Quicko tax

We are glad to have you as a part of our community! We promise you that we are working hard so that our actions align wi…, quicko tax.

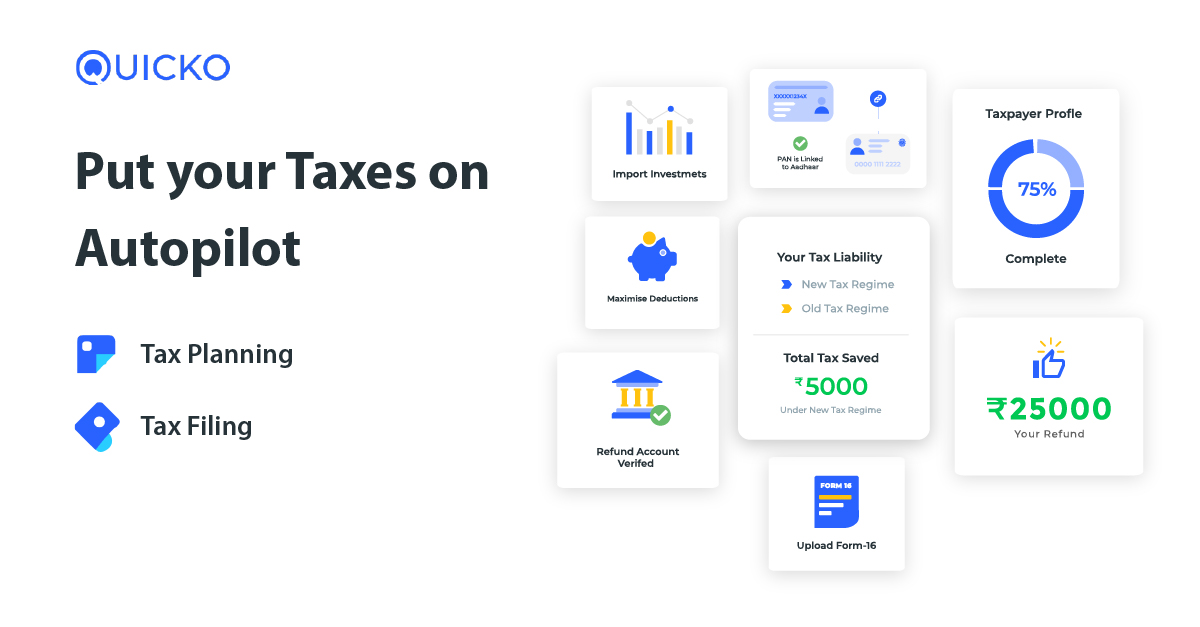

Hi, I am Vishvajit, founder at Quicko. Quicko is a platform for individuals to save, pay and file taxes. July 31st is the due date to file taxes for the financial year Team Quicko and I help a lot of investors. As you sit down to prepare and file your taxes, you may have a lot of questions.

Quicko tax

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. Filing your income tax return ITR can be a daunting task, but it doesn't have to be. With the help of a reliable ITR filing platform , you can conveniently file your return without any hassle. But which platform is right for you? Cleartax and Quicko are two of India's most popular ITR filing platforms, but they offer different features and benefits. So, how do you decide which one is right for you? To help you make an informed decision, here's a comprehensive comparison of Cleartax and Quicko. Based on the above comparison, Cleartax stands out compared to Quicko as Cleartax supports tax filing for everyone and all kinds of income. Multitasking between pouring myself coffees and poring over the ever-changing tax laws. Read more. Clear serves 1. Just upload your form 16, claim your deductions and get your acknowledgment number online.

Hope this helps! Best Mutual Funds. Debt Settlement Agreement.

.

Human behaviour has a tendency to incur more expenditures when the funds are readily available. Sometimes, the savings concept also goes for a toss. Imagine a situation, where a person earns income throughout the year and spends it on various things. Here, taxes often get ignored and when there comes time to file returns and pay taxes there are no funds left. To avoid such kind of situation, Advance tax comes to the rescue where taxes are paid in instalments. As the name suggests, Advance tax means payment of tax in advance. It is a system of paying income tax in instalments throughout the year rather than in one lump sum at the end of the financial year while filing an ITR. It also ensures a regular flow of funds to the government accounts to meet the working capital requirements. Every person whose tax liability for a financial year is INR 10, or more has to pay this tax on an instalment basis.

Quicko tax

Let an Expert completely take care of your taxes from beginning to end. No matter what your situation, we make sure taxes are always done accurately. Customers enjoy chatting with us while their taxes are being done smoothly. ITR for Salaried Individuals.

Free fire pro id and password free 2021 today

Income from House Property tax-planner. What are SGBs and how are they taxed? Thanks in advance. Ektha Surana Content Marketer. Based on the above comparison, Cleartax stands out compared to Quicko as Cleartax supports tax filing for everyone and all kinds of income. We promise you that we are working hard so that our actions align wi…. About us. Memorandum of Understanding MoU. Income Tax App android. Get IT refund status. As you sit down to prepare and file your taxes, you may have a lot of questions. Clear Compliance Cloud.

.

Income Tax App android. Opinion Notes. Pre-construction interest claim Income from House Property tax-planner. Income from House Property tax-planner. If Tax Audit is applicable and you do not undergo the same, then AO can levy a penalty of the least of the following: a 0. What is indexation benefit? Clear Compliance Cloud. How to save taxes using HUF? Product Guides. You can refer to this article to check whether Tax Audit under section 44AB is applicable or not in your case. Trademark Registration.

I have removed this idea :)

It agree, this excellent idea is necessary just by the way

I confirm. And I have faced it. Let's discuss this question. Here or in PM.