in its sole discretion.

Interactive brokers futures fees

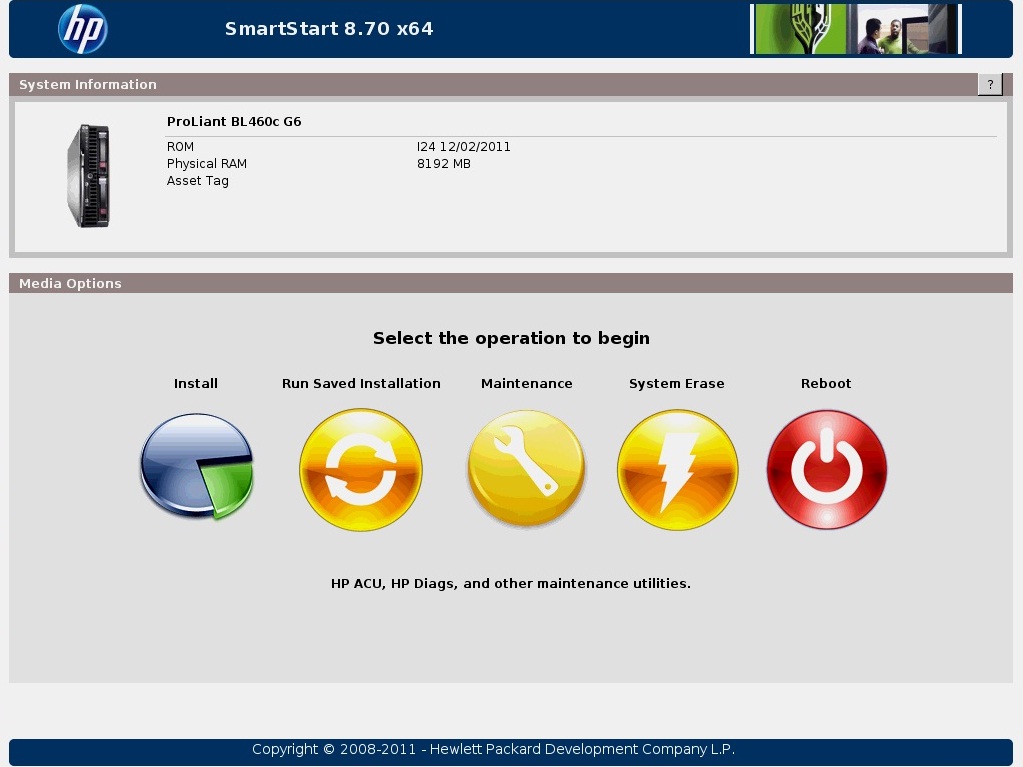

Low commissions with no added spreads, ticket charges, platform fees, or account minimums. The below schedule of fees applies only to clients who execute futures trades with IBKR and then give them up for carrying by another broker. Execution Only Commissions. Montreal Exchange. Overnight Position Fee. Interactive Brokers Home. Commissions Futures. North America Europe Asia-Pacific.

Dominican republic travel adaptor

Client Portal. When you trade stocks with ProRealTime Trading, your order will be automatically routed to the exchange offering the best price. While TradeStation has been known for catering to high-net-worth , experienced, and active traders, the company has undergone somewhat of a rebranding by expanding its reach to investors of all experience levels. London Stock Exchange. Both brokers also have web, desktop, and mobile versions of the trading platforms. Open an account. Both apps also support a wide range of order types, including conditional orders and the easy ability to choose an options strategy, such as vertical and calendar spreads, butterfly, and condors using drop downs. For both brokers, users can build their own screens, screen based on technical factors, save screens for future use, and create a watchlist from screen results. Interactive Brokers has robust investor education programs available to customers and the public. Use profiles to select personalised advertising. Overview of Fees Clients and as well as prospective clients are encouraged to review our website where fees are outlined in detail. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. TDA is our top pick for investor education because it has all the information you could ask for tailored to every level of investor. For the lower starting ranges, the lower margin rates, and other potential cost savings to the investor, Interactive Brokers wins the cost category. Streaming real-time quotes, charting, and news are available across platforms, even if you're using multiple devices simultaneously.

Low commissions with no added spreads, ticket charges, platform fees, or account minimums.

TDA is our top pick for customer service overall in the review cycle. Finally, to assist in delivering price improvement on large volume and block orders and take advantage of hidden institutional order flows that may not be available at exchanges, IBKR includes eight dark pools in its SmartRouting logic. Interactive Brokers still remains focused on the more sophisticated, active trader with its Pro account but offers similar options to more novice investors with its IBKR Lite account. No minimum fee per order Lower contract fees If you meet the Trader pricing conditions during a 3 month period, you can request via email to upgrade to get lower fees. Costs passed on to clients in IBKR's Tiered commission schedule may be greater than the costs paid by IBKR to the relevant exchange, regulator, clearinghouse or third party. Additional exchange and clearing fees may apply in addition to the maximum fee per order. Please enable JavaScript support in your web browser's properties. Home Why choose ProRealTime? Euronext Paris, Brussels, Amsterdam. IBKR requires all users to be two-factor authenticated and does not allow users to partially or fully opt out. TD Ameritrade has a full suite of the most common order types, such as market, limit, stop-limit, and trailing stop orders. TradeStation also offers a sizable collection of trader education presentations and courses through its affiliate, YouCanTrade. Such adjustments are done periodically to adjust for changes in currency rates. ProRealTime offers reception and transmission of orders services on leveraged financial instruments with the broker Interactive Brokers who provides order execution services.

I apologise, but, in my opinion, you are not right. I can prove it. Write to me in PM, we will communicate.

It was specially registered at a forum to tell to you thanks for the help in this question.

I am final, I am sorry, but it does not approach me. I will search further.