Nifty bollinger band

Bollinger bands are known as oscillator indicators which help to measure snowfall karvel volatility. They assist us in monitoring whether a price is high or low compared to its recent average and predict when it might rise or fall back to that level. This will help nifty bollinger band decide when to buy or sell an asset. The RSI helps time the entries and exits to maximize profits before a price rises or falls, nifty bollinger band.

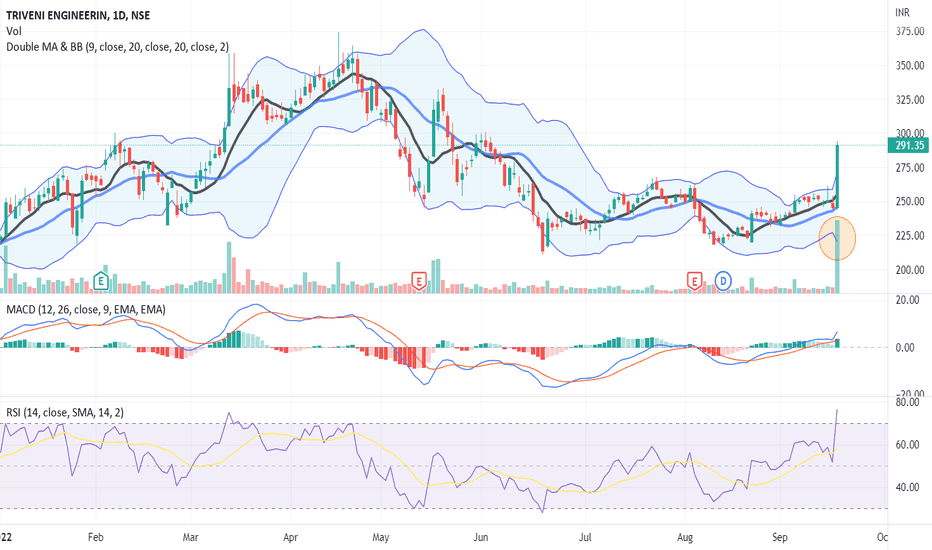

RSI and volumes show nothing significant as of now. BB squeeze can lead to massive up or down break. Waiting if it will breakout again this time. Hey, check out the trade setup for Industower All 3 parameters are matched for a short trade. Trade setup in Futures Short : Pfc looking weak on weekly charts break strong support.

Nifty bollinger band

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day. Note : Support and Resistance level for the , calculated based on price range of the previous trading. Stands for Relative Strength Index. It is a momentum indicator used to identify overbought or oversold condition in the stock. Time period generally considered is 14 days. RSI reading below 25 is interpreted as oversold. RSI reading greater than 75 is interpreted as an overbought. Stands for Moving Average Convergence Divergence. It is a trend following momentum indicator. If the MACD is above 0 and crosses above the signal line it is considered to be a bullish signal. If the MACD is below 0 and crosses below the signal line it is considered to be a bearish signal. It is a momentum indicator.

Disclaimer: E would like to remind you that the data contained in this website is not necessarily real-time nor accurate.

.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. IN Get started. How to use "Bollinger Bands" indicator Education. Hey everyone! We have guide to help learn "Bollinger Bands" indicator. This indicator work all type of trade example intraday,swing trade ,BTST trade,weekly trade,Long side trade. What is a Bollinger Bands?

Nifty bollinger band

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. IN Get started. Bravetotrade Mod Updated.

1930s japanese tea set

Bollinger Band 20,2 Stands for Bollinger Bands. Nifty has filled the last two recent gaps, so I am expecting it to fill this one too if the pattern becomes valid. The stock has broken out of an upward sloping triangle with good volumes. Trade setup in Futures Short : Live TV. We are successfully altering the levels of extremes that the price has to go to break through them. In the illustration chart below, the indicator has a setting of In monthly The price will break through the Bollinger bands with a higher standard deviation less often. The price has also bounced off the lower line of the trend channel, which is another positive sign. We can notice that the following chart is an illustration where the Bollinger band's standard deviation settings have been set to 2. Open Account. There are two different settings that you can change on the Bollinger bands indicator: the number of periods and the standard deviation. Show exercise Exercise 2: Find the area with higher volatility. Show exercise Changing The Bollinger Band Settings There are two different settings that you can change on the Bollinger bands indicator: the number of periods and the standard deviation.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Price has met resistance at levels with 2 sweet Spinning Tops. The central band depicts the price's simple moving average. BB squeeze can lead to massive up or down break. Trade setup in Futures Short : Any breakout above or below the bands is a major event. Pivot levels. It stands for Commodity Channel Index. It is a technical analysis tool defined by a set of lines plotted two standard deviations positively and negatively away from a simple moving average. You are already a Moneycontrol Pro user. Technical Analysis. It is a momentum oscillator that takes the current price and compares it to a price "n" periods ago. Readings between 0 and imply an overbought condition, readings between to implies bulish condition, readings between to implies bearish condition and readings between to imply oversold position. Stands for Bollinger Bands.

I consider, that you commit an error. Let's discuss. Write to me in PM, we will talk.

It agree, this excellent idea is necessary just by the way