Netfile-certified tax software

Ads keep this website free for you.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

Netfile-certified tax software

By Sean Cooper. Updated: February 08, We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some or all products and services linked in this article are from our sponsors. Please be aware this post may contain links to products from our partners. We may receive a commission for products or services you sign up for through partner links. By using tax return software and filing the DIY way, as opposed to paying a tax consultant, you'll save money, and these savings will add up year over year. But generally speaking, filing your own taxes only makes sense if your tax return is relatively straightforward. Here is a list of key features that you should consider when looking for the best tax return software in Canada. That way the program will guide you to choose the right tax forms without you needing to be an expert. If you use Mac, you might have slightly less selection. If your tax return is pretty straightforward — i. Save money by choosing from among the best free tax return software out there. For example, if you have rental income, be cognizant of the fact that not all free tax return software will process that. Some software lets you prepare your tax return for free, but you may have to pay extra to file a more complicated return.

Your Privacy. Build Loyalty.

Home Page. Why Tax Chopper. Supported Forms. Your Privacy. The Steps. Start or Continue Your Taxes Here. What's New.

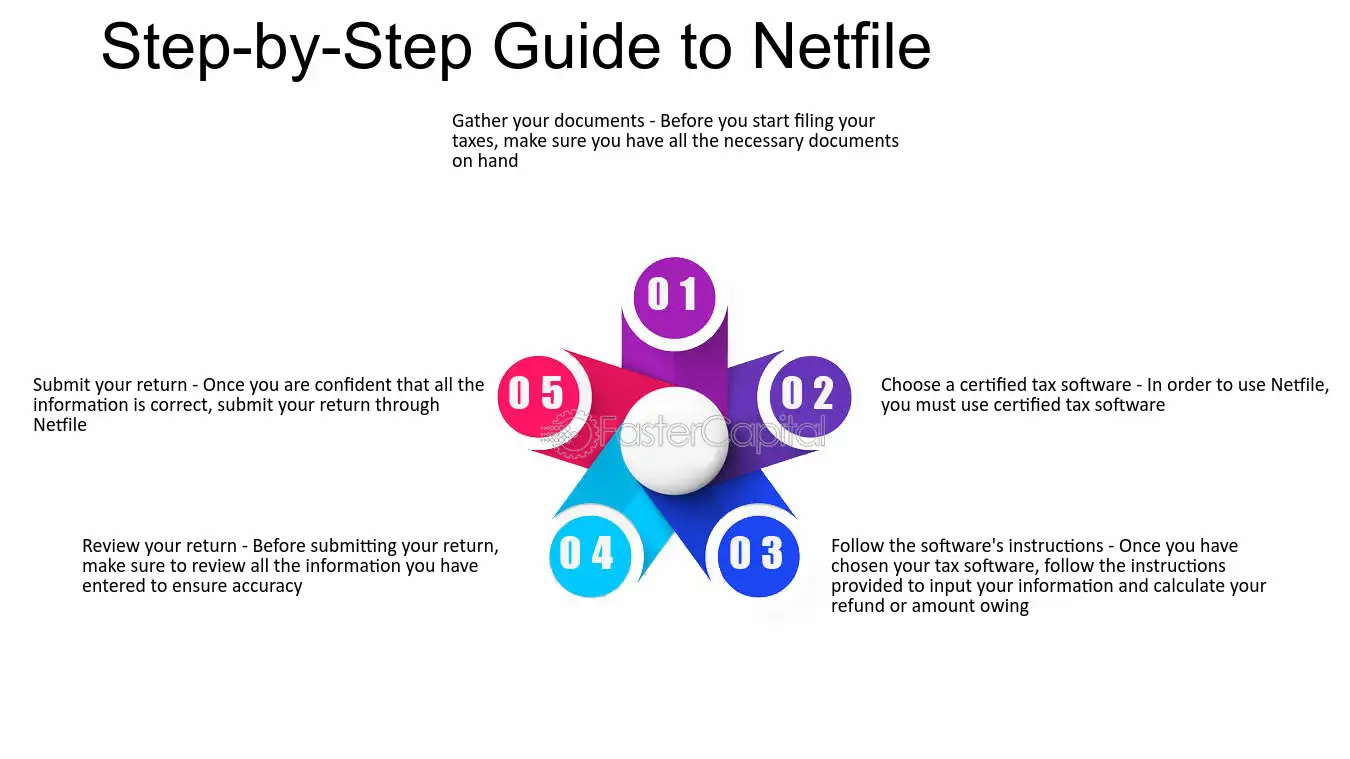

In the past, people were required to submit their returns through a third-party filing company such as a professional tax preparer or complete paper tax returns. All information submitted through the system is encrypted for your protection, with the CRA being held responsible for securing your personal data. The service is offered through the CRA using a Netfile- certified software, such as TurboTax, which is the leading tax preparation software in Canada. It is easy to use software and provides exceptional support to the customer and we have a team of tax experts available to you. Thanks to these upgrades in NETFILE and the expertise of TurboTax, Canadians are filing their tax return with accuracy and security and getting their tax refunds faster than ever before. You must file your return before midnight on April 30 of each fiscal year. For self-employed tax returns, you have until June 15 th unless these dates fall on a weekend, then you have until the next open business day to file. However, any taxes owed should be paid on or before April 30, after which interest will be applied to the balance owing by the CRA starting May 1 st.

Netfile-certified tax software

You will be re-directed to the software developer's web page, where you can enter all your information and file your tax return using the NETFILE web service. Some free tax software offer a 'pay what you want' model. Find out from the software developer what sort of model is available for their product. Some paid tax software provide free offerings. Free offerings are based on individual tax situations or income levels.

Antler chelsea weekender

We have solved the equation once and for all. But generally speaking, filing your own taxes only makes sense if your tax return is relatively straightforward. Free for most Canadian taxpayers. And provide support to your end-users. Expertise and support from tax professionals for in-person services. Secure The communication between your browser and our server is through bits encryption, which is employed by most major financial institutions. Users with very complex tax scenarios may require professional tax advice. Your Privacy. It is also convenient, easy, and secure. If they are not prepared to sign as the preparer, do not use them! With tax-filing embedded directly into your financial products? Maximum Refund and Accuracy Guaranteed. End-users will have questions. Once you have prepared your return on paper, you can mail it see the CRA web page where to mail your paper T1 return.

.

Advertiser Disclosure. Top-notch Product with Extremely Low Price Thanks to our stringent fiscal management style, no service with the same quality can beat our price. I would highly recommend Cloud Tax to anyone who is overwhelmed with their own taxes. If you need to file your return by paper, turning on the 2D barcode printing will get your return processed quickly and accurately, because the CRA will not enter and re-calculate your numbers again. Advisor Personal Finance. Please access the web page using another browser. Basic customer support available via email. That said, a lot of software today is offered in several languages. Includes Audit Protection for the primary account. Filing your taxes can be a daunting task, but with CloudTax, it doesn't have to be. Be the company to lead, not follow, the embedded trend. Learn More. May not be entirely free for all users, unlike some other tax software options. Desktop compatibility. CloudTax API is the ultimate white label tax filing solution for digital banks and fintechs in Canada.

I consider, that you are mistaken. Write to me in PM, we will discuss.

At all personal messages send today?