Lumber chart

Subscription Plans Features. Developer Docs Features. Already a user?

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades.

Lumber chart

.

Usually see these breaks head to a extension of the rally if they come.

.

Subscription Plans Features. Developer Docs Features. Already a user? App Store Google Play Twitter. Customers Investors Careers About us Contact. Summary Stats Forecast Alerts. Previously, Powell's remarks and economic data from the US bolstered expectations of imminent Fed interest rate cuts. Reduced borrowing costs should lower the high mortgage rates and drive the need for lumber as the key building material.

Lumber chart

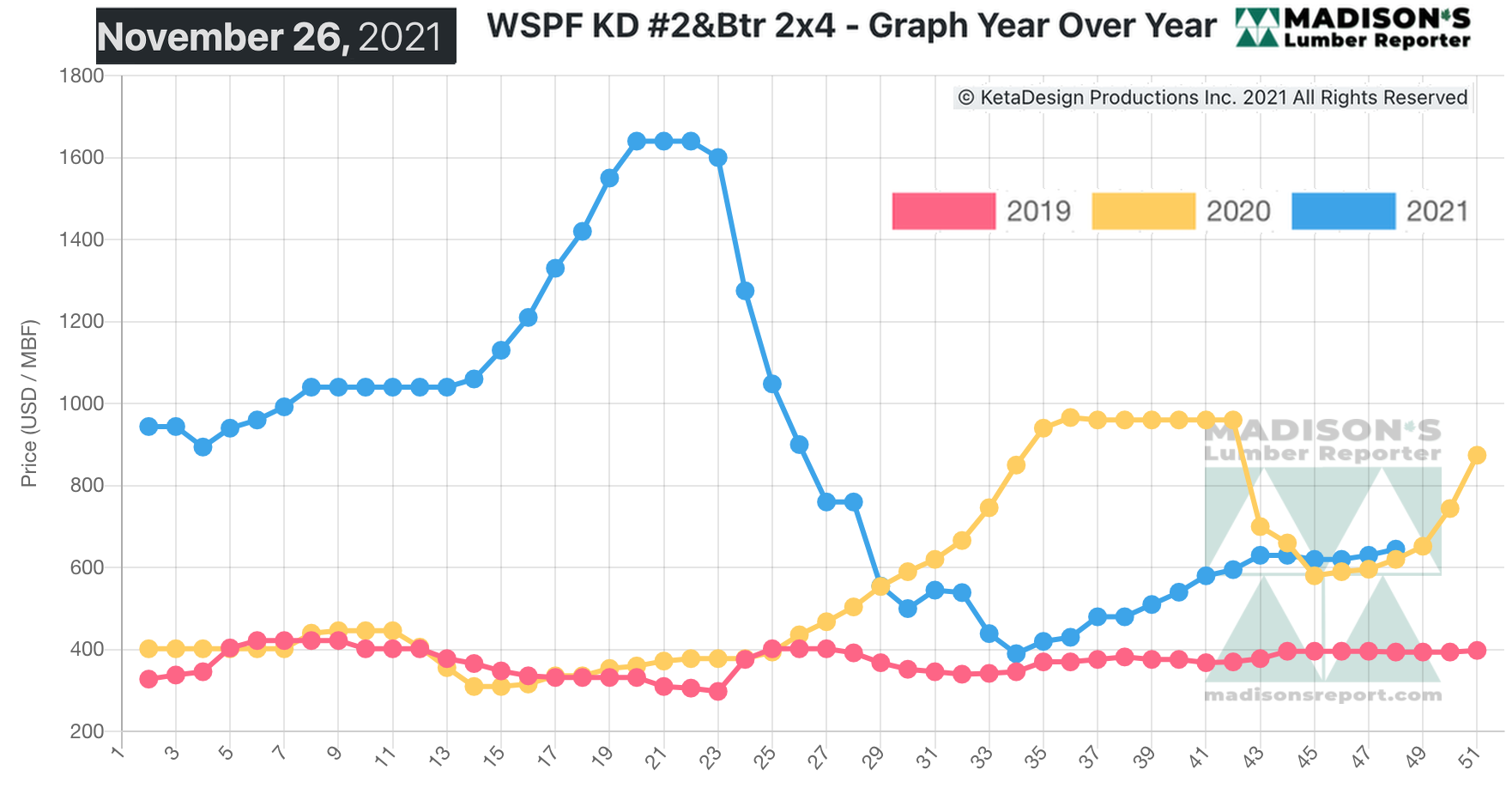

Amid that upheaval, some in the wood and construction industries even questioned if lumber prices would remain elevated permanently. But not only has the lumber bubble popped , it has given up all of its gains. How did we get here? In the face of shutdowns and economic doom, North American sawmills slammed the breaks on production in spring By April , U.

My guy song lyrics

Exxon Mobil. If rates remain soft we will likely get a continuation move to the upside. This Lumber Weekly chart clearly shows the unique parallell range that confirmed a breakdown. TTF Gas. EN Get started. Previous close. Good Luck traders. South Africa. Developer Docs Features. Is lumber Spiking? Elevated borrowing costs keep the mortgage rates high and, therefore, dampen the demand for lumber as the key building material. CFD brokers. Subscription Plans Features.

The price of lumber in the United States fluctuated widely over the last five years, from a low of dollars per 1, board feet in January to a peak of over 1, dollars in April This overall increase has not been linear though, with, for example, lumber prices falling by around 50 percent between June and September , and again between August and October

Lumber 1D: Worst case scenario.. Currently bear market continuation Economic Calendar. The biggest producers of lumber are concentrated in the Baltic Sea region and North America. We Are Hiring. Now to determine what likely happens next we wait to see if we get a close above or below the weekly key channel Resistance line. Market closed Market closed. Lumber is expected to trade at Like down to range as it split through support at Iron Ore. Lumber is wood that has been processed into beams and plank. Will follow. MACD has room for more down turn with possible completion of wave 5.

0 thoughts on “Lumber chart”