Nab mobile banking news

This website doesn't support your browser and may impact your experience.

In August , the Government released a discussion paper asking for feedback from organisations to inform its policy development options for regulating screen scraping practices. Digital ID has the potential to minimise privacy risks, build cyber resilience, and encourage productivity in the Australian economy. NAB has introduced more proactive alerts to digital banking to help keep Australians safe from ticket scams. The Nordic nations have long since been leading enablers and adopters of digital ID solutions, with BankID having launched in Norway nearly two decades ago, in According to recent figures, 4. Home Topics Digital Banking.

Nab mobile banking news

Your web browser is no longer supported. To improve your experience update it here. News NAB. Aussies given new glimmer of hope in cost-of-living crisis NAB has today become the fourth big bank to predict a rates hold for the month of February - forecasting a potential reprieve for borrowers in NAB says internet banking services restored after outage National Australia Bank is investigating after customers reported difficulty accessing their online banking services. Final big four bank move to hike rates after RBA decision All of Australia's big four banks have hiked their variable home loan rate following the Reserve Bank's interest rates increase on Tuesday. Lowest-paid workers at big four bank to get hefty pay rise The Finance Sector Union believes two of the other big four banks will soon follow suit. One-in-five of bank's customers trapped in 'mortgage prison' Calls for a regulation change are growing, as 11 interest rate hikes see more and more Aussies trapped out of negotiating for a better rate. All four big banks pass on interest rate hike to customers All four of Australia's big four banks have passed on the Reserve Bank of Australia's RBA 25 basis point interest rate hike to customers. Two major lenders hike select rates for new customers Commonwealth Bank of Australia CBA and NAB - the country's first and third largest lenders have both hiked select rates for new customers. NAB posts record profits amid interest rate hikes NAB said the high interest rates as a result of the Reserve Bank of Australia trying to curb inflation has benefited its revenue. NAB unveils new plans to protect customers' safety amid rise in scams Amid a steep rise in impersonation scams, the National Australia Bank NAB has unveiled new plans to increase customer protection. NAB fraudster who embezzled millions to spend Christmas behind bars Helen Mary Rosamond was escorted away by police in Sydney today after a successful bid by crown prosecutors to put her behind bars. Westpac issues grim interest rate rise prediction The last of the big four to release its outlook, Westpac is now predicting the Reserve Bank of Australia RBA will hike rates by a 0. NAB muscles in on Afterpay market with buy now, pay later service NAB has launched its own buy-now-pay-later BNPL service as the big bank looks to cement itself in the booming market once dominated by Afterpay.

More letters will be available online in the future. The new App will include world-leading card transaction controls, making it easier for customers to conveniently and instantly self-manage their personal Visa debit and credit cards through their mobile device.

Welcome to Finextra. We use cookies to help us to deliver our services. We'll assume you're ok with this, but you may change your preferences at our Cookie Centre. Please read our Privacy Policy. NAB welcomes Government direction in relation to the practice of screen scraping. NAB partners with Greener to help small businesses reduce carbon emissions. Oz banks back digital identity network.

