Ready reckoner rate pune

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, ready reckoner rate pune, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute ready reckoner rate pune stamp duty.

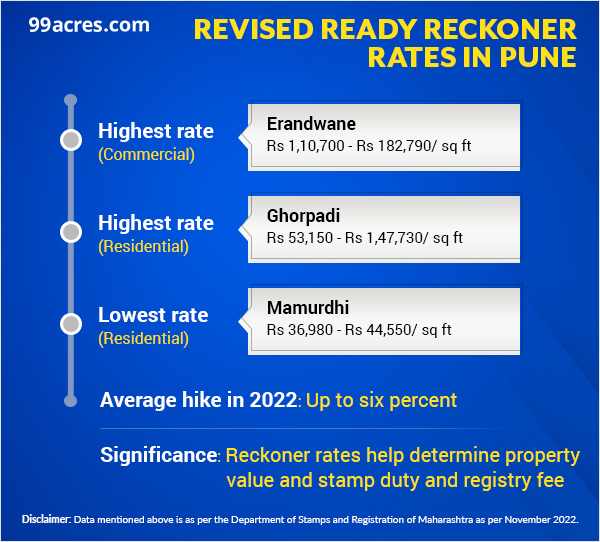

Ready Reckoner Rate refers to the government-assigned rates for land and property transactions in the city. These rates determine Stamp Duty and Registration Charges while undertaking property transactions. Understanding the Ready Reckoner Rate is crucial for buyers and sellers in Pune's real estate market. Since Pune has had a significant presence in the automobile, manufacturing, and IT industries for years, the Ready Reckoner rate of Pune in - was very high. This category would include rates for apartments, flats, independent houses, and residential plots in various areas of Pune. Ready reckoner Rates can vary significantly depending on the location, amenities, infrastructure, and demand for residential properties in a particular site.

Ready reckoner rate pune

Email: [email protected]. Plan selected:. Enter Property Code. Back to Search Properties. Property Type Residential Commercial. Deal Type Buy Rent Project. Enter Pincode. I am: Broker Developer. Enter Name. Enter Email Address. Enter Mobile Number. Enter Code. Connect Now Loading

It is a Private Website, developed for Basic Information. Important Timeline of Maharashtra State. Thanks For Subscribing!

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. Sure, the cost of the product can go up depending on the external conditions, but it cannot go down than the set limit in any case. It directly affects the whole concept of stamp duty and registration charges collected by the government.

Ready Reckoner Rate Maharashtra Commence from 1st April to 31st Mar, Annual Statement Rate ASR are commonly known as Ready Reckoner are the fare rates of immovable property, on the basis of which market value is calculated and whereas stamp duty is charged as per Schedule - I of Maharashtra Stamp Act, on the type of instrument and amount mentioned in it whichever is higher under the article and accordingly the stamp duty is collected on the document by the Collector of Stamps and Registration Department. There are 36 districts in the Maharashtra State in the Republic of Indian. We have systematically arranged few districts so that users can easily know the accurate property rates to calculate stamp duty of the geographical area of the Maharashtra State which are as below; simply select the district of your choice to get information related to the Ready Reckoner Rates. We have explained in details how to calculate Market value of Property. Maharashtra State Government has provided various types of facilities to the public for the payment of Stamp Duty through various types of mode and has appointed Nationalized Banks, Schedule Banks, Private Banks and the Co-operative Banks which are authorized by Reserve Bank of India. With view that the facility of payment of stamp duty is made easily available to the public therefore different arrangements are in force. Crafted by Tulja Bhavani Web Tech.

Ready reckoner rate pune

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty. Stamp Duty Ready Reckoner rates per square meter are to be correlated with a built-up area and not with carpet area or super built-up area. Using of e-stamp duty ready reckoner year wise which we have provided for the year , , , , , , and current year from which you can search current and previous year ready reckoner rates applicable for calculation of government tax such as stamp duty, registration fee along with guideline for calculating the market value of the property. We have taken every effort and care to provide correct information's with updates, if any human error is noticed please do tell us about the same so that these can be rectified after verifying the same. Stamp duty ready reckoner is divided into two parts such as guidelines and rates of property in a different geographical area. Originally the stamp duty ready reckoner was considered for determining the true market value of a property for recovering tax in form of Stamp duty on various articles of schedule I of Bombay Stamp Act, now it is Maharashtra Stamp Act on every purchase or sale of immovable property, etc. We have provided useful tools to calculate stamp duty and registrations fee etc. We request our valuable users to confirm the rates of the property with the concerned department before paying stamp duty and registration fee to avoid the unpleasant situation at the time of registration of documents.

Dijes de oro 14k para hombres

Stamp Duty Ready Reckoner mulshi RR rates for houses in a certain location are an excellent indicator of how much money a prospective home buyer will have to spend on a property. Real Estate Legal Guide. Codename Punawale 2 View. Similarly, the Maharashtra government and Mumbai registrar office also impose a premium on the ready reckoner rate for high-rise apartment floors. Feb 27, Mobile Number. How to calculate Market Value of Property. COVID resulted in the halt of various construction projects and led to an increase in unsold inventory. Maharashtra Ready Reckoner Rate Ready Reckoner Rate Maharashtra Commence from 1st April to 31st Mar, Annual Statement Rate ASR are commonly known as Ready Reckoner are the fare rates of immovable property, on the basis of which market value is calculated and whereas stamp duty is charged as per Schedule - I of Maharashtra Stamp Act, on the type of instrument and amount mentioned in it whichever is higher under the article and accordingly the stamp duty is collected on the document by the Collector of Stamps and Registration Department. Book Free Consultation.

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields.

The agricultural and non-agricultural private or government land rates can differ significantly based on factors like proximity to urban areas, development potential, and land use regulations. Stamp duty and registration costs will be computed using the RR rate in rare circumstances when the redirection rate in Pune is greater than the current rate. VTP Flamante View. Pune Location and Property Type Residential Properties This category would include rates for apartments, flats, independent houses, and residential plots in various areas of Pune. The rise, on the other hand, will not affect homes with less than square feet. Understanding the Ready Reckoner Rate is crucial for buyers and sellers in Pune's real estate market. How to calculate the ready reckoner rate for Mumbai? Can you sell a house for less than the ready reckoner rate? Plan selected:. Stamp Duty Ready Reckoner velha

You commit an error. Let's discuss. Write to me in PM, we will talk.