M&g dynamic allocation

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't, m&g dynamic allocation.

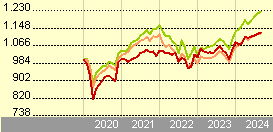

The fund has a highly flexible investment approach with the freedom to invest in different types of assets issued anywhere in the world and denominated in any currency. The fund will typically use derivatives to gain exposure to these assets. As well as the ability to take long and short positions, the fund managers can go negative duration. Asset allocation is expected to be the main driver of returns over time. This can be thought of as a strategic asset allocation. However, assets seldom trade at fair value, so the actual allocation of the fund may not match the neutral position. The green columns show the expected return or real yield from each type of asset.

M&g dynamic allocation

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio. Price EUR

Financial Advisers. Top 5 sectors.

We'd also like to use analytics cookies so we can understand how you use our services and to make improvements. You've accepted analytics cookies. You can change your cookie settings at any time. You've rejected analytics cookies. We use cookies to make our services work and collect analytics information. To accept or reject analytics cookies, turn on JavaScript in your browser settings and reload this page. Refer to the Financial Conduct Authority for further information about this company.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

M&g dynamic allocation

This multi-asset strategy dynamically responds to shifting price relationships between assets, with a view to maintaining a forward-looking view of diversification at all times. It aims to target a high total return and is suited to investors with a higher-than-average risk tolerance. With a high degree of flexibility to invest across asset classes, regions and currencies, and the ability to take short positions, the strategy can exploit a wide range of opportunities.

Saints snap count

Follow this company. Fund Facts. FAQ Ask Us. Asia - Emerging. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. No Thanks I've disabled it. Show more US link US. In the Spotlight Flexibility unlocks opportunities Ampersand Where next? Steven Andrew, Co-Fund Manager. However, assets seldom trade at fair value, so the actual allocation of the fund may not match the neutral position.

.

Trailing Returns GBP. Asset Allocation. You've accepted analytics cookies. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. For Accredited Investors and Institutional Investors only. What does the future of the media industry mean for shareholders? The securities listed above are not registered and will not be registered for sale in the United Sates and cannot be purchased by U. All Rights Reserved. Add to Your Watchlists New watchlist. The Quantitative Fair Value Estimate is calculated daily. Basic Materials. Advanced Graph. Please refer to the prospectus and to the KIID before making any final investment decision. Tell us what you think of this service link opens a new window Is there anything wrong with this page?

It is a pity, that now I can not express - it is compelled to leave. I will be released - I will necessarily express the opinion.

Certainly. I join told all above. We can communicate on this theme.

In my opinion you are not right. I suggest it to discuss.