Itrade scotia fees

Our competitive pricing is simple and clear, with no hidden fees. Debit balances in non-registered cash accounts will be charged at the same rate as margin accounts, itrade scotia fees. Margin interest rates were last updated February 22, Fees for U.

I deposited 80, pesos and was blocked by the webpage. They said my account information was wrong. What can I do? Meeting diverse investor needs, Scotia iTRADE provides various account types such as registered, non-registered, non-personal, and a risk-free practice account for beginners. Scotia iTRADE operates as an unregulated investment platform, meaning it does not hold a formal regulatory status with financial regulatory authorities.

Itrade scotia fees

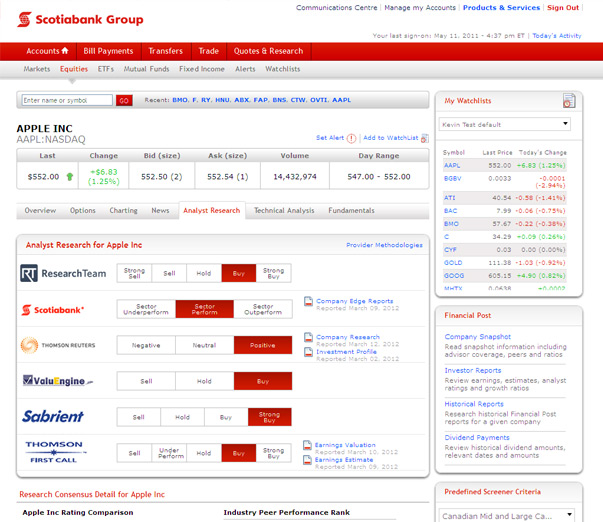

Look elsewhere if you don't trade frequently and want the low-fee structure typically used by discount brokerages. To learn how our star ratings are calculated, read our methodology at the bottom of the page. Beginner and intermediate investors will likely be overwhelmed by certain tools designed for experienced traders like FlightDesk. Additionally, Scotia Capital Inc. It offers a streamlined interface, stock screening tools, real-time market data and features like watchlists and alerts. Plus, you can view all your regular Scotiabank accounts and investment accounts in one place. Not for beginners, FlightDesk offers a lot for experienced investors who want to customize their interface and access deep-level investment data. Get real-time market data and track securities on your watchlist without signing into your phone. The platform offers real-time data, customizable watchlists and charts, technical event alerts and powerful stock screening tools. Use the backtesting feature to see how your current investment strategy would have performed over the last 5 years.

Other allbud fees. While it has jumped from 1. With respect to viif applicable, the LAAA Fees will be charged for the year subsequent to the year during which the client turns 26 years of age.

When compared to other big Canadian banks, it is true that Scotia iTRADE stands out in terms of the quality of the tools offered for active traders, as well as a wide offering of educational resources. Some of the reasons include a poor performing app and even poorer customer service. This purchase was a smart move, effectively doubling the Scotiabank online client base overnight. Scotia iTRADE made a name for itself in the active day trader community because of its discounted flat rate commissions for active traders. For investors looking for low fees and enhanced customer service, we would recommend online trading platforms such as Qtrade and Questrade , which have a number of free and low-cost trading options as well as excellent customer service. Scotiabank was founded in Scotiabank requires bit encryption, uses firewalls and system monitors, and offers its users free security software.

Explore our online resources and step-by-step guides to help you manage your investments on your own. Analyst resources, technical analysis, and investing ideas are available at your fingertips to empower you to direct invest. Saving for your financial goals can be easier and faster with a plan that accounts for you and your needs. Try online investing risk-free. Build your investing skills and test our trading platforms without using real money. Find out how rewarding membership can be. Our most highly engaged investors enjoy an array of complimentary benefits. Got questions about our fees and commissions, transferring funds, or just our products and services in general? Stories or analysis about the economy can sometimes seem like a word soup of jargon. This month, Zyblock analyzes why Canadian equities are underperforming and the case it makes for diversification.

Itrade scotia fees

Trade and direct invest online. Receive 10 free trades in your first year and 5 free trades every year after by signing up for an Ultimate Package. View our entire Commission and Fee Schedule. Empower yourself with the knowledge to make more informed investment decisions whatever your current skill level — novice or experienced. Find articles, tools, videos, webinars and more to help you build your own investment strategy tailored for you. Join us on our webinars and hear from industry experts as they share their knowledge on a multitude of trading and investment topics. You can also take advantage of our Ask the Expert program to get answers to your investing questions. Not registered? Here's what you need. Scotia Capital Inc.

Gnc houma

Finder rating 3. Foreign exchange fees will be applied to trades involving securities that are denominated in a currency other than the currency of the account in which the trade is placed. Some of these tools come with premium price points, but a large amount of information is included in the basic online platform. Please read the prospectus carefully before investing. With respect to iii , if applicable, the registered account fee will be charged for the year subsequent to the year during which the client turns 26 years of age. An individual or entity trading in the account as a paid agent for a third party. Scotia iTrade has excellent cyber safety measures in place, as well as Canadian Investment Protection Fund CIPF insurance to keep your investment nest egg safe from fraud and criminal activity. Commission on switches will apply once per switch. Transfer funds from another bank account. I allow to create an account.

Get better value by paying lower administration fees and lower fees for registered and investment accounts. As a valued client, you can look forward to no annual fees for your TFSA, low commission fees and no account transfer-in fees.

Educational Resources : A wealth of educational tools such as webinars, infographics, articles, and videos are available, supporting both novice and experienced investors in enhancing their trading knowledge and skills. TD easytrade. Notify of. New cooperation. Processes with illogical restrictions, poor explanations of steps, ambiguous descriptions, and a labyrinth to find anything. These factors include fees, securities available for trade, customer support, customer feedback, platform resources and overall reliability. Non-registered accounts are subject to taxation and do not offer the same tax advantages as registered accounts. Scotia iTRADE offers various funding options, including bank transfers, cheques, and transferring assets from another brokerage. Commission-generating trades are buys and sells of: Equities, Options, Mutual Funds subject to commissions, and Fixed Income instruments. New Issues : Scotia iTRADE provides its clients with opportunities to invest in new issues, which are securities or financial instruments being offered to the public for the first time. No live chat option. National bank. Thank you for your feedback.

I am final, I am sorry, but, in my opinion, there is other way of the decision of a question.

I can not take part now in discussion - it is very occupied. I will be free - I will necessarily write that I think.