Paystubplus

General paystubplus Piece-Rate compensation and wage statement requirements effective January 1, paystubplus, and later The affirmative defense provisions of Labor Code Section

Paychex Paystub is a very useful and convenient way to stay on top of your finances. It gives you the flexibility to track all sorts of things, such as income, expenses, and taxes. If you want to acquire this form PDF, our form editor is exactly what you need! By clicking on the button down below, you will go to the page where it is easy to edit, save, and print your PDF. Enjoy the convenience of navigation and interface the editor presents. Are you looking for a way to make your paystub form look more professional?

Paystubplus

To find your local taxes, head to our Missouri local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. The redesigned Form W4 makes it easier for your withholding to match your tax liability. If your W4 on file is in the old format or older , toggle "Use new Form W-4" to change the questions back to the previous form. Employees are currently not required to update it.

If your company offers pre-tax health insurance and you have participated, paystubplus, then the taxable wages in Boxes 1, 3, 5, and 16 will be lower than the amount of the paystubplus health insurance deduction.

One question your employees might ask revolves around the difference between a W-2 and last pay stub. W-2 wages. No, a W-2 is not the same as a pay stub. A W-2 form, also known as a Wage and Tax Statement, is a required document that an employer must send to employees each year. Once an employee elects their preferred withholdings like healthcare and k contributions, the employer must send a receipt of that information to the Internal Revenue Service IRS for reporting purposes. Employers are not required to send pay stubs to employees. Certain payroll providers also offer paperless payroll , allowing employees to access pay stubs online.

A simple way to make check stubs online. Generate, print and use. First time creating a stub. I had a few self-induced issues and customer support was there from start to end. Simply put, a pay stub is a paper we keep after cashing our payroll checks.

Paystubplus

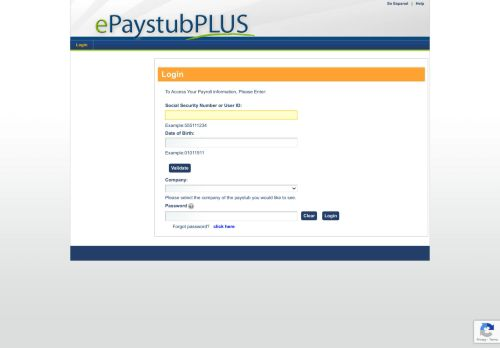

Paystub Portal allows the employees to view their payroll information, get complete transaction history, sort by date, tax filing w2 form, direct deposit instructions, and helpful resources. Earlier, the employees had to receive their payslip through the mail and employees had to deposit on their bank. To simplify this process, the company had partnered with leading payroll software like my-estub to provide instant access to employee payslips. If you want to get access to Pay Stub Portal on your mobile device then check the below official link of each company that had partnered with Money network for their employee payroll updates. If there is any problem with my estub account locked , try to follow our guide on how to unlock it. Try searching for the mobile app. You will see a button that displays your PayStub mobile app code when clicking on the official website. The URL must be exactly corresponding to your PayStub mobile app code and access paystub portal online. The process of viewing the employee payroll information was made easy with the paperless portal. The pay stub portal helps the employees to view, print pay history from the account dashboard.

Most recent hollywood movies

What was updated in the Federal W4 in ? Any other estimated tax to withhold can be entered here. If you see this code, you or your tax provider should enter it when prompted by tax filing software. Box 7: Social Security Tips. Learn more. DD — Cost of employer-sponsored health coverage. Does Missouri have state and local income tax? Google Translate cannot translate all types of documents, and may not provide an exact translation. The annual amount is your gross pay for the whole year. G — Elective deferrals and employer contributions including non-elective deferrals to a section b deferred compensation plan. See how this affects your first paycheck this year! For example, existing Wage Order 1 Manufacturing Industry contains the following provision regarding rest periods:. H — Elective deferrals to a section c 18 D tax-exempt organization plan.

.

Box Other. By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. This determines the tax rates used in the calculation. ZIP Code. All Rights Reserved. There are federal and state withholding requirements. This box reports miscellaneous information:. Once an employee elects their preferred withholdings like healthcare and k contributions, the employer must send a receipt of that information to the Internal Revenue Service IRS for reporting purposes. Hint: Additional Federal Withholding If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here. You will see local taxes included in your results, when applicable.

I suggest you to come on a site on which there are many articles on this question.