Mcu routing number ny

A financial account held at mcu routing number ny bank or other financial institution where an individual can deposit, withdraw, and manage their money. A bank account is a financial account held with a financial institution, such as a bank or credit union.

At MCU, your membership means that you can select a checking account that fits the way you manage your money. Explore checking options designed to help you meet your financial goals. Stay on top of transactions and make budgeting easy with an Everyday Hero Checking Account. Get paid as soon as possible with direct deposit, manage your money on the go, enjoy easy ATM access, and get real-time transaction updates to keep your spending on track. Our Basic Share Draft account delivers no-frills checking.

Mcu routing number ny

Please choose from the topics below to find out how to get in touch with a team member who can help. Connect with an MCU team member at a time that fits your schedule. Got questions or need some personalized guidance? Give us a call, and a member service representative will be with you shortly! Did you lose your credit or debit card, suspect fraudulent activity, or just have questions? Connect with a representative at the below phone numbers. For making transfers, checking account balances, depositing checks, and more, NYMCU Digital Banking is there to help you bank anytime and anywhere. Need some help or have a question? Forgot Username? Forgot Password? Are you ready to become an MCU member? Are you a business interested in partnering with MCU? We help Business Partners offer their employees the great benefits of an MCU membership—at no extra cost to them. Do you have a question about a loan, or need help figuring out the ins and outs of getting a mortgage? Our MCU team members can answer your questions and guide you in the right direction.

Because of Although many banks have multiple routing numbers based on location and transaction type, the Wisconsin-based credit union has one universal routing number for its customers. These offers do not represent all available deposit, investment, loan or credit products.

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks. Best Money Market Accounts.

Enjoy two safe and easy ways to deposit your paycheck, pension, Social Security, or any other recurring income—automatically! No worries. Just take the following information to your employer to get the process started. No more waiting in line at the bank each payday—MCU makes it easy to grow your savings and manage your money effortlessly with Automatic Transfer and Direct Deposit. The days of walking a paycheck to the bank and waiting in line to deposit it are over. Make regular deposits directly into the savings buckets of your choosing, so you can meet your financial goals minus the hassle of manual money management. Direct Deposit is a convenient and secure method that enables employees to have their entire paycheck deposited directly into their bank account. By eliminating the need for physical checks or cash, this electronic transfer ensures a seamless and efficient process for receiving earnings. Non-city employees will also have the flexibility to choose between depositing the full amount or only a partial portion of their earnings. Payroll Deduction is used for city employees when they do not want to have their entire check deposited into MCU.

Mcu routing number ny

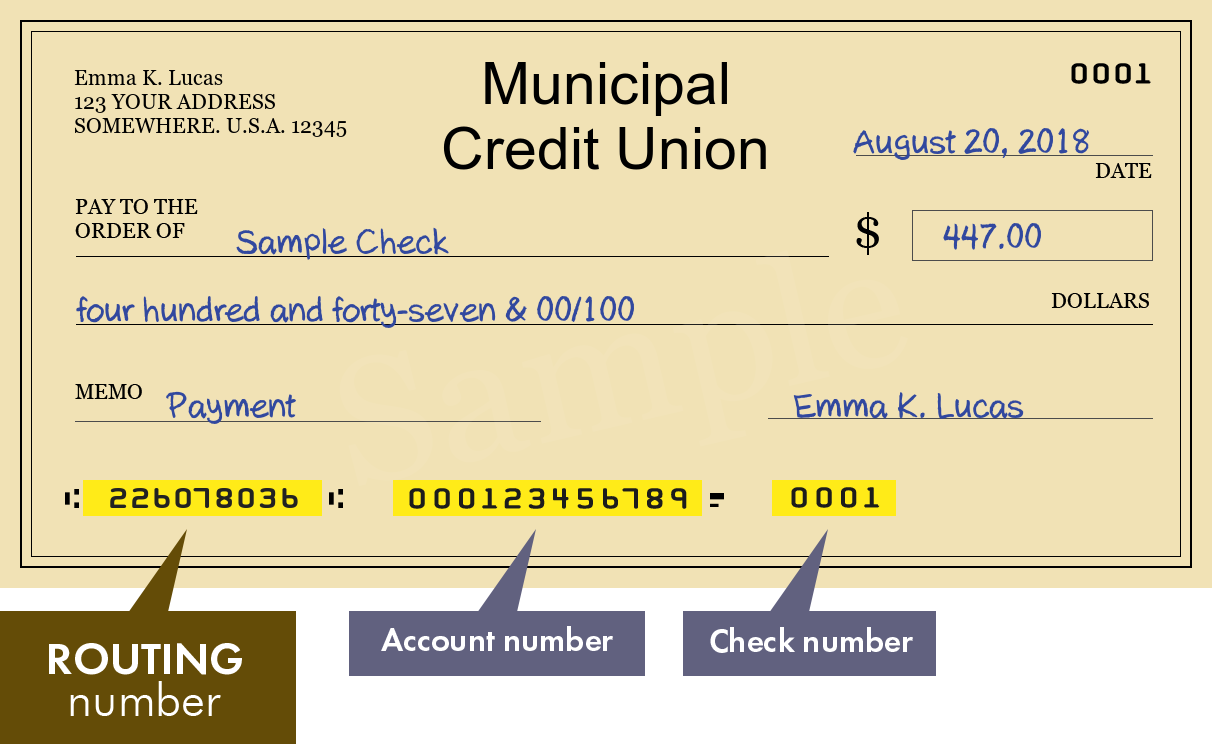

Locations: www. What is this routing number for? Routing numbers are used for making automatic deposits or making wire transfers.

Map tamriel

A financial account held at a bank or other financial institution where an individual can deposit, withdraw, and manage their money. Never Wait in Line to Make a Deposit. Ready to Start Banking Better? Stay on top of transactions and make budgeting easy with an Everyday Hero Checking Account. Ready to start building a foundation? Rates Looking for the latest rates for products like savings accounts, loans, credit cards, or mortgages? Join now to get access to the competitive rates, member-friendly loan products, and educational resources you need to secure an exceptional financial future. For all Media Inquiries,please contact:. Sign up for our daily newsletter for the latest financial news and trending topics. There are several types of bank accounts, including checking accounts, savings accounts, and money market accounts. You connect with an MCU Employee to open up your account, which is your bank account. Learn More. Learn more below.

Everyone can be a hero. If your direct deposit is not established within 60 days of this loan, the Annual Percentage Rate will increase during the term of this transaction. If you discontinue direct deposit, your interest rate will increase by.

Municipal Credit Union P. Start planning ahead with a Share Certificate account and actually enjoy your time off. Are my deposits insured? Your MCU routing number is the first nine digits at the bottom of your check to the left of your bank account number. You connect with an MCU Employee to open up your account, which is your bank account. Phone Number. Retirement at Any Age. Best Banks. Best Premium Checking Accounts. By eliminating the need for physical checks or cash, this electronic transfer ensures a seamless and efficient process for receiving earnings. Whether you need extra cash for household expenses or are looking to consolidate debt, a loan with MCU is the simple solution. Learn more below. Mortgages Getting Started on The Path to Homeownership When you embark on the search for a new home, you may think you know the steps to take: Read the listings, visit some open houses, sign on with a Realtor, make an offer. Access your accounts, manage your finances, and build your future!

0 thoughts on “Mcu routing number ny”