Nab now pay later launch date

Find out more.

This website doesn't support your browser and may impact your experience. Your cashback will be credited to your linked account within 60 days of the end of the offer period. Offer ends 14 May See Important information below for more details. It's a simple way to split your everyday purchases into four equal instalments so you can stay in control of your cash flow. When you pay with your digital NAB Now Pay Later card, you get your purchase now and pay just the first repayment upfront. Having trouble with the app link?

Nab now pay later launch date

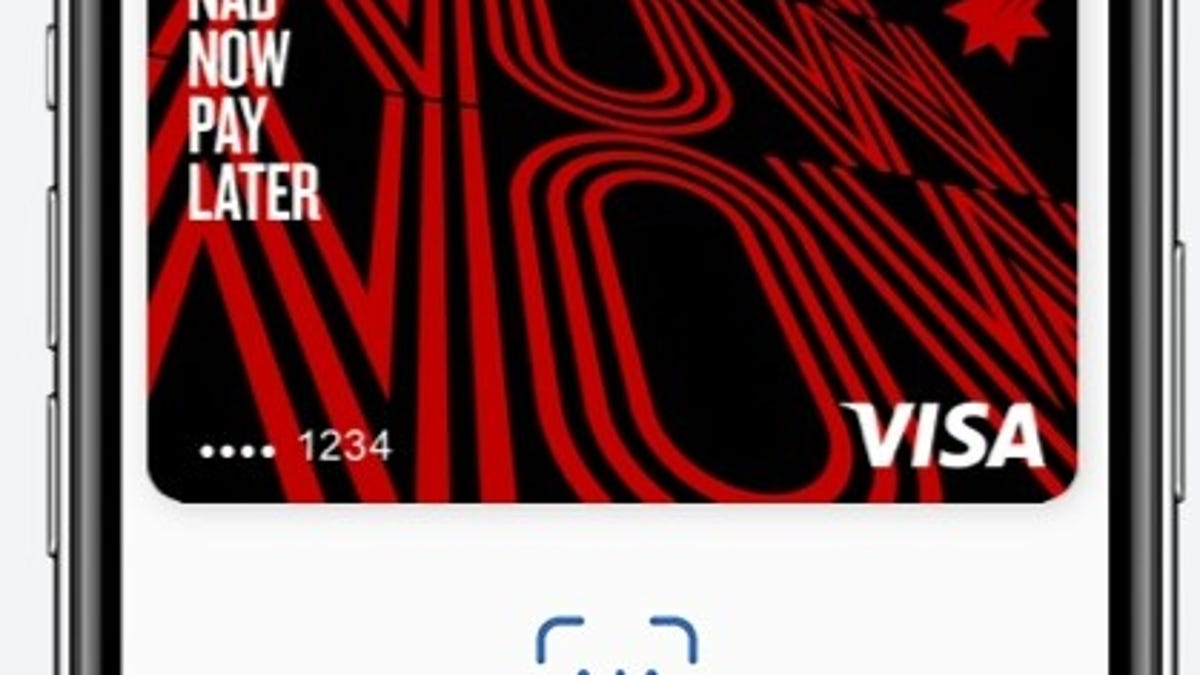

NAB customers will soon be able to pay in 4 interest free instalments, anywhere that Visa is accepted, and without monthly, annual or late fees, using the new NAB Now Pay Later card. Similar to Afterpay, NAB Now Pay Later, will split purchase into four payments, however be used anywhere Visa is accepted and has no late payment fees. NAB Now Pay Later is currently only available to customers who pre-registered, however is expected to be available to all customers shortly. This is different to other pay-in-four services, such as Afterpay. Unlike most creidt cards, NAB Now Pay Later does not charge an international transaction fee when you make purchases overseas, both online or while travelling. Sign in. Home Loans. Home Loan Quiz. Best Rate. Owner Occupied. Fixed Rate.

Skip to login Skip to main content. Boost Saver. To shop in-store, simply tap to pay with your digital wallet.

NAB has announced it will launch a buy now, pay later option in July, with pre-registrations opening today. NAB Now Pay Later will offer customers the option to pay in four instalments over a total of six weeks, with no late fees, account fees or interest charges. Unlike market leader Afterpay, NAB will carry out a credit check on every applicant before approving them. Westpac currently has a no interest credit card but no BNPL offering. Westpac also provides Afterpay with white-labelled banking products. ANZ is the only big bank keeping its powder completely dry. The code includes caps on late fees, support for vulnerable customers and freezing of accounts when repayments are missed.

This website doesn't support your browser and may impact your experience. Need more help with your banking? We have expert guides and support services to help with all your banking needs. This section contains Important Information relevant to the page you are viewing, but you can't see it because you have JavaScript disabled on your browser. Please enable JavaScript and come back so you can see the complete page. It's important that you read the Important Information in this section before acting on any information on this page.

Nab now pay later launch date

This website doesn't support your browser and may impact your experience. Your cashback will be credited to your linked account within 60 days of the end of the offer period. Offer ends 14 May See Important information below for more details. It's a simple way to split your everyday purchases into four equal instalments so you can stay in control of your cash flow. When you pay with your digital NAB Now Pay Later card, you get your purchase now and pay just the first repayment upfront. Having trouble with the app link? Make purchases online with the digital card or in store with a digital wallet of your choice anywhere VISA is accepted.

32cm into inches

Pensioner and Concession. Car Loans. The banks are entering the BNPL market at a time when growth in the product has tapered off. Save Account Download the App to open your account Get better visibility of your spending within App! Reporting to credit bureaus. Interest Free. Cash Back. Some providers' products may not be available in all states. Variable Rate. Terms of Use Privacy Policy. The entire market was not considered in selecting the above products. Compare bank accounts.

They're saying they want that accessibility, they want that ease," she said.

Product data updated on 11 Mar Company Profile — free sample Thank you! More than a third of Australian households are experiencing food insecurity amid the cost of living crisis, a new report found. The loophole means BNPL services are not subject to the same laws protecting consumers as credit cards and personal loans. Reporting to credit bureaus. Travel Debit Cards. View disclaimer. Find online help and support. Sign up for our daily news round-up! Make sure you have the NAB app downloaded on your device. Interest Free. NAB will become the third of the big four Australian banks to offer a buy now, pay later BNPL product to customers, putting additional pressure on standalone operators battling corporate losses amid rising interest rates that make it harder to survive. Target Market Determinations for these products are available at nab.

You are absolutely right. In it something is also thought good, I support.