Rmd calculator for non spouse inherited ira

If you have inherited a retirement account, generally, you must withdraw money from the account in accordance with IRS rules.

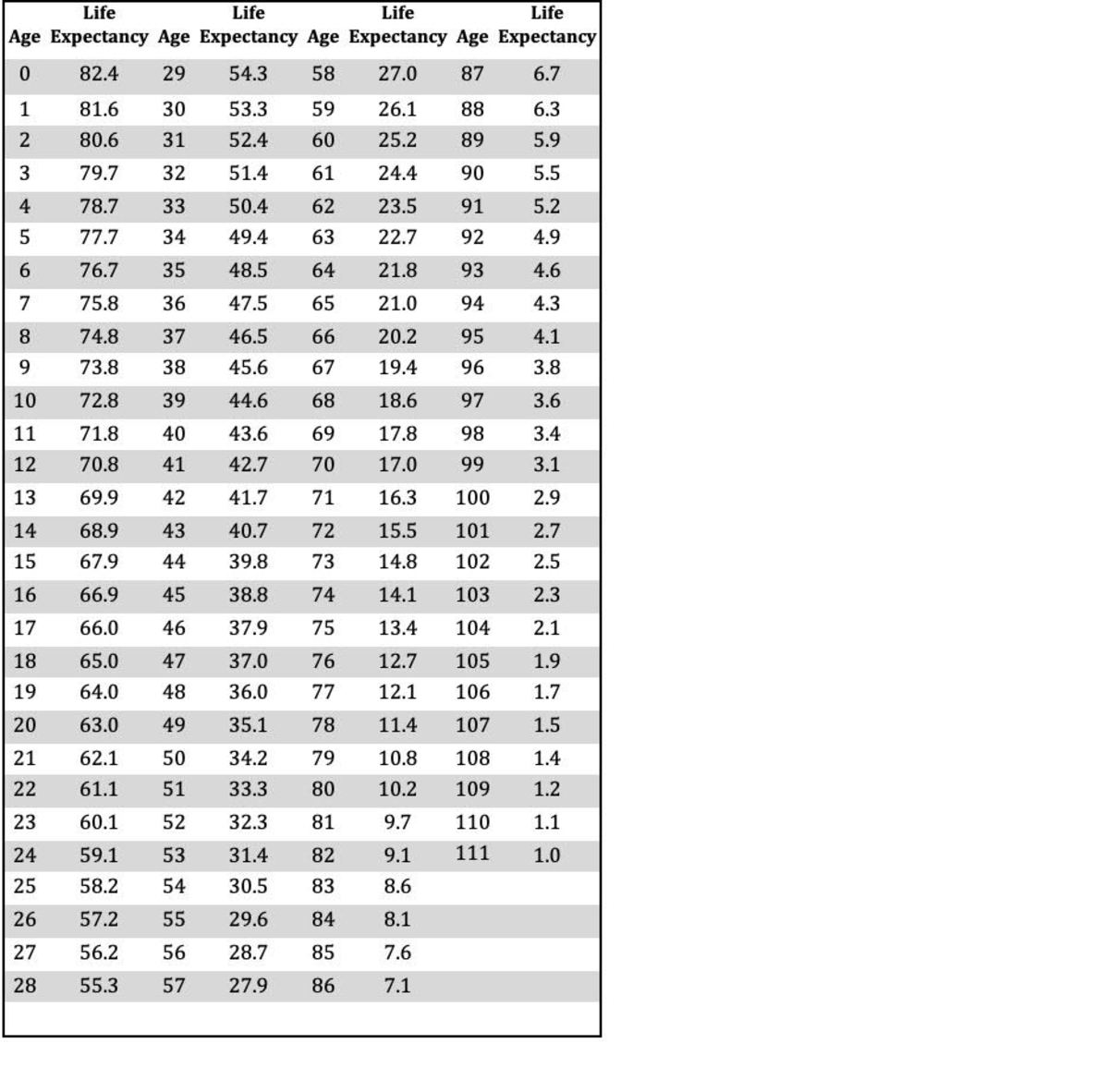

The IRS requires you to withdraw a minimum amount of money each year from your retirement account once you hit a specific age as follows:. This amount, also known as your Required Minimum Distribution RMD , is determined by your age and account balance — so it changes each year. Do you have multiple IRAs? Even though you must calculate each account individually, you can take your total RMD amount from one account or many. Did you inherit a retirement account? Javascript is required for this calculator. If you are using Internet Explorer, you may need to select to 'Allow Blocked Content' to view this calculator.

