Québec tax calculator

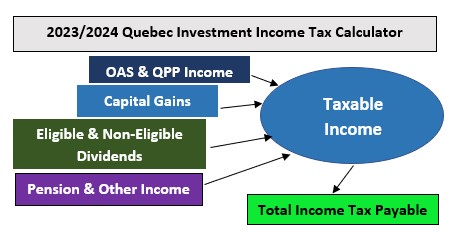

Get a quick, québec tax calculator estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Québec tax calculator

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations. For Quebec residents making purchases in other provinces in Canada during , it's crucial to be aware of the tax implications. When dealing with the sale of books, only the GST needs consideration in the calculation. Ensure compliance with the specific tax regulations of the province in question. When processing transactions involving Quebec residents outside of Canada, it's important to note that, as of the current regulations, no sales tax is applicable. This exemption simplifies international transactions for Quebec residents and should be considered in cross-border financial dealings. Keep up to date! No warranty is made as to the accuracy of the data provided. Calcul Conversion can not be held responsible for problems related to the use of the data or calculators provided on this website.

Quebec follows federal guidelines on the exemption of sales taxes to First Nations.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. The QST was consolidated in and was initially set at 6. Examples include auto insurance and home insurance. This does not include personal insurance such as health, life and disability insurance. However, services provided on a reserve to a First Nations individual will not be charged sales taxes. Quebec follows federal guidelines on the exemption of sales taxes to First Nations. Further exemptions and regulations can be found at here here.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Forbes Advisor Canada has a tool to help you figure it out. Your average tax rate is

Québec tax calculator

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada?

Album wham make it big

VPN Not Connecting? Prince Edward Island tax calculator Quebec tax calculator Saskatchewan tax calculator Yukon tax calculator. Do your taxes with the TurboTax mobile app Work on your tax return anytime, anywhere. Calculate your estimated tax return. Pay by setting up a pre-authorized debit agreement using CRA My Account or through a third-party service provider with credit card, e-transfer, or PayPal. Keep up to date! Quebec Provincial Tax. Here are the tax brackets for Canada based on your taxable income. Work on your tax return anytime, anywhere. Real Estate. Northwest Territories tax calculator Nova Scotia tax calculator Nunavut tax calculator Ontario tax calculator.

.

VPN Not Connecting? Gross Annual Income. Marginal Rate 1. This video explores the Canadian tax system and covers everything from what a tax bracket Canada income tax calculator Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. United States. Get organized for tax season with everything you need to file your taxes with ease. Keep up to date! However, services provided on a reserve to a First Nations individual will not be charged sales taxes. Ensure compliance with the specific tax regulations of the province in question. Learn more about income tax in Quebec. Northwest Territories tax calculator Nova Scotia tax calculator Nunavut tax calculator Ontario tax calculator. These tips will help you understand what to include when you file. So how exactly do taxes work in Canada? How do I report self-employment income?

0 thoughts on “Québec tax calculator”