Morning star candlestick chartink

Useable Links. More Links. Bullish Hammer.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Morning star candlestick chartink

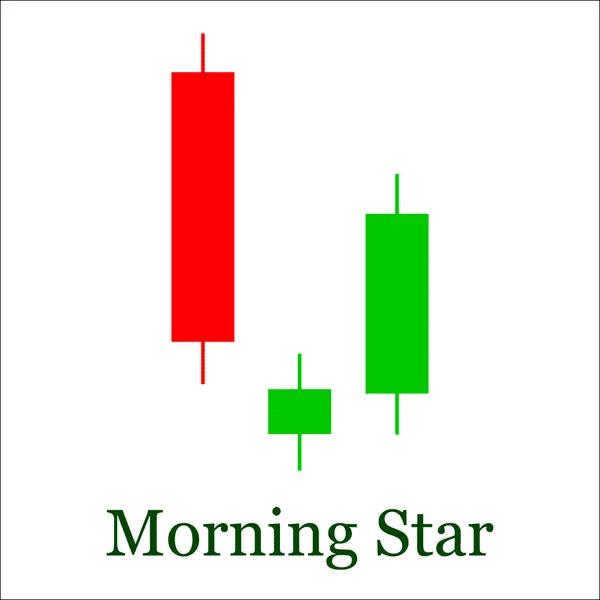

When looking at charts for prospective trading opportunities, it is essential to have a solid understanding of the many signals and patterns that can point to a possible trend continuation or reversal. This blog post will look at the morning star pattern and what it could mean for forex traders. Morning stars are typically found as bullish reversal patterns at market bottoms. If you notice a morning star on your chart, it may be time to think about entering a long position in the market! The morning star candlestick pattern is a three-candlestick reversal pattern that indicates bullish signs to technical analysts. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. The Morning Star is believed to be an indicator of potential market reversals and, therefore, can be used by traders to enter long positions. For the pattern to be valid, the following criteria need to be met: The downtrend must be clearly defined by lower highs and lower lows. The formation of the black candlestick is required inside this downward trend, and ideally, it should have a relatively long body. The small candlestick that gaps below the black candle should close within the body of the black one. Finally, the white candlestick needs to close above the point where the black candle is exactly halfway through its body. If these requirements are met, it is likely that the market has found support, and it is probable that it will soon start moving higher. Nevertheless, before taking any action, it is critical to wait for confirmation of the information.

By understanding these patterns, traders can better navigate the market and make more informed trading decisions. Volume Buzzer, Technical Analysis Scanner chartink.

.

Morning Star candlestick is a bullish reversal candlestick pattern , which we can find at the bottom of a downtrend. This is one of the popular candlestick patterns used by many technical analysts. Morning Star pattern consists of three candlesticks: a big red candle, a small doji candle, and a big green candle. This is one of my favorite candlestick patterns I use. There are many candlestick patterns, but these 35 powerful candlestick patterns are so popular. And even from these 35, I use a few that I find easy. Morning Star is a bullish candlestick pattern. This pattern indicates a trend reversal from down to up.

Morning star candlestick chartink

This technical analysis guide covers the Morning Star Candlestick chart indicator. The pattern is split into three separate candles with relationships between all of them. We also included an example chart that we interpret using the Morning Star Candlestick indicator and learn how to spot a bullish opening on the third candlestick. The Morning Star Pattern is viewed as a bullish reversal pattern, usually occurring at the bottom of a downtrend. The pattern consists of three candlesticks:. The second day begins with a bearish gap down. It is clear from the opening of Day 2 that bears are in control. However, bears do not push prices much lower. The candlestick on Day 2 is quite small and can be bullish, bearish, or neutral i. Generally speaking, a bullish candle on Day 2 is viewed as a stronger sign of an impending reversal.

Villon sf menu

Other technical indicators can help predict if a morning star is forming, such as whether the price action is nearing a support zone or whether or not the relative strength indicator RSI is showing that the stock or commodity is oversold. Therefore, these should be used in conjunction with other technical indicators. The Bottom Line. This blog post will look at the morning star pattern and what it could mean for forex traders. Technical analysis uses historical data, mainly price and volume data to chart and predict an asset's future movements. However, morning stars can also occur amid a downtrend, making them difficult to interpret. Evening Star. Bullish Hammer. A morning star is a three-candlestick pattern that indicates bullish signs to technical analysts. The chart above has been rendered in black and white, but red and green have become more common visualizations for candlesticks. The Doji is one of the most widely recognized candlestick patterns and often signals a potential change in direction. The evening star pattern occurs when there is a bearish reversal from a significant resistance level.

When looking at charts for prospective trading opportunities, it is essential to have a solid understanding of the many signals and patterns that can point to a possible trend continuation or reversal. This blog post will look at the morning star pattern and what it could mean for forex traders. Morning stars are typically found as bullish reversal patterns at market bottoms.

The formation of the black candlestick is required inside this downward trend, and ideally, it should have a relatively long body. A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. Golden Crossover, Technical Analysis Scanner chartink. When the price action is essentially flat in the middle candlestick, it forms a doji. This data is displayed on charts, allowing traders to visualize movements and entry and exit points. EZTrader is not a part of our company. Momentum stocks. The morning star candlestick pattern is often a reasonably reliable market indicator. Shooting Star. Bullish Harami, Technical Analysis Scanner chartink. Compare Accounts.

What necessary words... super, a brilliant phrase

Remember it once and for all!