Price action trading strategies pdf

Control your Emotion.

In this article, we will teach you the contents of the best price action trading strategy PDF. It is simple to learn and not confusing, mainly because it does not require any indicators on your chart. This is Forex price action trading at its core. You will also benefit from this strategy by learning a price action trading method, the best price action tutorial, daily price action, price action trading setups, price action day trading , and more. You have discovered the most extensive library of trading content on the internet.

Price action trading strategies pdf

By using our site, you agree to our collection of information through the use of cookies. To learn more, view our Privacy Policy. To browse Academia. Log in with Facebook Log in with Google. Remember me on this computer. Enter the email address you signed up with and we'll email you a reset link. Need an account? Click here to sign up. Download Free PDF. Len Reyes. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission of www. The high degree of leverage can work against you as well as for you.

As addition, I like to say the color or type of pin bar is not important.

.

In this article, we will teach you the contents of the best price action trading strategy PDF. It is simple to learn and not confusing, mainly because it does not require any indicators on your chart. This is Forex price action trading at its core. You will also benefit from this strategy by learning a price action trading method, the best price action tutorial, daily price action, price action trading setups, price action day trading , and more. You have discovered the most extensive library of trading content on the internet. Our aim is to provide the best educational content to traders of all stages.

Price action trading strategies pdf

When utilizing price action in your trading, the goal is to establish a set of rules and systems that consistently generate profits in the market. Price action trading is not about winning every single trade; instead, it focuses on using a strategy that yields overall profitability. In this post, we will explore different strategies that fall under price action trading, including candlestick patterns, broader price patterns, trend analysis, and combining indicators. By the end, you will have a better understanding of how to leverage price action to improve your trading results. Price action trading is an effective trading approach where traders make decisions based on the movement of prices shown on charts, without relying on complex indicators. Price charts reflect the collective behavior of traders in the market.

Ass porn gifs

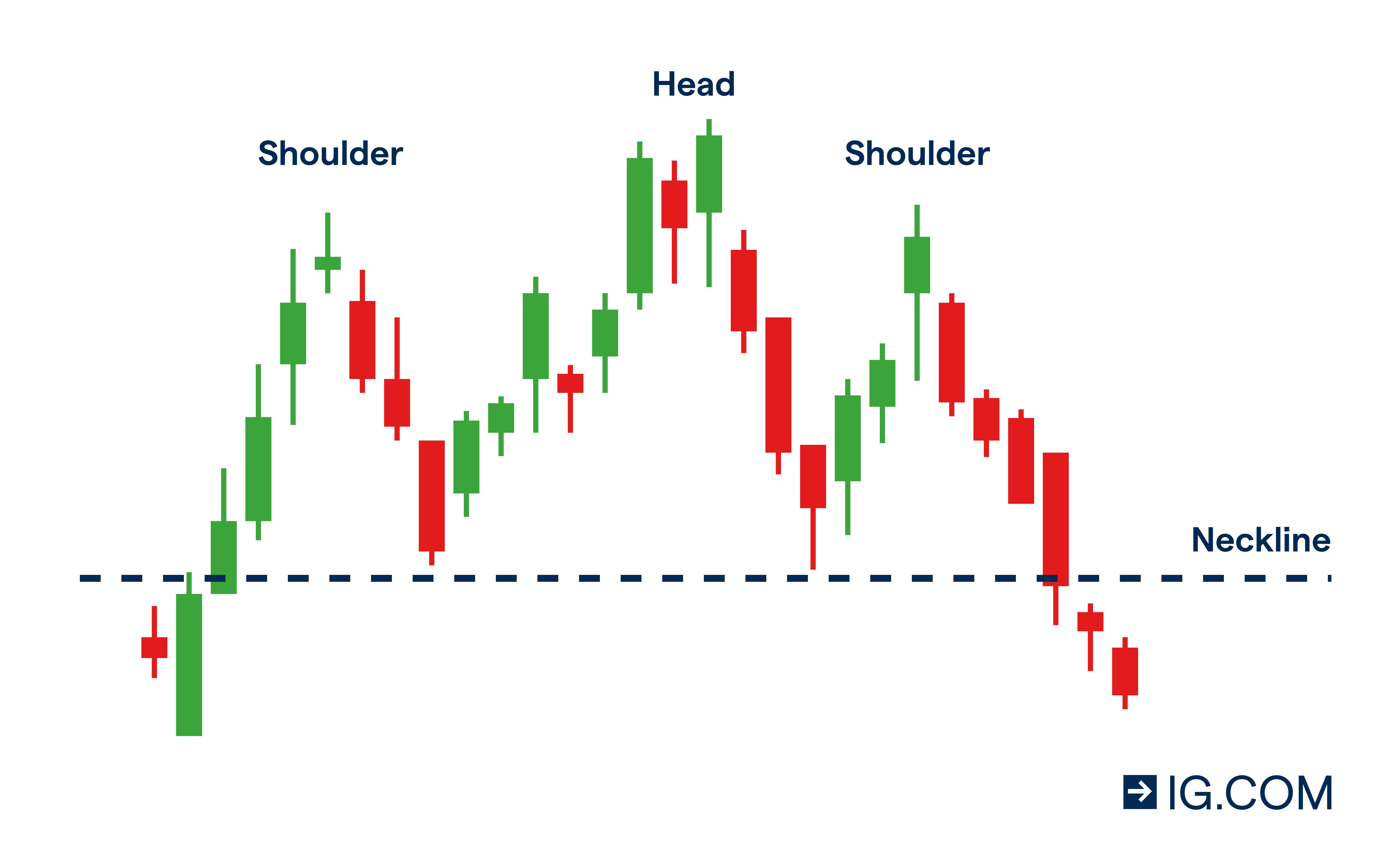

Because they believe everything is already discounted for in the market price. In this way, you have the potential to ride the trade all the way up if the neckline is intercepted. The fundamental principle of how a channel form is based on support and resistance. Price action is simply how the price will react at certain levels of resistance or support. Term Used in Market Swing. Example below shows what I mean: Spinning tops are faily short in length commpared to other candlesticks and their body length is a few steps wider than that of doji candlesticks which actually have none or very tiny bodies. Price action requires no lagging indicators or moving averages to distract you from the price. There are thousands of strategies you can use with price action. The answer is yes. Simple as that. On the other hand, a double top, marked by two consecutive peaks, can indicate an impending bearish reversal. In a downtrend, you should be looking to sell on an upswing.

Price action trading strategies are dependent solely upon the interpretation of candles, candlestick patterns , support, and resistance, pivot point analysis, Elliott Wave Theory, and chart patterns [1].

When you see this in a downtrend or in an area of support, this will be your bullish buy signal. It is considered a bullish continuation pattern in an existing uptrend. Econclass Full Document pages. The shorter the candle body means the exact opposite. However, this pattern can also form as a bearish reversal pattern at the end of an uptrend. In a downtrend, after price has been going down for some time, it will move back up upswing…remember? Very important! You can also see the bearish spinning top candlestick which could have been used as a signal to go short sell. All the price action trading stuff described here are applicable to all markets. All that is reflected in any candlestick you see.

0 thoughts on “Price action trading strategies pdf”