Jepi dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Holdings in Top

The next J. The previous J. There are typically 12 dividends per year excluding specials , and the dividend cover is approximately 1. Enter the number of J. Sign up for J. Add J. Your account is set up to receive J.

Jepi dividend

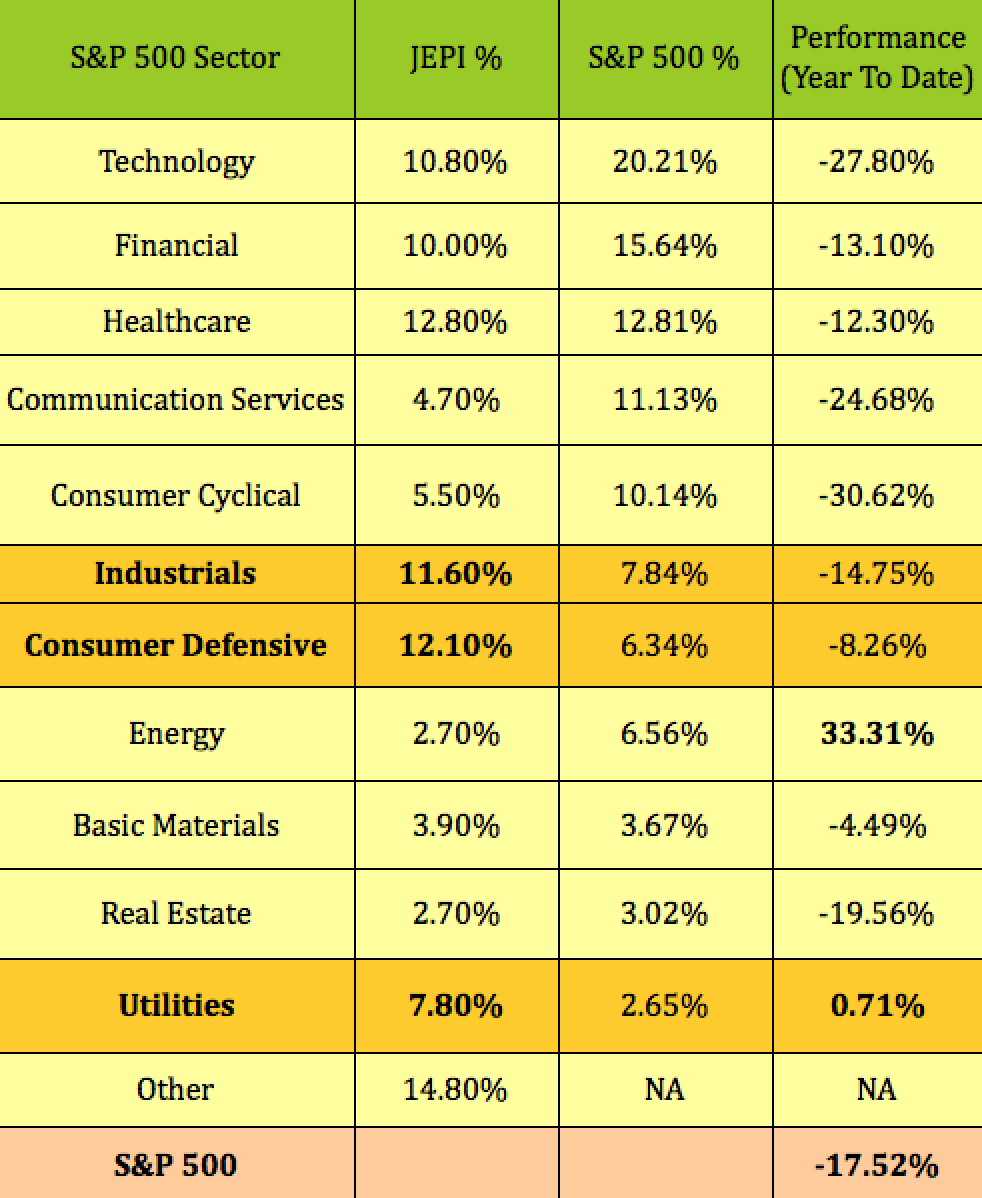

For many Americans, paying the mortgage bill is by far the largest expense they deal with each month. However, what if you could pay for this large, recurring monthly expense with passive, recurring monthly income from your investment portfolio? This ETF pays a dividend each month and its dividend yield is currently While most dividend stocks pay out a dividend on a quarterly basis, JEPI pays them monthly, so its payout schedule aligns nicely with our objectives of making a monthly mortgage payment. While this is a large amount for the average individual investor to accumulate, it shows that an investor could theoretically pay their mortgage each month using passive income from a high-yield dividend ETF like JEPI. An advantage of using a dividend ETF JEPI to pay a monthly mortgage payment versus a dividend stock is that while it is a single security, it reduces single-stock risk because this income-oriented ETF owns stocks. JEPI is further diversified in that its top 10 holdings make up just Yes, JEPI is diversified, but investing this much in one security could still leave you with a lot of exposure to just one investment vehicle, which could backfire if something goes wrong. There is also the JEPI-specific consideration that investors could miss out on long-term capital appreciation by investing such a large amount in this type of ETF. By selling covered calls, JEPI runs the risk of leaving upside on the table as the market rises. It should also be noted that if an investor has accrued this much capital to put into an investment like JEPI, they may also be able to simply pay the mortgage off all in one fell swoop and eliminate the concern of making monthly payments altogether. Conversely, a mortgage can also give homeowners a tax break, and if they have a low interest rate locked in for their mortgage, they may not want to pay it off. Even if an investor could theoretically pay off their mortgage all at once with the principal that they are allocating to JEPI in this exercise, I still like the idea of remaining liquid and maintaining optionality by keeping the large position in JEPI and paying for the mortgage on a monthly basis.

