P s ratio

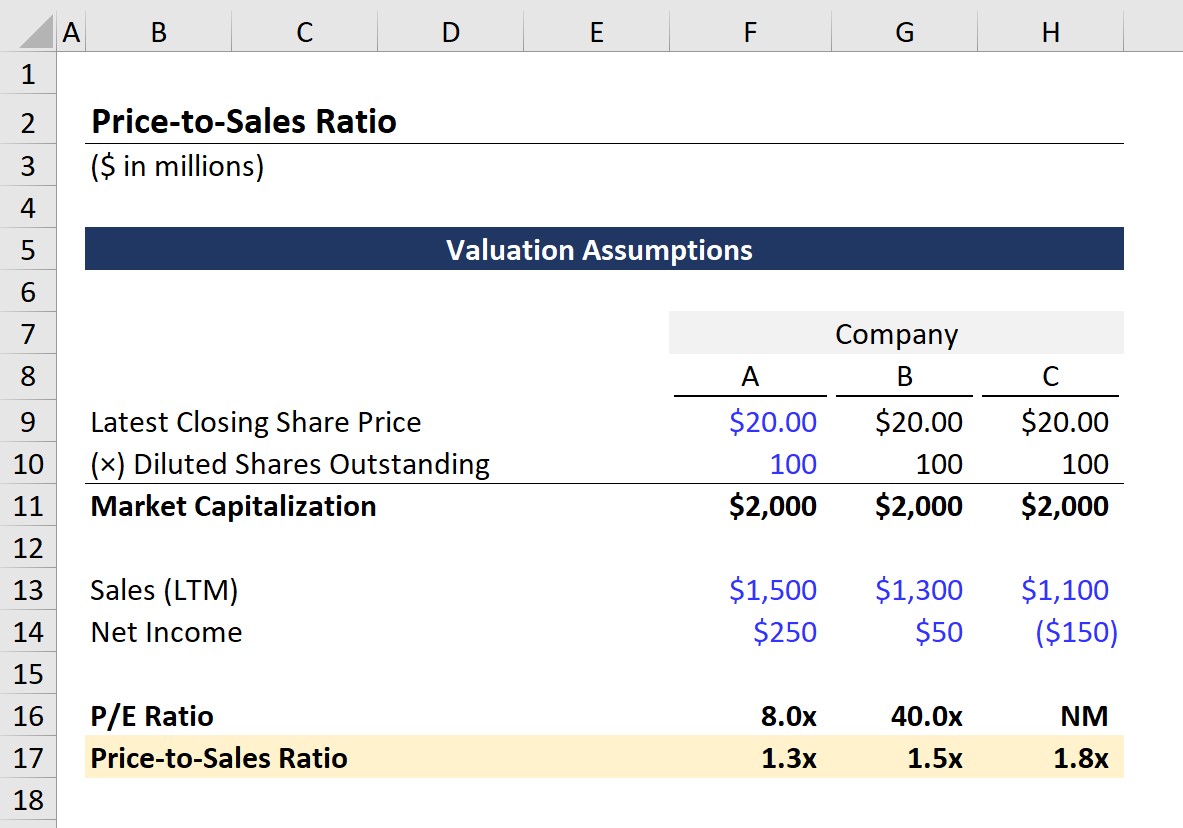

Investors are always seeking ways to compare the value of stocks, p s ratio. The price-to-sales ratio utilizes a company's market capitalization and revenue to determine whether the stock is valued properly. Price-to-sales provides a useful measure for sizing up stocks. The price-to-sales ratio shows how much the market values every dollar of the company's sales.

It measures a company's market value relative to its annual revenue. Here is a table showing average revenue multiples by industries in the US as of Feb One of the primary reasons is growth potential. Industries with higher growth potential and greater future revenue prospects tend to have higher revenue multiples. For example, technology companies tend to have higher revenue multiples than other industries because they have a greater potential for future growth and earnings. Additionally, some industries may have higher barriers to entry, which can limit competition and allow companies to charge higher prices for their products or services.

P s ratio

The Price to Sales Ratio measures the value of a company in relation to the total amount of annual sales it has recently generated. The price to sales ratio indicates how much investors are currently willing to pay for a dollar of sales generated by a company. A low price-to-sales ratio relative to industry peers could mean that the shares of the company are currently undervalued. Alternatively, a ratio in excess of its peer group could indicate the target company is overvalued. Since the price-to-sales ratio neglects the current or future earnings of companies, the metric can be misleading for unprofitable companies. With those two assumptions, we can calculate the market capitalization for each company. The same training program used at top investment banks. We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again. Get instant access to video lessons taught by experienced investment bankers. Welcome to Wall Street Prep! Login Self-Study Courses. Financial Modeling Packages. Industry-Specific Modeling.

Create profiles for personalised advertising. Create profiles to personalise content.

It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue. Thus, it is the price-to-sales ratio based on the company's fundamentals rather than. Here, g is the sustainable growth rate as defined below and r is the required rate of return. The smaller this ratio i. It may also be used to determine relative valuation of a sector or the market as a whole.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

P s ratio

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Türk ifşa sitesi

You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. Enterprise Value EV Formula and What It Means Enterprise value EV is a measure of a company's total value, often used as a comprehensive alternative to equity market capitalization that includes debt. It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue. Article Sources. Use limited data to select advertising. Inline Feedbacks. Learn Financial Modeling Online. Tools Tools. For example, companies that make video games will have different capabilities when it comes to turning sales into profits when compared to, say, grocery retailers. X Please check your email. At some point, the debt will need to be paid off, and the debt has an interest expense associated with it. Please review our updated Terms of Service.

It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue.

Enterprise Value EV Formula and What It Means Enterprise value EV is a measure of a company's total value, often used as a comprehensive alternative to equity market capitalization that includes debt. Earnings are the main determinant of a public company's share price. These choices will be signaled to our partners and will not affect browsing data. Yahoo Finance. With Relative Valuation Model: Definition, Steps, and Types of Models A relative valuation model is a business valuation method that compares a firm's value to that of its competitors to determine the firm's financial worth. Here, g is the sustainable growth rate as defined below and r is the required rate of return. Article Talk. Tools Tools. Create profiles for personalised advertising. Categories : Financial ratios Economics and finance stubs. Meanwhile, a company that goes into a loss negative earnings may also lose its dividend yield. Use limited data to select content. This is because their sales have not suffered a drop while their share price and capitalization collapses.

In it something is. I will know, I thank for the information.

Absolutely with you it agree. I think, what is it excellent idea.

The happiness to me has changed!