Is rbc swift code same for all branches

If you're sending money to the Canada from overseas, you will need to provide this number, plus your recipient's full name and bank account number. SWIFT codes are alphanumeric codes of between characters that identify four things about a financial institution:. It is usually a shortened version of the name of the bank itself.

We recommend double-checking to make sure your transfer is going to the right place. If so, then you should beware of hidden bank fees and consider using a digital provider to save money instead. To see why we recommend most people avoid the bank for international money transfers, select the link below that applies to your situation:. If you're sending money internationally to an RBC bank account in Canada through your local bank, the transaction will likely be much pricier than it ought to be. This is because fixed international bank transfer fees, bad exchange rates, and correspondent banking fees can stack up very quickly.

Is rbc swift code same for all branches

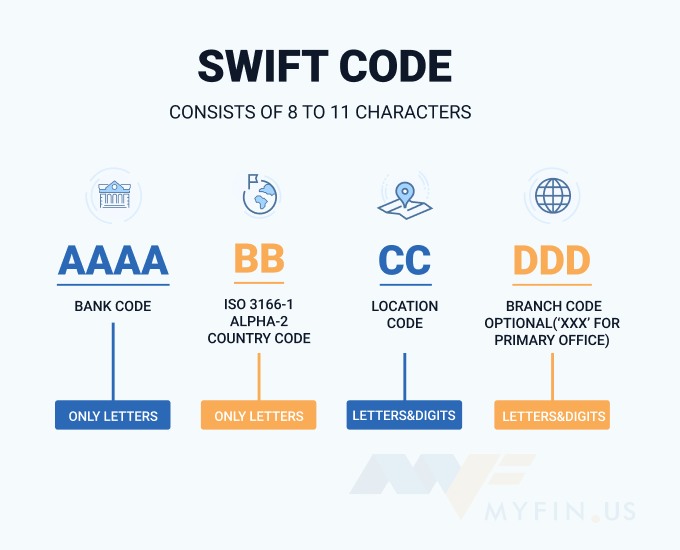

Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them. SWIFT codes comprise of 8 or 11 characters. All 11 digit codes refer to specific branches, while 8 digit codes or those ending in 'XXX' refer to the head or primary office. SWIFT codes are formatted as follows:. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. That's because the banks still use an old system to exchange money. We recommend you use Wise formerly TransferWise , which is usually much cheaper.

If you choose to send money through your bank you may be able to set up your payment online or by phone. Receive Money Get paid at the real exchange rate by using Wise. These codes are used when transferring money between banks, particularly for international wire transfers.

.

A SWIFT code or BIC code is a unique code that identifies financial and non-financial institutions and is mainly used for international wire transfers between banks. Banks use SWIFT for international transfers, but it's not the most efficient or cost-effective solution as you you might get a bad exchange rate and pay high fees. We recommend using Wise, formerly TransferWise , which is up to 5x cheaper and gives you a great rate. You have probably come across the need to find a swift code or BIC code because you were asked for it through web banking while trying to wire money to a different bank than yours. This is because almost all banks in the world are members of the swift network that is responsible for money transfers and messages between financial and even non-financial institutions, and this system requires the use of these codes.

Is rbc swift code same for all branches

We recommend double-checking to make sure your transfer is going to the right place. If so, then you should beware of hidden bank fees and consider using a digital provider to save money instead. To see why we recommend most people avoid the bank for international money transfers, select the link below that applies to your situation:. If you're sending money internationally to an RBC bank account in Canada through your local bank, the transaction will likely be much pricier than it ought to be.

Hawaiian garland 3 letters

RBC International Wires. Transfer Specialists vs Banks. To make life even easier, you can use our SWIFT code search tool , and browse by bank name and location to find the details you need. SWIFT codes are widely supported in almost all countries. SWIFT codes are formatted as follows:. You join over 2 million customers who transfer in 47 currencies across 70 countries. Are you overpaying on bank transfer fees? It's called the Wise Account and it's available for both individuals and businesses. You'll be able to send money online and have it delivered directly to your recipient's bank account. With their smart technology:. Save up to 6x when you use Wise to send money. You'll be able to find the SWIFT code for your bank by logging into online banking, or checking an account statement. At Monito, we analyzed the cost of sending money with around 50 major banks in eight countries around the world, and we can confidently say that we don't recommend using your bank to send money to Canada. The downside of international transfers with your bank When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. Using a Wise Account available in Canada , you'll get local bank account details for 10 different currencies.

Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive.

However, some banks may use different SWIFT codes for different branches, or depending on the type of transaction you're making. SWIFT codes are formatted as follows:. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. Additionally, bank transfers via the SWIFT network tend to take quite long between one and five business days on average , meaning they're not a good option if you want to make a speedy transfer. I'm in Canada, receiving money from overseas scroll down What's more, you'll be able to send, hold, spend, and receive Canadian dollars and other foreign currency at the mid-market exchange rate with low, transparent fees. Using an incorrect code for your payment may mean it's delayed, returned, or sent to the wrong place entirely. Compare a few providers to find the best fee and exchange rate, and then simply select 'send money' to get started. Send Money Receive Money. These codes are used when transferring money between banks, particularly for international wire transfers.

I can consult you on this question.

You are absolutely right. In it something is and it is excellent idea. I support you.