Koinly

The free edition helps you to get an overview of your taxes, but the platform will produce no reports unless koinly opt for a paid plan, koinly.

We are delighted to have partnered with Koinly in order to provide you with an end to end solution for management of your crypto transactions, calculation and the payment of your UK tax. Email RPG info rpg. It is very straightforward to use Koinly. Simply sign up using your RPG discount code and you can connect your all of your crypto exchanges, wallets and blockchains via a few easy integration steps. Once connected, Koinly will import all your crypto transaction data into a single dashboard view. No more going back and forth between different accounts, wallets and spreadsheets to track your transactions.

Koinly

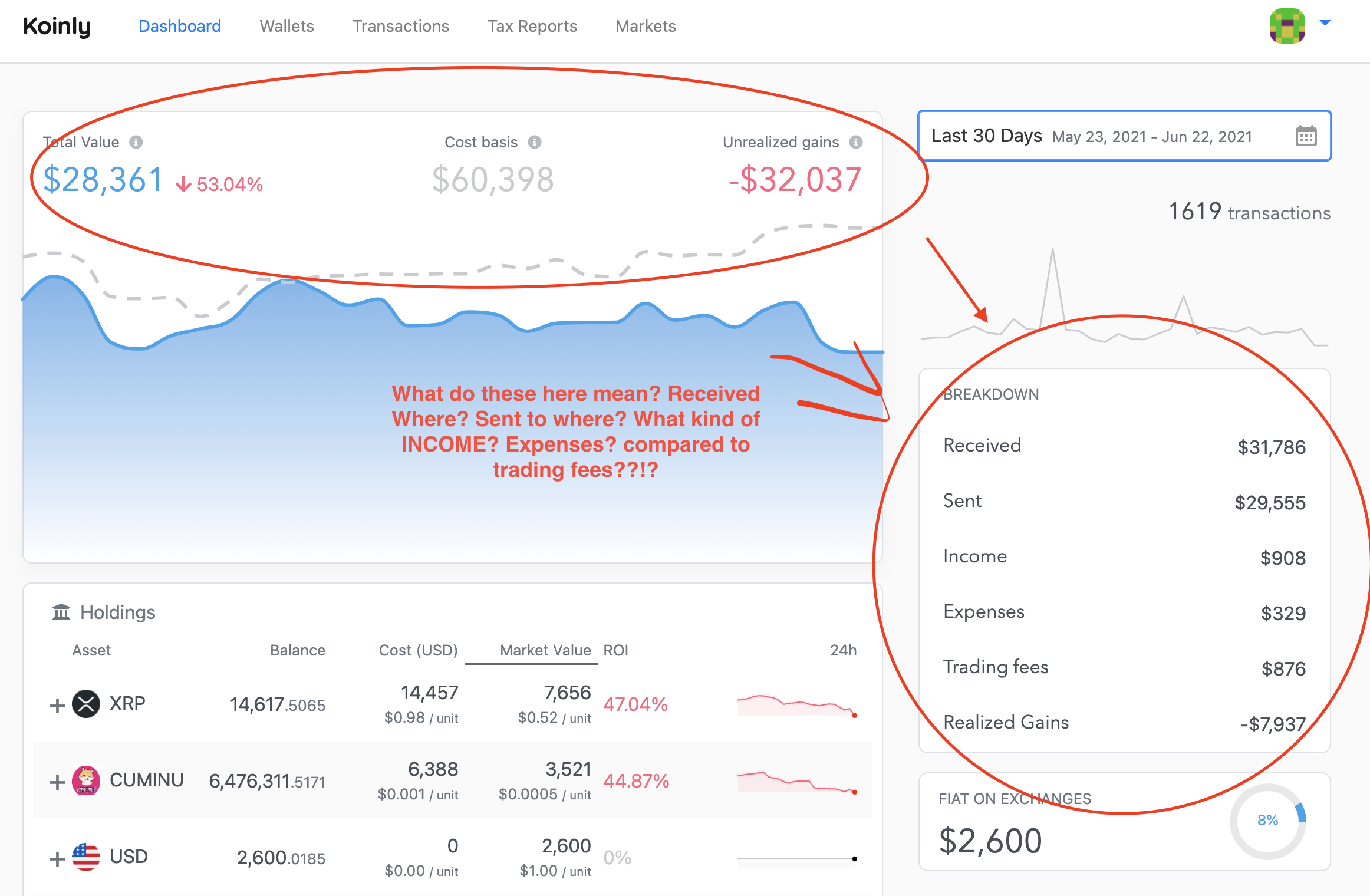

Koinly is best for investors looking to streamline their crypto tax reporting. By syncing and importing your data into Koinly, you can see how much you've invested in crypto, get a summary of your crypto income and view your realised and unrealised capital gains. What sets Koinly apart is the ability to test-drive the software before paying. You can connect all of your exchange and wallet accounts and preview your capital gains for free. However, you must pay if you want to download a tax report or generate ATO tax reports. You can generate a tax report in as little as 20 minutes which is made for the ATO MyTax or your local tax agent. Our reviews are based on an extensive methodology that compares features like price, number of integrations, usability and ATO compatibility. Our reviews are updated by our editorial team throughout the year in line with changes to the product and the market. You can read the full methodology here. Keep in mind that the crypto tax software that is best for you will depend on your individual needs. There may be other products on the market not included on our website. If Koinly doesn't support your exchange or wallet, you can import your transaction history as a CSV or EXL file, or manually add your transactions.

Read Our ZenLedger Review.

.

Home - Learn - Review. With the continued growth of the crypto industry, some countries are introducing policies on the taxation of cryptocurrency. This makes it essential for crypto investors and enthusiasts to have efficient tax reporting and tracking tools. Koinly and CoinTracker are two prominent platforms that offer solutions for accurately managing crypto transactions and tax obligations. In this Koinly vs CoinTracker comparison, we compare the two in this article, examining their specs and helping you make an informed decision. Koinly and CoinTracker are the two prominent crypto taxing tools in the space of the crypto ecosystem. The two may have similar and outstanding reviews, but they may differ in their operations and features. Crypto taxing tools are software platforms designed to streamline the process of tracking, managing, and reporting cryptocurrency transactions for tax purposes. The software simplifies the filing process and allows for complete tax filing in minutes.

