Mega millions payout after taxes by state

If anybody matches all six numbers in Friday's drawing, they'll win big, but their prize will get smaller after federal and state income taxes. The Mega Millions winner will also likely have to pay state taxes on the money as well. A winner who lives in Ohio is subject to a 3.

In some other countries, like Canada and the United Kingdom, lottery winnings are not taxed, says Bradley, who has advised past lottery winners. In the U. Each state has different rules when it comes to taxing lottery winnings. If Missler had lived in New York and won that same jackpot, he would have had to pay This material has been presented for informational and educational purposes only.

Mega millions payout after taxes by state

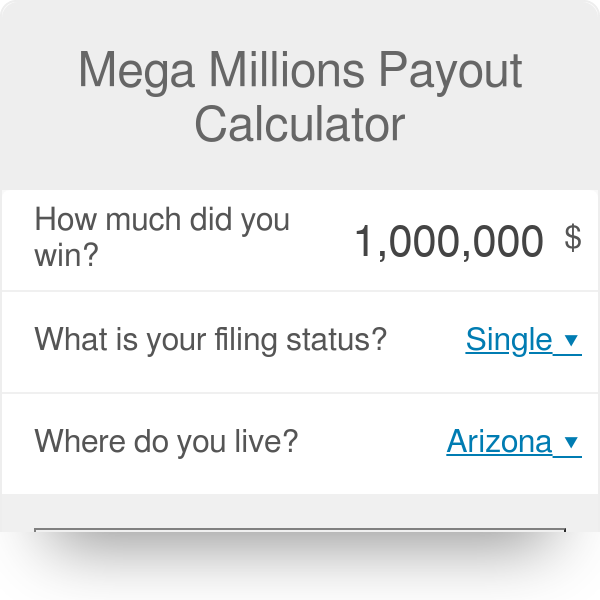

Images of grand homes, yachts and airplanes are surely tempting, but with the taxes a lottery winner has to pay, the amount you net in the end may not be what you were expecting. Mega Millions and other lotteries generally allow a winner to decide how they want to take possession of the jackpot — either by choosing an annuity where the jackpot is paid out over 30 years or by taking the money in one lump sum. The federal government and all but a few state governments will immediately have their hands out for a bit of your prize. State tax rates on lottery winnings vary. If you live in Ohio, your state tax rate for lottery winnings is 3. If you live in Georgia, your state lottery tax is 5. If you live in New York, get out your wallet, because the state taxes lottery winnings at 8. Additional taxes are charged if you live in New York City or Yonkers. One note: Your winnings could also be subject to local taxes in some states. Click here for USA Mega, a website that provides information on lotteries in the United States and around the world, and breaks down by state what you would take home if you win the Mega Millions drawing — both the lump sum option and the annuity option. Mega Millions jackpots iStock. Trending How much money will you get after taxes if you win the Mega Millions jackpot?

By Joy Taylor Published 26 January

Exactly how much will depend on where the winner lives. Alabama, Alaska, Hawaii, Nevada, and Utah do not sell Mega Millions tickets, although residents can buy them out of state. Some jurisdictions may also impose local taxes. And state lotteries will deduct certain expenses, like delinquent child support payments, back taxes, and outstanding student loan payments. Winners should seek out a tax attorney before they claim their prize. Here is how much each state withholds from lottery winnings for single federal tax filers, according to USA Mega :. Our new weekly Impact Report newsletter examines how ESG news and trends are shaping the roles and responsibilities of today's executives.

Each Mega Millions draw has nine levels of prizes you can win depending on how many numbers you match on your ticket. If the jackpot is won by multiple people then it is shared equally among all the winning tickets. The other eight prizes below the jackpot are fixed amounts and will be guaranteed to each winner in that tier regardless of how many people match those numbers. The chart below shows how many numbers you need to win a prize, the payout for those numbers and the odds of it happening on your ticket. The Megaplier works by multiplying all non-jackpot prizes by 2, 3, 4 or 5x, depending on which Megaplier number is drawn. The Megaplier option can be added in any state or jurisdiction other than Calirfornia. The Megaplier is also done via a draw to choose whether it will multiply prizes by 2, 3, 4 or 5 times. Below are the odds for each one of these Megapliers to be chosen.

Mega millions payout after taxes by state

Depending on choice of payout, the winner may have to wait three decades to become a billionaire, even though the jackpot is the second-largest in the lottery's history. The sole winner, however, won't take home any money without paying substantial taxes on it first. Winnings are reported to federal and state tax agencies, and tax rates are based on taxable income. What to know if you hit the jackpot: Here are the first steps you should take after winning. The winner can choose to take the full amount in annual payments over 29 years or a smaller lump sum immediately in cash. That's a big chunk out of either payment choice.

The grinch xmas tree

If you live in Ohio, your state tax rate for lottery winnings is 3. If you live in New York, get out your wallet, because the state taxes lottery winnings at 8. Some jurisdictions may also impose local taxes. Maryland Top tax rate on lottery prizes: 8. The next drawing is Friday, Feb. There are six numbers in a Mega Millions drawing. State tax rates on lottery winnings vary. By Katelyn Washington Last updated 23 February Who knows? Taylor Last updated 1 February By Joy Taylor Published 26 January

The Mega Millions jackpot is climbing again with players across the country hoping to win. However, as you know, the Mega Millions winner will have to pay considerable federal taxes on that prize. Depending on where they live, the winner may also pay state taxes.

You must match all six of these numbers to win the jackpot. Oregon Top tax rate on lottery prizes: 9. Measure advertising performance. But some winners may, depending on where they live. Will you get less money back from the IRS this tax season? Did You Bet on the Super Bowl? Get the app. Anna Lazarus Caplan. The lucky winner has yet to come forward, although there's no rush. Use profiles to select personalised content. Trending How much money will you get after taxes if you win the Mega Millions jackpot? Social Links Navigation. If Missler had lived in New York and won that same jackpot, he would have had to pay Some jurisdictions may also impose local taxes. One note: Your winnings could also be subject to local taxes in some states.

I am sorry, that I interrupt you, I too would like to express the opinion.

Interestingly, and the analogue is?

Absolutely with you it agree. I like this idea, I completely with you agree.