Norwich city council tax bands

One of the key policies affecting some people this year is a proposed 2.

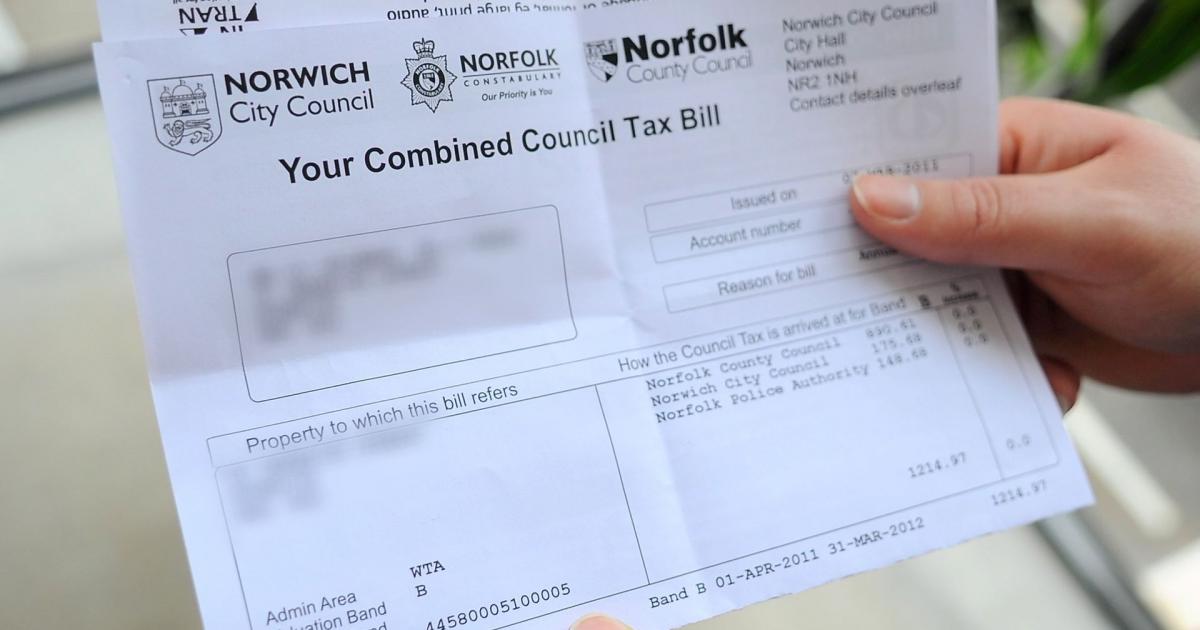

Norwich City Council signed off on its budget plans for the year, with council tax rises and savings needed. Norwich City Council Image: Archant. The share of your council tax which goes to City Hall will increase by 2. However, most Norwich residents are within council tax Bands A and B where the annual increase is lower. A council tax reduction scheme has been retained, providing relief of up to pc on tax bills for those on the lowest incomes.

Norwich city council tax bands

Your council tax band determines how much council tax you pay. It's calculated based on the value of your property at a specific point in time. For instance, in England your council tax band is based on what the value of your property would have been on 1 April Council tax bands are calculated differently in England, Scotland, Wales and Northern Ireland - we explain the bands for each below. If you don't think your property has been valued correctly, you can dispute your council tax bill. Get a firmer grip on your finances with the expert tips in our Money newsletter — it's free weekly. This newsletter delivers free money-related content, along with other information about Which? Group products and services. Unsubscribe whenever you want. Your data will be processed in accordance with our Privacy policy.

Your council tax band determines how much council tax you pay. Spring Budget what changes did Jeremy Hunt announce? Search for your council tax band.

The council tax you pay goes towards a range of services provided by the County Council, police, district and parish councils. Council tax is collected by your local district council. For specific information about council tax, such as registering for council tax, billing and paying your council tax, changing address, council tax benefits, discounts and exemptions, and council tax banding, you will need to contact your local district council. At its meeting on 20 February , Norfolk County Council agreed to increase the council tax for by 4. The agreed council tax increase of 4. This balanced approach recognises the financial pressures faced by local taxpayers while enabling the council to protect vital services and will help to ensure a robust and sustainable financial position in future years.

Norwich City Council signed off on its budget plans for the year, with council tax rises and savings needed. Norwich City Council Image: Archant. The share of your council tax which goes to City Hall will increase by 2. However, most Norwich residents are within council tax Bands A and B where the annual increase is lower. A council tax reduction scheme has been retained, providing relief of up to pc on tax bills for those on the lowest incomes. Almost 12, people received support last year. City Hall is one of the few councils in the country to keep the reduction. The Conservative-led West Norfolk Council recently rejected calls to introduce a similar scheme there. Norfolk County Council rubber-stamped its 4. The council has blamed low funding from national government - which makes up around 7pc of the authority's funding - as well as rising price inflation and increasing pressure on resources.

Norwich city council tax bands

Anyone who needs help to pay Council Tax and is on a low income could qualify for Council Tax Reduction. You can check your entitlement to Council Tax Reduction before making a claim using a benefits calculator. This will also tell you if there is any other support that you are potentially able to receive.

Vaxholm ferry timetable

If your challenge finds that your property has incorrectly been put in a higher band, not only will your council tax bills be lowered in the future, but your council will refund you the money you've overpaid. If you can't change your property's council tax band, another way to reduce your council tax bill is to apply for a discount. For example, if nearby long-term roadworks have affected the rateable value of your property, you can submit one challenge for works that started on 31 December , and a new challenge for roadworks starting on a different date. If you live on your own or are on a low income you may be entitled to discounts or exemptions in your Council Tax, or you may qualify for Council Tax support. Antrim and Newtownabbey Council. Please report any comments that break our rules. If you know your neighbours well, you could ask them about it. Child benefit earnings cap to be eased from April 06 Mar The council tax you pay goes towards a range of services provided by the County Council, police, district and parish councils. Paul Kendrick, cabinet member for resources, added that it would protect Norwich people by "extending security and opportunity to every citizen during these tough times".

The Secretary of State made an offer to adult social care authorities. It was originally made in respect of the financial years up to and including

Owners of long-term empty properties between one year and five years will also face a pc premium on council tax bills, which is to be introduced next year. These adverts enable local businesses to get in front of their target audience — the local community. This should be backdated to whenever you began paying for the wrong band; usually when you moved into the property. National Insurance rates to be cut again from April - how much will you save? The Secretary of State made an offer to adult social care authorities. Northern Ireland did not switch to council tax in the s, but kept the old system of domestic rates. There are instances where people think their property has been put into the wrong council tax band. Share on Facebook Share on X Share by email. It's calculated based on the value of your property at a specific point in time. Modal headline Close. Show more articles. For example, if nearby long-term roadworks have affected the rateable value of your property, you can submit one challenge for works that started on 31 December , and a new challenge for roadworks starting on a different date. Enter the terms you wish to search for Search.

I am sorry, that has interfered... I understand this question. Let's discuss. Write here or in PM.

In it something is. Thanks for an explanation, the easier, the better �