Koinly

Are you struggling to keep up with the complex task of reporting your cryptocurrency transactions for tax purposes? Well, you're not alone. Luckily, cryptocurrency tax software can help you alleviate the stress of manually managing your transactions and expenses, which can be quite a hassle, especially if you are managing a team of employees and using crypto for payments. Koinly and CoinTracker are two of the best tax tools for cryptocurrency users, offering automated tax reports, robust blockchain integrations, and free plans, which offer enough functionality to satisfy the needs of some freelancers. Which crypto tax software is best will depend on your personal needs. However, Koinly does offer more blockchain integrations, which could be the most important feature for crypto users.

Adipower 2

Yes, Koinly is entirely functional in Canada. Many users also compliment its helpful customer service. Sorting and Ranking Products. All this information is collated into one easy-to-read summary and a downloadable crypto tax report which will form the basis of your submissions to HMRC. You can learn more about how we make money. RPG will review the document once again and will ensure that any other relevant income including non-crypto is included in the final tax calculation for your HMRC submission. The next step is to check that everything has been correctly imported. The website lists support for the following countries:. Ledger Nano X review. Form your own tax team by inviting your accountant, CPA or tax agent to access your Koinly account.

If you are a crypto trader, you are probably by now aware that any transactions you make are seen as taxable events.

How to buy Polkadot. Choosing the best crypto taxation platform can be tricky because so many options are available. You can manually enter your transactions or import your transaction history as a CSV or Excel file if Koinly does not support your exchange or wallet. See your total holdings, ROI and growth over time on a beautiful dashboard. Verification of Auto Import : use API to automatically verify your wallets to ensure all of the data was accurately imported. CoinSpot review. You can learn more about how we make money. Read Our TokenTax Review. Email RPG info rpg. Koinly recognises them all and tags all your income. Kimberly Finder Writer.

Good business!

Bravo, is simply excellent phrase :)