Investing materias primas

The Trend Change Indicator is an all-in-one, user-friendly trend-following tool designed to identify bullish and bearish trends in asset prices, investing materias primas. It features adjustable input values and a built-in alert system that promptly notifies investors of potential shifts in both short-term and long-term price trends. This alert system is crucial for helping less active

Add another dimension to your portfolio with commodities Do you know how commodities stack up against other investment options? Investing In Commodities For Dummies is a straightforward resource that provides an in-depth look at what commodities are and how they might prove beneficial to your portfolio. This approachable reference covers the basics on breaking into the commodities market while dispelling myths and sharing a wide range of trading and investing strategies. Simply put, it spotlights the opportunities on the commodities market while leading you away from the mistakes that have plagued other investors. Use this text to understand how to diversify your portfolio, measure risk, and apply market analysis techniques that guide your decision-making. Commodities, including oil, silver, gold, and more, play an important role in everyday life.

Investing materias primas

.

Materias primas. Trend Change Indicator. It compares the price of a given asset to the index value.

.

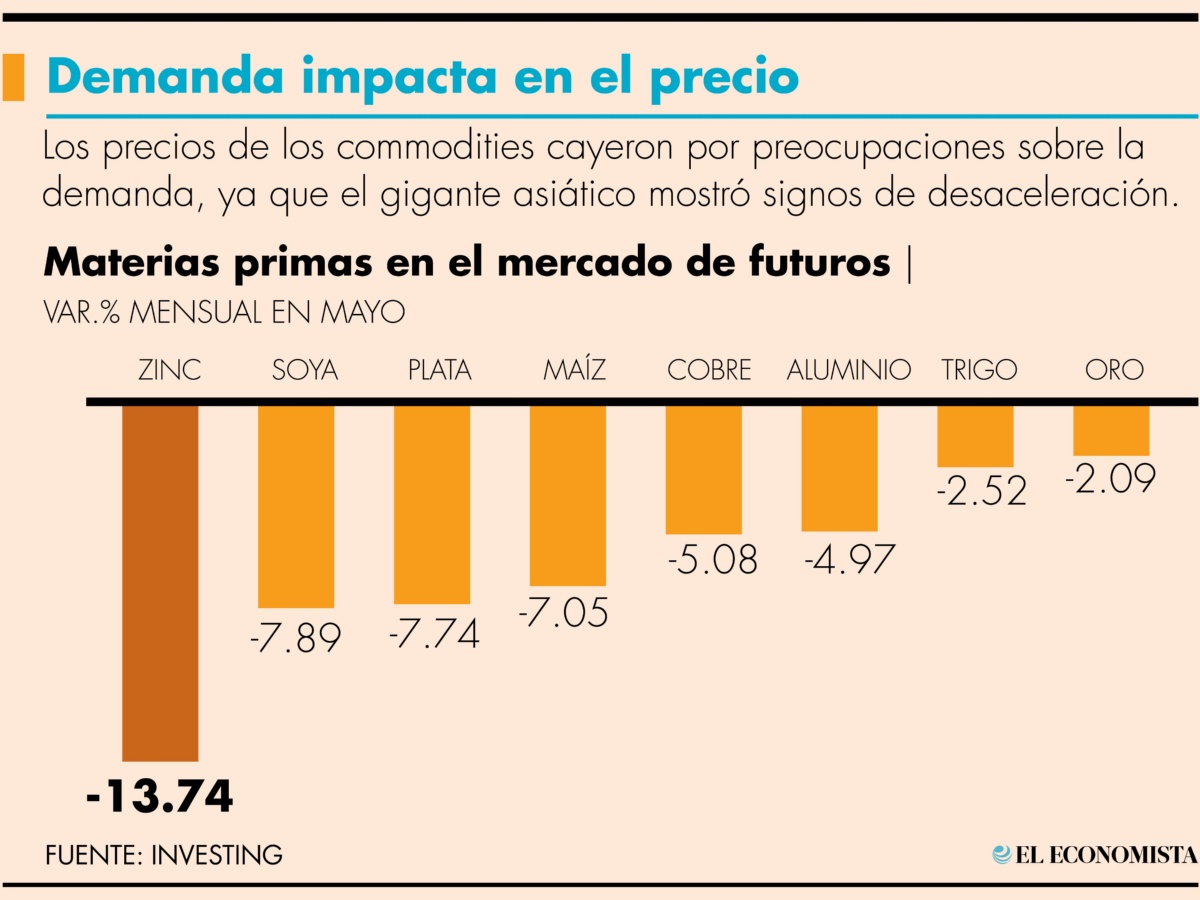

Inicio Trading. Encuentra el mejor broker. Autor Bruno De La Garza. Revisor Humberto Calzada. Invertir en materias primas o commodities es una excelente manera de diversificar un portafolio de inversiones. El trading con materias primas generalmente se realiza en mercados de futuros, donde los inversores especulan sobre el precio futuro de una materia prima comprando o vendiendo contratos de futuros. Los mercados de materias primas incluyen los mercados de futuros, opciones, contratos por diferencia CFD y otros. Invertir y hacer trading en materias primas son dos enfoques diferentes para obtener beneficios en los mercados de materias primas. Objetivos a largo plazo vs.

Investing materias primas

Una materia prima es un producto sin procesar que debe ser homogeneizado para que pueda introducirse dentro de los mercados. Esto da como resultado una materia prima en concreto. Pongamos por ejemplo el caso del acero, que puede comprarse al mismo precio en cualquier parte del mundo. Invertir en materias primas supone hacerlo en un mercado ciertamente complejo , ya que no se trata de inversiones ciertamente aseguradas. Nosotros, como inversores, somos los que determinamos el riesgo que vamos a asumir a la hora de invertir en materias primas. Sin embargo, quitando el factor del desconocimiento, el principal riesgo de invertir en materias primas es que estos productos cuentan con una volatilidad alta. Por otro lado, son unos productos altamente especulativos y que, para los inversores cortoplacistas, son un instrumento para obtener mucho beneficio en poco tiempo, debido al apalancamiento. La bolsa ofrece una buena variedad de materias primas con las que poder negociar. Generalmente, hablamos de oro, plata, platino, paladio o diamantes. Son materias primas muy importantes para el desarrollo del ser humano y de la industria.

