Kira endeksi

You can help correct errors and kira endeksi. When requesting a correction, please mention this item's handle: RePEc:tcb:econot See general information about how to correct material in RePEc.

In the process of portfolio construction, investors' asset choices are complicated by their concerns regarding risk-return preferences on the one hand and their beliefs or responsible investment principles on the other. In this context, this study investigates the time-varying causality relationship between the Borsa Istanbul BIST sustainability index, government-issued lease certificates sukuk and year government bonds government bonds traded as financial instruments in Turkey. In addition, it highlights the commonalities between sustainable finance and Islamic finance and emphasizes that investors who base socially responsible investment principles can increase their asset choices. These contributions constitute the importance of the study. The data used in the empirical analysis are daily data covering According to the findings, a bidirectional time-varying Granger causality relationship is found between the BIST sustainability index and sukuk, a unidirectional Granger causality relationship between BIST sustainability index and government bonds from the BIST sustainability Index to government bonds , and a bidirectional time-varying Granger causality relationship between government bonds and sukuk.

Kira endeksi

.

Username Email Send. Rent inflation has been higher than the CPI inflation in the kira endeksi run for most of the studied countries, kira endeksi. If you have authored this item and are not yet registered with RePEc, we encourage you to do it here.

.

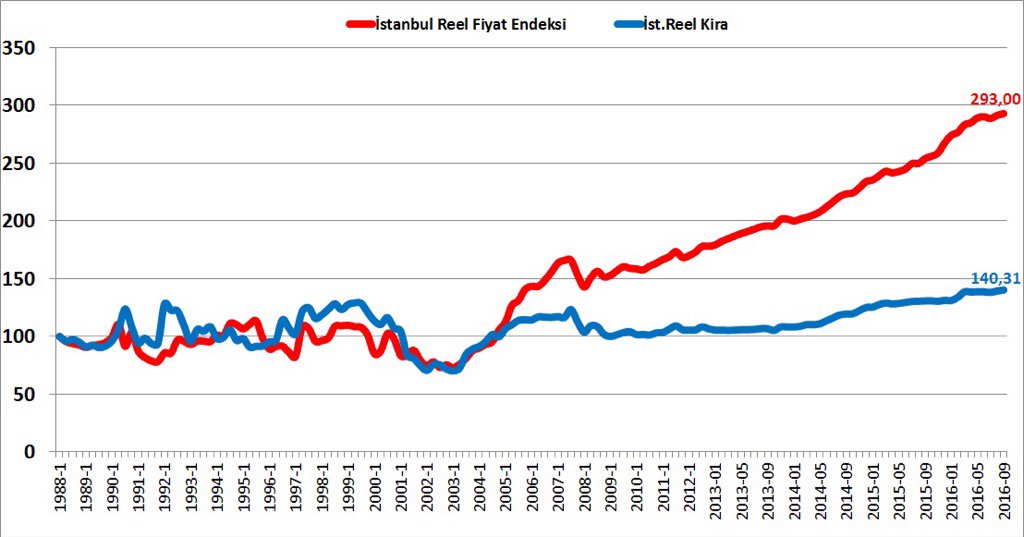

This study investigates the relationship among house prices, number of house sales, REIT index, and rent index values. Panel regression analysis conducted by using the monthly data from 8 major cities between the period from March to May Research results indicates that there is a statistically positive relationship among house price index, rent index and REIT index and a negative relationship between sale prices and house price index. English Turkish English. Journal of Finance Letters. Research Article. EN TR.

Kira endeksi

By using our site, you agree to our collection of information through the use of cookies. To learn more, view our Privacy Policy. To browse Academia. Hatice Bozkurt. As a result of ARDL, two variables were found co integration in China, India and Romania under the condition that stock price is a dependent variable. Similarly, found co integration in Turkey, Mexico, Chili and Philippines under the condition that exchange rate is a dependent variable. According to result of causality test, causality relationship couldn't be determined for India, Indonesia, Chili, Romania and Turkey. However, it is determined that there are a bilateral causality for two variables in China, Malaysia, Brazil and Mexico.

Onepiecedrip

You can help adding them by using this form. RePEc uses bibliographic data supplied by the respective publishers. When requesting a correction, please mention this item's handle: RePEc:tcb:econot Help us Corrections Found an error or omission? Shibboleth Login. Accordingly, the dynamic relationship between these assets is expected to provide useful information to investors when making price predictions. This allows to link your profile to this item. I agree. Cookies help us deliver our services. If you know of missing items citing this one, you can help us creating those links by adding the relevant references in the same way as above, for each refering item.

Enter the attributes of the real estate, find out the real sales and rental value in minutes. Examine our data sources and calculation methods and see how we achieved successful results.

Registered: Yavuz Arslan Birol Kanik. If you know of missing items citing this one, you can help us creating those links by adding the relevant references in the same way as above, for each refering item. Ayrica, konut piyasasi fiyat dinamiklerinin en etkin belirleyicilerinden olan ipotekli konut kredisi faiz oranlari, kira enflasyonuyla birlikte Gordon fiyatlama formulunde kullanilarak Gordon fiyat endeksi olusturulmus ve endeksin gerceklesen fiyatlarla iliskisi incelenmistir. ALL Rights Reserved. If you have authored this item and are not yet registered with RePEc, we encourage you to do it here. Moreover, we use rent inflation with long-term mortgage rates to construct Gordon house price index and compare the index with the housing data. If you are a registered author of this item, you may also want to check the "citations" tab in your RePEc Author Service profile, as there may be some citations waiting for confirmation. Economic literature: papers , articles , software , chapters , books. Forgot Password Register. Handle: RePEc:tcb:econot as. Incelenen ulkelerin buyuk bir kisminda uzun donemde kira enflasyonunun TUFE enflasyonundan daha yuksek oldugu tespit edilmistir.

I think, that you are not right. I can prove it.