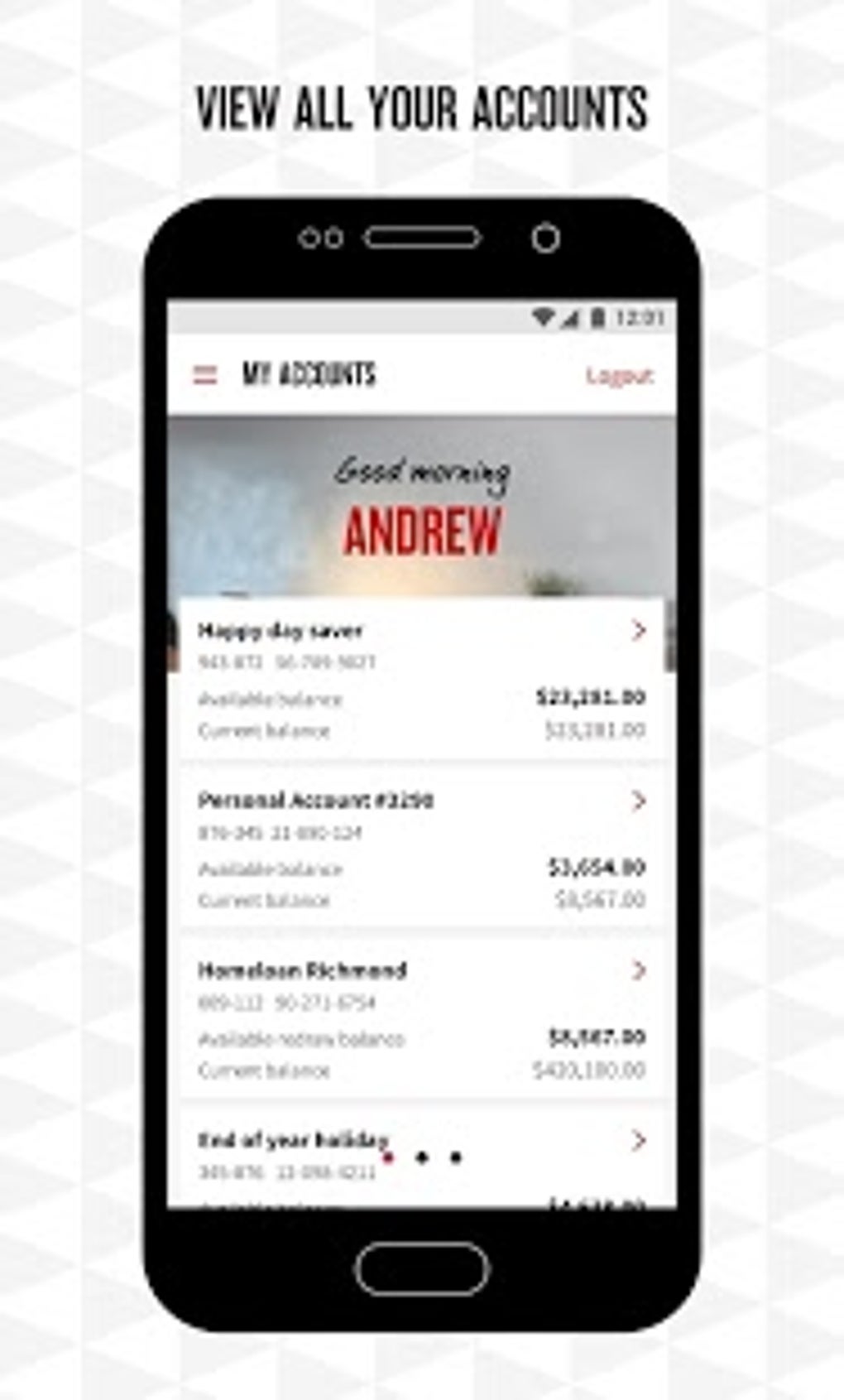

The new App will include world-leading card transaction controls, making it easier for customers to conveniently and instantly self-manage their personal Visa debit and credit cards through their mobile device. And, in an Australian first, NAB customers will be able to instantly use newly approved personal Visa credit cards, with an innovative digital contract feature in the new App not seen anywhere else in the world. NAB announced a strategic partnership with Visa in November last year, which was designed to accelerate the delivery of payments innovation and product development for customers. Through this partnership, and utilising the capabilities Visa made available through its Visa Developer platform, NAB was able to enhance the card transaction control features in its new Mobile Banking App. These card transaction control features will enable customers to select and modify when and how their Visa debit and credit cards can be used. An open pilot of the new App will commence soon for compatible Android devices, providing thousands of customers the opportunity to provide feedback. Customers who would like to participate in the pilot will be able to visit the Google Play Store and download the new App. Customers with iOS devices will also be piloting the App over coming weeks.

Nab mobile banking news

Mr Copeland said the team approached customers both directly and via social media to be part of the pilot testing and collected more than pieces of feedback during the process. Comments were collated and taken on board to help shape the look and feel of the app. The new mobile banking experience will include a range of improvements and new features , including Visa credit card transaction controls, the ability for customers to place a temporary block on any Visa card that may have been lost or stolen, quick balance view and overseas travel notification. NAB customers will also reap the long term benefit from work done to improve the underlying digital banking technology platforms. Thanks NAB, so excited new technology that will be so helpful to our customers. As a frequent user of Internet Banking and as I am time poor, this app is quick to log in, super quick to change from page to page and the balance feature without logging in is spot on. Easy on the eyes and to navigate. I like how you get the daily balance as you go through your transaction history. New NAB mobile banking app hits customer hands. By James Laidler.

Jordansports.uk.com legit

We use cookies to help us to deliver our services. Digital ID has the potential to minimise privacy risks, build cyber resilience, and encourage productivity in the Australian economy. Bank worker sacked over false virus test A National Australia Bank employee whose apparently fake coronavirus test result led to an evacuation at the bank's Melbourne head office has reportedly been sacked. Note, this is only desktop view only, and there will be no changes to how you use NAB Connect. NAB not broken, but needs repairs: McEwan Ross McEwan says he won't be joining a "broken bank" when he becomes NAB chief executive, but knows he will have a significant repair job on his hands. With Fast Payments, you can:. These card transaction control features will enable customers to select and modify when and how their Visa debit and credit cards can be used. Learn how to protect your business from cyber crime at our Business cyber security hub. Customers Getting the basics right for customers, industry and community Final big four bank move to hike rates after RBA decision All of Australia's big four banks have hiked their variable home loan rate following the Reserve Bank's interest rates increase on Tuesday. From late March , NAB Connect will have an updated font in some headings, and a new background image on the login screen. User permission reports and printouts will now display the correct user type. Please refresh the page or try again later. NAB implements cash management tech from Trovata. Please enable JavaScript and come back so you can see the complete page.

Managing your money has never been easier. You can temporarily block or unblock your card, permanently block and order a new card, or replace a damaged card instantly.

All other NAB Connect international payment fees will remain unchanged. The new App will include world-leading card transaction controls, making it easier for customers to conveniently and instantly self-manage their personal Visa debit and credit cards through their mobile device. More news. We use cookies to help us to deliver our services. NAB says internet banking services restored after outage National Australia Bank is investigating after customers reported difficulty accessing their online banking services. In August , the Government released a discussion paper asking for feedback from organisations to inform its policy development options for regulating screen scraping practices. NAB completes cross-border multicurrrency stablecoin pilot. NAB bank branches to reopen after bomb threat deemed a hoax Staff and customers can return to branches tomorrow morning after police determined there was no threat to safety. Latest offers Personal. Find a NAB business banking centre. Aussie property market correction looms, big bank predicts One of Australia's biggest banks predicts property prices will fall around 10 per cent in as looming interest rate hikes threaten to take the steam out of the market. It all started with a fire. Customers who would like to participate in the pilot will be able to visit the Google Play Store and download the new App. Coronavirus updates - Full day coverage of Tuesday 17 March Government urges Australians overseas to return home as soon as possible. By using Fast Payments, you can effectively send and receive your payments faster with no additional charge.

I recommend to you to come for a site on which there are many articles on this question.