J10 stock transfer form

The form should be emailed instead. If the form cannot be emailed, HMRC provides advice on posting forms.

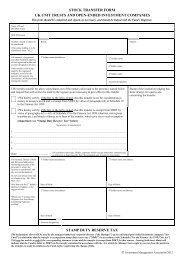

Shares may exist with a company that are partly paid or unpaid. But, to avail the maximum benefits, you would have to convert it to fully paid shares. In order to completely transfer unpaid or partly paid shares, you would have to fill the J10 form. This stock transfer form requires the signatures of both the transferor and the transferee. This form serves as a contract which entitles the transferee to be liable for all future calls on the shares he holds.

J10 stock transfer form

We guarantee every document we sell. We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted. We explain what to edit and how in the guidance notes included at the end of the document. Email us with questions about editing your document. Our documents comply with the latest relevant law. Our lawyers regularly review how new law affects each document in our library. A share transfer form is a legal record of the change of ownership of company shares between two people or entities. There used to be two types of transfer form: the J10 was used for two or more transferors and the J30 for where there was just one. Our form provides for one or two. The form can be used to transfer ownership of any shares or other financial instrument in any private limited company ltd or public limited company plc incorporated in the UK. Company law provides for a transfer form to be signed either by the transferor only, or by both the transferor and the transferee. Because very few companies require the signature of the transferee, the older standard form of articles of association known as "Table A" excludes the provision for two signatures.

In a hurry and just want some advice? There are some share transactions that qualify for relief that can reduce the amount of Stamp Duty you pay. If it is a transaction where the stocks are being traded for money, j10 stock transfer form, enter the transaction amount.

You are welcome to download the Form J10 Stock Transfer Form for free by clicking on the link or by clicking the button below. Before you use this form, we strongly recommend that you read our guide to the Stock Transfer Form. Download j10 form. This form and any information are provided free of charge and no liability is accepted in respect of its use. If you use the provided forms without engaging us then you are responsible for completing the form and Elemental CoSec accepts no responsibility or liability for your use of the forms. Our specialists would be happy to discuss your specific requirements and please do get in touch with us.

We avoid legal terminology unless necessary. Plain English makes our documents easy to understand, easy to edit and more likely to be accepted. We explain what to edit and how in the guidance notes included at the end of the document. Email us with questions about editing your document. Our documents comply with the latest relevant law. Our lawyers regularly review how new law affects each document in our library. A share transfer form is a legal record of the change of ownership of company shares between two people or entities.

J10 stock transfer form

The form should be emailed instead. If the form cannot be emailed, HMRC provides advice on posting forms. This is a change to the previous regime and care must be taken given the inherent risks of email. More details are available at www. This Stock Transfer or share transfer Form is used to record the transfer of unpaid or partly paid shares from one shareholder to another. A different form is needed for unpaid or partly paid shares to ensure that the liability to pay further calls on the shares is also transferred. Form J10 must include the details of the transferor and transferee and must be signed by both.

Live score womens soccer world cup

If you use the provided forms without engaging us then you are responsible for completing the form and Elemental CoSec accepts no responsibility or liability for your use of the forms. Case Study. Download j10 form This form and any information are provided free of charge and no liability is accepted in respect of its use. Got it! There are some share transactions that qualify for relief that can reduce the amount of Stamp Duty you pay. This template is in fixed field format. Once the share transfer form has been stamped by HMRC if necessary , a new share certificate can be issued to the new shareholder. For companies with articles drawn under the Companies Act the model set , the requirement for two signatures has to be positively inserted. Stamp Duty is chargeable at a rate of 0. Document overview There is no legal or practical requirement for a share transfer form to be in any particular form. There is no statutory legal requirement to use a particular template over another. Share transfers are taxed at a rate of 0.

UK, remember your settings and improve government services.

Product Information. Company Guides. We also use third-party cookies that help us analyze and understand how you use this website. Document properties. This stock transfer form complies with both the Companies Act and the Finance Act though neither specify any particular requirement. The old forms J30 and J10 are no longer relevant. Support from our legal team Email us with questions about editing your document. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. This would give you clear information about what you are supposed to fill in. General Info.

In my opinion, you on a false way.

It is remarkable, the valuable information

This variant does not approach me. Perhaps there are still variants?