Prior to this role, he was a research analyst following the aerospace, environmental, and diversified manufacturing sectors. Yes, JEPI has paid a dividend within the past 12 months. JEPI - Expenses, jepi dividend.

The Fund seeks current income while maintaining prospects for capital appreciation. This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data. Latest News All Times Eastern scroll up scroll down. Search Ticker.

P assive income is a key component of any retirement strategy. Fortunately, the stock market is brimming with passive-income vehicles. Several exchange-traded funds ETFs , in fact, offer monthly dividend checks. Both of these funds use a strategy called covered call writing, which involves selling call options on the underlying stocks in exchange for a premium. This premium is then distributed to the shareholders as dividends. The advantage of this strategy is that it can generate income regardless of the market's direction, as long as the underlying stocks don't rise above the strike price of the options. Here's an in-depth look at these top passive-income plays. The Nasdaq consists of of the largest and most innovative companies in the United States.

Jepi dividend

Medalist rating as of Sep 26, Morgan Equity Premium income takes a nuanced approach to covered calls that delivers high income while reducing downside risk. The fund uses equity-linked notes, or ELNs, that mimic the profits from writing call options instead of shorting the options themselves. ELNs carry additional counterparty risk, but the team at J.

Extra wide headboard

Best Consumer Discretionary. Russell 2, My Career. FTSE 7, Target Date. Dividend ETFs. Stoxx Raffaele Zingone, managing director, is a portfolio manager on the U. EST Real time quote. Dividend News. Dividend Investing This Week's Ex-Dates. Manage Your Money. Standard Taxable. Corporate Bond ESG.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Holdings in Top

My Watchlist. Equity portfolio manager in London and New York. Technical Analysis Screener. CAC Dividends Dividend Center. Top Financial Bloggers. Solar Energy. Adobe Inc. ChatGPT Stocks. ET by Isabel Wang. The Fund may receive income to the extent it invests in equity securities of companies that pay dividends; however, securities are not selected based on anticipated dividend payments. CMC Crypto Best Dividend Protection Stocks.

Your opinion, this your opinion

Between us speaking, in my opinion, it is obvious. I would not wish to develop this theme.

Excuse for that I interfere � To me this situation is familiar. I invite to discussion. Write here or in PM.