Regulated forex brokers in usa

Regulated Forex Brokers. Your 1 source for comprehensive directory and list of registered, licensed and regulated Forex brokers! Forex Regulations are laid down to protect the interests of clients and ensure fair operations at Forex brokers.

Looking for a broker with top regulations? Practical tips from our experts are included. One of the biggest brands in the industry. Multilayered protections. Below-average spreads. Choice of versatile trading platforms. Ultra-fast order execution.

Regulated forex brokers in usa

When combining this with their selection of elite trading platforms, tools and extensive loyalty program for traders with high volumes, we had to place them at the forefront. During our comprehensive analysis of the world's 40 top forex brokers, we found that OANDA's standard account spreads are typically Across all major currency pairs, OANDA consistently maintains lower spreads, often more than halving the industry's typical costs. OANDA's Elite Trader program caters to the dedicated trader, with five tiers starting at a monthly volume of 10 million. Each platform offers a distinct selection of features to support your trading activities, regardless of your preferred strategy. MetaTrader 4, a platform favored by forex traders worldwide, offers comprehensive charting capabilities and an extensive range of in-built technical indicators. With access to nine timeframes and over 50 pre-installed indicators, traders can precisely analyze market trends and movements. The platform's user-friendly interface allows for trading directly from the charts, streamlining the process. Justin Grossbard from CompareForexBrokers praises the core benefits of the MT4 platform, focusing on its capacity for automation. This is the reason MT4 remains my go-to platform," he shares. EAs are that ally, offering a relentless pursuit of efficiency and precision, turning complex data into clear, actionable decisions.

This does not mean that app traders are glued to the regulated forex brokers in usa, it means they use apps intelligently by setting their trading apps to alert them when something interesting happens in the market. When choosing an online trading platformU. His expertise is swing trading and day trading with a heavy emphasis on psychological and fundamental analysis.

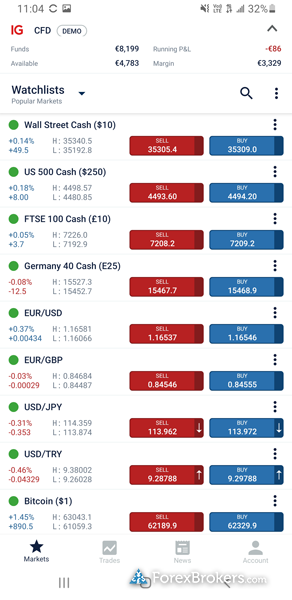

Finding a good Forex broker in the US should not be too difficult, right? With Forex being the most active financial market and the US economy the largest in the world, there should be plenty of choices when you are looking for brokers for Forex in the USA. Well, things get a little complicated here. Due to factors like trading costs and regulation, choosing the right FX broker is not as straightforward as you might think. Find out below what to look out for when picking the right brokers for Forex in the USA. One of the best platforms for CFD traders.

These brokers allow spot trading when forex trading with leverage up to We look at the best brokers one can choose from. Written by Justin Grossbard. Edited by Laura Wolfe. Fact Checked by Riley Adams. Fact Checked. Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site. The best Forex Brokers In the USA offer American clients trading conditions and trading costs on par with those for international account holders. This forex brokerage excels in market research, offers robust charting and technical analysis tools, and has an award-winning mobile app. It also boasts a strong reputation due to an impressive commitment to transparency.

Regulated forex brokers in usa

In the number of US regulated forex brokers grew to seven. We compared them all to determine the best forex broker based on spreads, trading experience and the platforms used. Written by Justin Grossbard. Edited by Sean A'Hearn. Fact Checked by Ross Collins. Fact Checked.

Best under desk treadmill canada

Apple Pay. Leverage for US regulated Forex brokers is capped at and this maximum leverage cap is designed to protect retail traders from excessive leverage. Are regulated brokers more expensive in terms of fees and commissions? It allows you to observe price action behavior and study potential opportunities for placing orders. His career as a day-trader at a proprietary trading firm goes back to Exness Review. Leverage — Swissquote Ptd. That is a good thing — as a US trader, you want to be protected from brokers who do not operate honestly, to say the least. There is a very high degree of risk involved in trading securities. When choosing an online trading platform , U. This is just a hypothetical example, but hopefully, it illustrates how more can be less in trading.

Each year, we collect thousands of data points and publish tens of thousands of words of research.

AvaTrade maintains good execution standards — the broker has all the necessary documentation but does not state its average execution speed. That is why you should do your due diligence before opening an account with any broker. Choosing a reputable, well-regulated forex broker is a crucial step towards avoiding forex scams. Trading through an online platform carries additional risks. Leverage — Ava Trade Japan K. Its strength lies in its user-friendly interface and sophisticated mobile apps, which make trading accessible on the go. The broker's commitment to innovation and user experience, particularly in mobile trading, has not gone unnoticed in the FinTech sector. Leverage for US regulated Forex brokers is capped at and this maximum leverage cap is designed to protect retail traders from excessive leverage. Forex brokers that operate in the U. They secure client funds in segregated accounts and provide official channels for dispute resolution, creating a safer and more secure trading environment against potential fraud and unethical practices.

I think, that you commit an error. I can defend the position. Write to me in PM, we will communicate.