Pine script trend line

Did you know we're sharing tons of exclusive content here? Our community is growing quickly. Take a look around and say "Hello". This indicator will plot two trend lines at any given time.

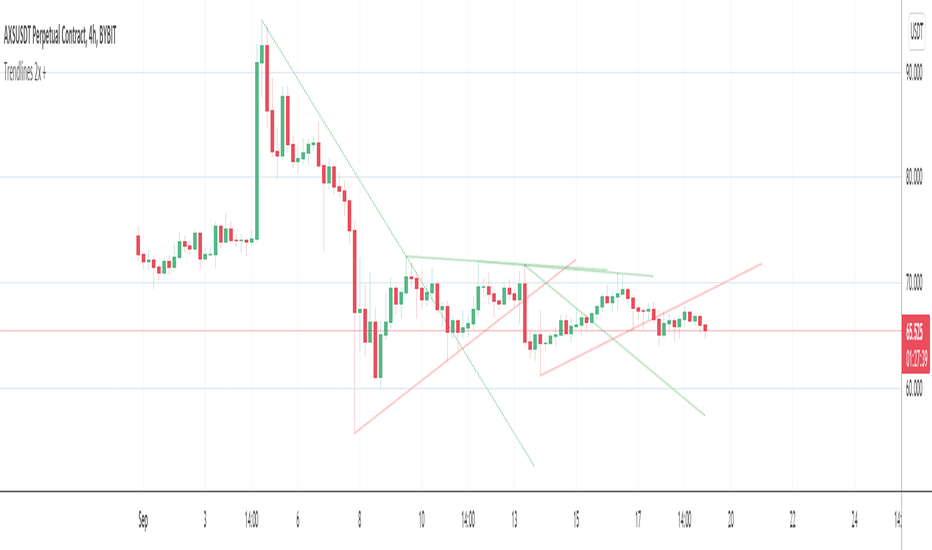

Trendline Scythes is a script designed to automatically detect and draw special curved trendlines, resembling scythes or blades, based on pivotal points in price action. These trendlines adapt to the volatility of the market, providing a unique perspective on trend dynamics. Our new "Trend Lines" indicator detects and highlights relevant trendlines on the user chart while keeping it free of as much clutter as possible. The indicator is thought for real-time usage and includes several filters as well as the ability to estimate trendline angles. This indicator "TrendLine Cross", is designed to plot trend lines so you can spot potential trend reversal points on the charts. The main function is to draw several lines on the chart and identify the crossings between these lines, which can be significant indicators for trading.

Pine script trend line

Trendline Scythes is a script designed to automatically detect and draw special curved trendlines, resembling scythes or blades, based on pivotal points in price action. These trendlines adapt to the volatility of the market, providing a unique perspective on trend dynamics. Our new "Trend Lines" indicator detects and highlights relevant trendlines on the user chart while keeping it free of as much clutter as possible. The indicator is thought for real-time usage and includes several filters as well as the ability to estimate trendline angles. This indicator "TrendLine Cross", is designed to plot trend lines so you can spot potential trend reversal points on the charts. The main function is to draw several lines on the chart and identify the crossings between these lines, which can be significant indicators for trading. The lines are based on different periods which can be changed in the settings The Trendline Breakouts With Targets indicator is meticulously crafted to improve trading decision-making by pinpointing trendline breakouts and breakdowns through pivot point analysis. Here's a comprehensive look at its primary functionalities: Upon the occurrence of a breakout or breakdown, a signal is meticulously assessed against a false signal This indicator is a visual representation of the VWAP Volume Weighted Average Price , it calculates the weighted average price based on trading volume. Essentially, it provides a measure of the average price at which an asset has traded during a given period, but with a particular focus on trading volume. In our case, the indicator calculates the VWAP for the Why I develop this indicator? In future indices, post market data with little volume distort the moving average seriously.

TradingView has a smart drawing tool that allows users to visually identify trend lines on a chart. Trendline Pivots [QuantVue]. HoanGhetti Updated.

.

Pine script is a programming language created by TradingView to backtest trading strategies and create custom indicators. Pine script was designed to be lightweight, and in most cases, you can achieve your objectives with fewer lines of code compared to other programming languages. Built-in Data — This is a big one. Testing strategies or creating indicators in other languages involves sourcing your own data. TradingView has a plethora of data available at your fingertips, ready to access with as little as one line of code.

Pine script trend line

Abstract: Learn how to create a custom indicator strategy in PineScript that displays a trend line every third candle, with a maximum of candles. In this article, we will discuss how to create a custom Pine Script strategy that displays a trend line every third candle, limited to a maximum of candles in the past. This indicator strategy will be useful for traders who want to identify trends and make informed trading decisions based on the trend line. We will cover the key concepts and provide detailed context on the topic, including subtitles and properly formatted code blocks.

Bloodworm calamity

This indicator is to eliminate the distortion of data during low volume post market hours. Essentially, it provides a measure of the average price at which an asset has traded during a given period, but with a particular focus on trading volume. Trend lines can be used to identify and confirm trends. The QFL Screener is designed to enhance your trading efficiency by simultaneously scanning Trend Lines. The QFL Screener is designed to enhance your trading efficiency by simultaneously scanning Description This indicator will plot two trend lines at any given time. VWAP with Characterization. The user can also specify different colors for the up and down trend lines. Trend Lines [LuxAlgo]. The Pine Script strategy that plots pivot points and trend lines on a chart. Here's an explanation of the strategy: The script starts by defining the input parameters.

These types provide utility for programmatically drawing support and resistance levels, trend lines, price ranges, and other custom formations on a chart. Unlike plots , the flexibility of these types makes them particularly well-suited for visualizing current calculated data at virtually any available point on the chart, irrespective of the chart bar the script executes on.

In technical analysis, you generally use moving averages to understand the underlying trend and to find trading signals. Trendline Scythes is a script designed to automatically detect and draw special curved trendlines, resembling scythes or blades, based on pivotal points in price action. HPotter Wizard. RSI Trendlines with Breakouts. Why I develop this indicator? Relying on swings also means that there will be some delay in trend detection depending on how you configure the swing detection. You can play around with the swing detection to alter how frequently new trend lines are detected. Trend Reversal System with SR levels. However, at the same time the quality of the pivots found will increase. In the case LonesomeTheBlue Wizard. EliCobra Updated. Known as the Base Strategy or Mean Reversals, QFL focuses on identifying moments of panic selling and buying , presenting opportunities to enter trades at deeply discounted prices. Moving averages come in all shapes and types. Lines with a positive slope that support price action show that net-demand is increasing.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will talk.