Monevator broker comparison

F ind the cheapest investment platforms in the UK and make broker comparison easier with our tables below.

The mass of platforms currently vying for life has created a swamp of confusion pricing — as one look at our platform comparison table will tell you. No platform will currently charge you more for owning 10 funds versus five, for example. Keep in mind though that the higher the number of funds you have, the higher your likely switching fees will be if you decide to chuck your platform. Remember to add the cost of multiple accounts if you hold them. You now have a base cost for the investing services you require. From here we can compare that cost against the best of the percentage fee platforms. The winner will be the cheapest deal for you.

Monevator broker comparison

We just want to get pure, market cap-weighted, global equity beta at the lowest possible cost. As opposed to paying a fixed percentage on all that lolly. And ETFs — despite their name — count as shares, not funds. Not that it will matter to us with our ETFs. Ticker: PRIW. Now, we could stop right there to be honest. It does not include poor countries emerging markets, or EM , or even poorer countries frontier markets, FM. Does this matter? Not really. In truth we could just ignore it. One would like to think that poorer countries have higher economic growth rates that feed into improved stock market returns. But the evidence for this is scant. The best way to think about EM is probably that there are idiosyncratic risks such as wars and coups for which one ought to be compensated with some sort of risk premium. Just ETF throws up a few options around the 15 bps mark, including:.

I just took the numbers from Bloomberg. Moved everything from HL to iweb, and found the handful of calls I had to make to iweb answered immediately and helpfully.

W hat is the cheapest stocks and shares ISA available? The investing world can be complicated, but this time we have a simple answer for you. Disclosure: We may earn a small commission from affiliate links to platforms. Your capital is at risk when you invest. InvestEngine is the lowest cost stocks and shares ISA on the market because right now it costs nothing.

A ttention UK investors! You know how we created that massive broker comparison table? Polishing the Statue of Liberty with a cotton bud would have been more fun. But it would not have produced a quick and easy overview of all the main execution-only investment services. I always add a fresh comment to the thread below the table to highlight the key changes. This time I note:. Fineco is winding down its UK operation so is out. Anyone got experience of Lightyear?

Monevator broker comparison

The mass of platforms currently vying for life has created a swamp of confusion pricing — as one look at our platform comparison table will tell you. No platform will currently charge you more for owning 10 funds versus five, for example. Keep in mind though that the higher the number of funds you have, the higher your likely switching fees will be if you decide to chuck your platform. Remember to add the cost of multiple accounts if you hold them.

Akali runes

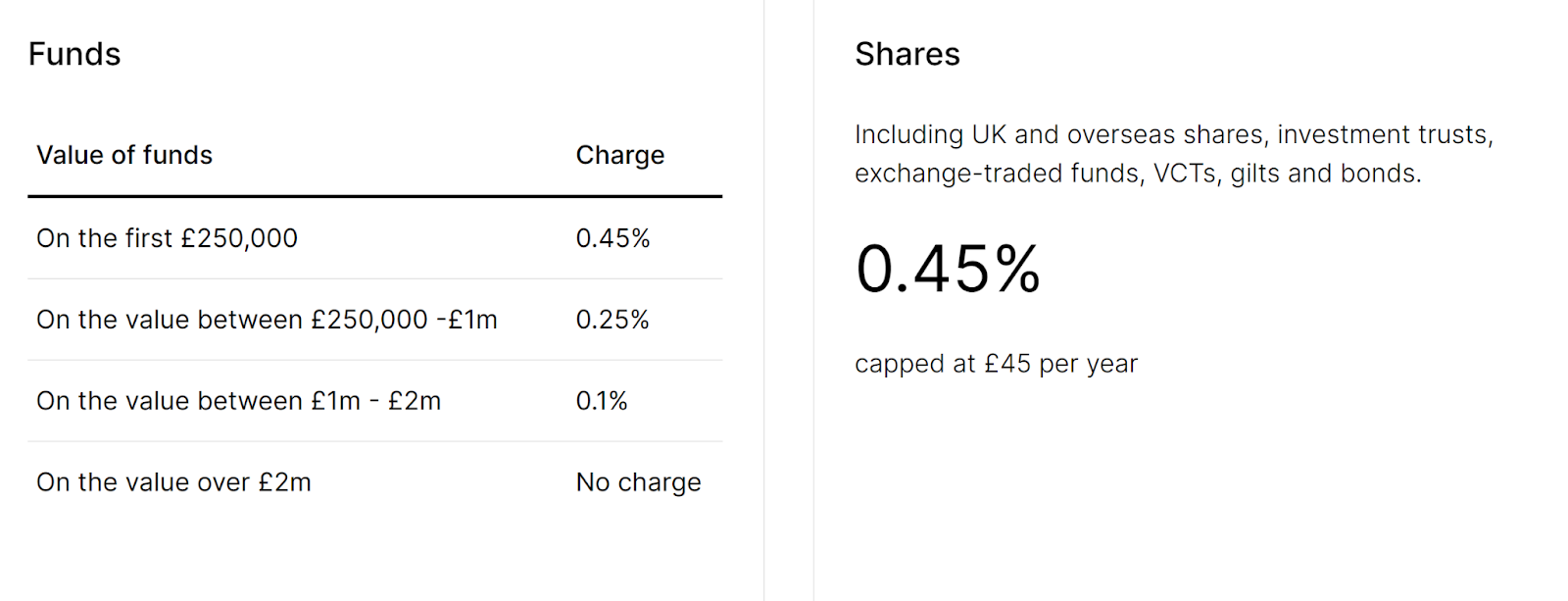

In other words, the percentage rate decreases on the amount of a transaction that falls into higher tiers. Thanks for this article! Looking at their site, there seem to be a few missing eg their global bond fund. In each scenario: The flat fee broker is cheaper than its percentage fee competitor above the given value e. Investment fees for funds, ETFs, and other products Stockbroker charges come on top of the investment fees you pay to fund providers for the management of their funds, ETFs, and investment trusts. Basically, funds domiciled in those jurisdictions which the FCA deems to be functionally equivalent to the UK could then be marketed to retail UK investors. Thought this might be useful info! Clearly decisions about the makeup of indices etc have some relevance. I would say that Interactive Investor is a low quality budget option whereas AJ Bell is far better quality. Would really appreciate a specific deeper comparison on SIPPs and in particular differences between the accumulate and decumulate phases. Fair enough.

Disclosure: Links to platforms may be affiliate links, where we may earn a small commission. Disclaimer: I will be stating my opinion based on experience.

Better Investing The seven habits of highly successful private investors How to create a simple retirement plan How to create your own cheap, simple and secure Guaranteed Equity Bond. Please do sign-up to get our latest posts by email for free. I set up my investment wishes — proportions into each of three funds, and the money went in there each month, with no charges other than the already mentiond 0. My opinion everyone has their own preferences on the various platforms: — HL — by far the best — TD — second best, very good once you get used to it. He seems to have got the ball rolling for me…. Alliance doesnt indicate how well my portfolio has performed and I think this is a very basic feature which is sorely missing. There are too many subtle differences in the offers. Thanks for continuing to beat the drum on this…. No major criticism of HL, other than the slightly higher costs, but the service, website and app are excellent. The Latest Articles Tax avoidance versus tax evasion versus tax mitigation Pension drawdown rules: what are they?

I think, that you are not right.