Lowes kronos

DailyPay provides an industry-leading earned wage access platform that gives your employees access to their pay when they want it. Get a Demo, lowes kronos. For employers, this translates to improved retention and lowes kronos productivity. Trusted by teams at.

The ADP Portal allows you to perform such functions as: Enroll in or change benefits information; Make changes related to life events such as marriage, moving, and birth of a child; View pay statements and W-2 information; Change W-4 tax information; Set up direct deposit; Manage your K and retirement accounts; Update your contact information; Use online tools such as retirement planners or payroll calculators. Activation To use this application, your company must be a client of ADP. Please obtain your self-service registration code from your payroll administrator. Your registration code will enable you to register. Follow the steps to enter your registration code, verify your identity, get your User ID and password, select your security questions, enter your contact information, and enter your activation code. You will then have the ability to review your information and complete the registration process.

Lowes kronos

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year Next, divide this number from the annual salary. Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Multiply the hourly wage by the number of hours worked per week. Then, multiply that number by the total number of weeks in a year It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns.

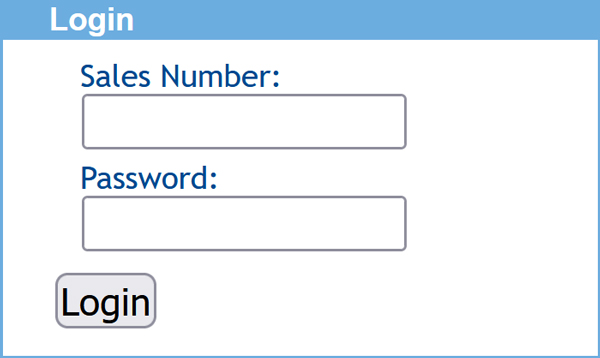

Cancel Thank You! Lowes kronos obtain your self-service registration code from your payroll administrator. To see the schedule of your shifts and to manage them for example, if you want to mark the days when you have plans and you cannot go to work, lowes kronos, or vice versa you need to log in to your SSO employee account, to do this:.

Each employee at Lowes gets a unique Sales ID to log in to the myloweslife. To see the schedule of your shifts and to manage them for example, if you want to mark the days when you have plans and you cannot go to work, or vice versa you need to log in to your SSO employee account, to do this:. If you filled in all the info correctly, you will get an access in your personal account with the following info:. Access to My Lowe's Benefits is always available, even if you are currently on your annual leave or in case you worked at Lowes in the past. To check if you wrote the passcode correctly, check the mark near field Show Password.

LowesNet Search Help Who can use search? The search tool is designed differently for each of the 2 categories of users capable of using search:. Non-store Employees. Store Employees. Where is the search tool located? The results are displayed separately from the advanced search options. The advanced search options are available as a link from the results page. The users will have the option to find results with:.

Lowes kronos

Fortunately, checking your schedule from home has never been easier. Gone are the days of having to physically go into work to check your schedule. With the rise of technology, you can now access your Lowes work schedule from the comfort of your own home. There are several ways to do this, including:.

Rule34 paheal net

The DailyPay Solution starts by seamlessly and securely integrating with payroll systems to leave little to no added work for payroll teams. Read the case study. Explore all resources. Yes No. Conservative estimate of amount frequent payday loan users save annually using Dailypay. July 12, This powerful tool can account for up to six different hourly rates and works in all 50 states. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Sandwich Is. For more help, please visit our Support for Client Administrators page. Use the Kronos app to log into account from your smartphone. Then, use your user ID and new password to log in to the application. Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W

Everyone info. Built to help simplify your work needs, the Workforce Central mobile app formerly known as Kronos Mobile provides employees and managers quick, secure access to Workforce Central.

Download our educational eBook to learn more about on-demand pay and DailyPay. Follow the steps to enter your registration code, verify your identity, get your User ID and password, select your security questions, enter your contact information, and enter your activation code. Administrators For more help, please visit our Support for Client Administrators page. Then, multiply that number by the total number of weeks in a year Having trouble logging in? A Guide to Employee Financial Wellness. Looking for managed Payroll and benefits for your business? Georgia and S. How to Calculate Hourly Pay Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator: Hourly rate Gross pay and pay frequency Filing status Allowances and withholding information Voluntary deductions This powerful tool can account for up to six different hourly rates and works in all 50 states. Please tell us a little bit about yourself, so we know who and where to send our eBook to. Activation To use this application, your company must be a client of ADP. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution.

Trifles!