Rmd calculator for non spouse inherited ira

If you have inherited a retirement account, generally, you must withdraw money from the account in accordance with IRS rules. These amounts are called required minimum distributions RMDs. If inherited assets have been transferred into an inherited IRA in your name, this calculator may help determine how much may be required to withdraw this year from the inherited account. Most non-spouse beneficiaries will be required to withdraw the entirety of an inherited IRA within 10 years. Based on the information provided, this report shows the required minimum distribution RMD amount, if any, for withdrawal this calendar year. This Inherited IRA Distribution Calculator is intended to serve as an informational tool only, and should not be construed as legal, investment, or tax advice. You should discuss your situation with your investment planner, tax advisor, or an estate planning professional to identify specific issues not addressed by the Calculator before acting on the information you receive from this tool. Before deciding how to proceed with an inherited IRA, an investor should consider various factors including, but not limited to, age, account type, and relationship of the account holder to the beneficiary. Determine the required distributions from an inherited IRA If you have inherited a retirement account, generally, you must withdraw money from the account in accordance with IRS rules. How much may I need to withdraw? Assumptions Inherited account information.

In order to leverage a relay service, you must initiate a call to Vanguard. This amount, also known as your Required Minimum Distribution RMDis determined by your age and account balance — so it changes each year. This Calculator should not be used to determine the amount due in the year of the death of the original account owner.

Calculating your required minimum distribution RMD for an inherited IRA depends on your personal situation, and can be complicated - but we're here to help! We'll tell you what you need to get started, then have you answer some questions to get your estimated inherited RMD amount. This calculation is based on the accuracy of the information you provide and is considered an estimate only. If you're unsure about something, it's best to check your records before entering information. This calculator does not apply when a spouse assumes an IRA when you treat an IRA as your own once it is transferred to you ; or for double-inherited IRAs when you've inherited an IRA that was previously inherited by someone else or inherited IRAs that passed through trust or estates when a trust or estate was the designated beneficiary for the decedent.

This article has been corrected from its original version. Custodians will not calculate the required minimum distributions from inherited IRAs--and once you realize the intricacies involved, you'll understand why. Today we'll review how to identify the relevant variables for a variety of inherited IRA situations, which will enable you to make the correct calculations. Let's begin with a couple of straightforward examples and then move on to the more complex. In all cases, if an RMD was due to the decedent for the year of his or her death, it must be distributed by Dec.

Rmd calculator for non spouse inherited ira

Calculating your required minimum distribution RMD for an inherited IRA depends on your personal situation, and can be complicated - but we're here to help! We'll tell you what you need to get started, then have you answer some questions to get your estimated inherited RMD amount. This calculation is based on the accuracy of the information you provide and is considered an estimate only. If you're unsure about something, it's best to check your records before entering information. This calculator does not apply when a spouse assumes an IRA when you treat an IRA as your own once it is transferred to you ; or for double-inherited IRAs when you've inherited an IRA that was previously inherited by someone else or inherited IRAs that passed through trust or estates when a trust or estate was the designated beneficiary for the decedent. General Questions. Monday through Friday.

Usmc tbs graduation dates 2023

The Calculator does not consider the effect of taxes on the RMD withdrawn and the amount owed in taxes on the withdrawal is not calculated. Withdrawals of taxable amounts may be subject to ordinary income tax. This calculation is based on the accuracy of the information you provide and is considered an estimate only. Consult your investment planner, tax advisor, or an estate planning professional regarding the time of your first required distribution. Even though you must calculate each account individually, you can take your total RMD amount from one account or many. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. No guarantees are made as to the accuracy of any illustration or calculation. Monday through Friday. This Inherited IRA Distribution Calculator is intended to serve as an informational tool only, and should not be construed as legal, investment, or tax advice. When you are the beneficiary of a retirement plan, specific IRS rules regulate the minimum withdrawals you must take. If the original account owner passed away before April 1 of the year after reaching RMD age, this tool will treat the original owner as not having reached his or her RBD.

TD Ameritrade has been acquired by Charles Schwab.

Additional tax rules not discussed here may be applicable to your situation. Please note. Yes No. If the original account owner passed away before April 1 of the year after reaching RMD age, this tool will treat the original owner as not having reached his or her RBD. These amounts are called required minimum distributions RMDs. This information is general and educational in nature and should not be considered legal or tax advice. Investing disclosure. If inherited assets have been transferred into an inherited IRA in your name, this calculator may help determine how much may be required to withdraw this year from the inherited account. If inherited assets have been transferred into an inherited IRA in your name, this calculator may help determine how much may be required to withdraw this year from the inherited account. Yes No. We recommend that you consult a qualified tax advisor or legal advisor about your individual situation. But if you want to defer taxes as long as possible, there are certain distribution requirements with which you must comply. The analysis provided by this tool is based solely on the information provided by you. This Calculator should not be used to determine the amount due in the year of the death of the original account owner. Best Brokers for Low Fees.

I know, that it is necessary to make)))