Nursing memes night shift

Here is my "Williams Percent Range with Trendlines and Breakouts" indicator, a simple yet powerful tool for traders. The Price of Hard Money. Los futuros de divisas funcionan de la misma manera y se utilizan para especular sobre los movimientos de los tipos de cambio. Add another dimension to your portfolio with commodities Do you know how commodities stack up against other investment options? This script displays information about the components of the Goldman Sachs Commodity Index. Personally I found a lot of problems while detecting the trend direction. Investing Zones. This script integrates a range of critical economic indicators, including unemployment rates, inflation, Federal Reserve funds rates, consumer confidence, and The Market Health Monitor is a comprehensive tool designed to assess and visualize the economic health of a market, providing traders with vital insights into both current and future market conditions. Use this text to understand how to diversify your portfolio, measure risk, and apply market analysis techniques that guide your decision-making. Scalping is not an easy task to do. Compartir en: Facebook Twitter. Note: I have been testing on a 15min timeframe. Recession Warning Traffic Light.

El comercio de especias literalmente dio forma al mundo moderno. Los animales, textiles y joyas que se desplazaban a lo largo de la Ruta de la Seda hacia el mercado forjaron lazos entre Europa y Asia. Los vikingos zarparon hacia tierras en busca de cereales y ganado.

Materias primas. ES Empiece. Still using the standard DXY weights, this indicator allows you to create a tailored index for other currencies, provided that a currency pair exists for each of the 6 components Essentially a modification of the Correlation Coefficient indicator, that displays a 2 ticker symbols' correlation coefficient vs, the chart presently loaded.. Traders, i have been observing crude oil for about 3 months now and somehow I can see that crude is respecting 42 days Moving average and crosses have created massive spikes most of the time. Depending upon your current investment portfolio and your financial goals, it might be a great idea to add commodities to your strategy. Investing in commodities for dummies Autor: Bouchentouf, Amine. Market Relative Candle Ratio Comparator. Price Average Zones. This approachable reference covers the basics on breaking into the commodities market while dispelling myths and sharing a wide range of trading and investing strategies. This indicator can only be used with 'GOLD' ticker.

0 thoughts on “Investing materias primas”