Salary calculator barcelona

Salary calculator barcelona you accept a new position in Barcelona, Spain you need to find out what kind of salary you will need there so you don't end up regretting the move later on. Depending on your employer's offer, you may also need to explain why your salary expectation is what it is. You can do this with our independent salary and cost-of-living calculations.

The final amount you receive after the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated monthly. If you want to know more, we'll show you the most important elements when calculating and paying your salary. This is the final amount you receive before the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated on an annual basis. If you want to know more, we'll tell you the most important elements when calculating and paying your salary. More BBVA.

Salary calculator barcelona

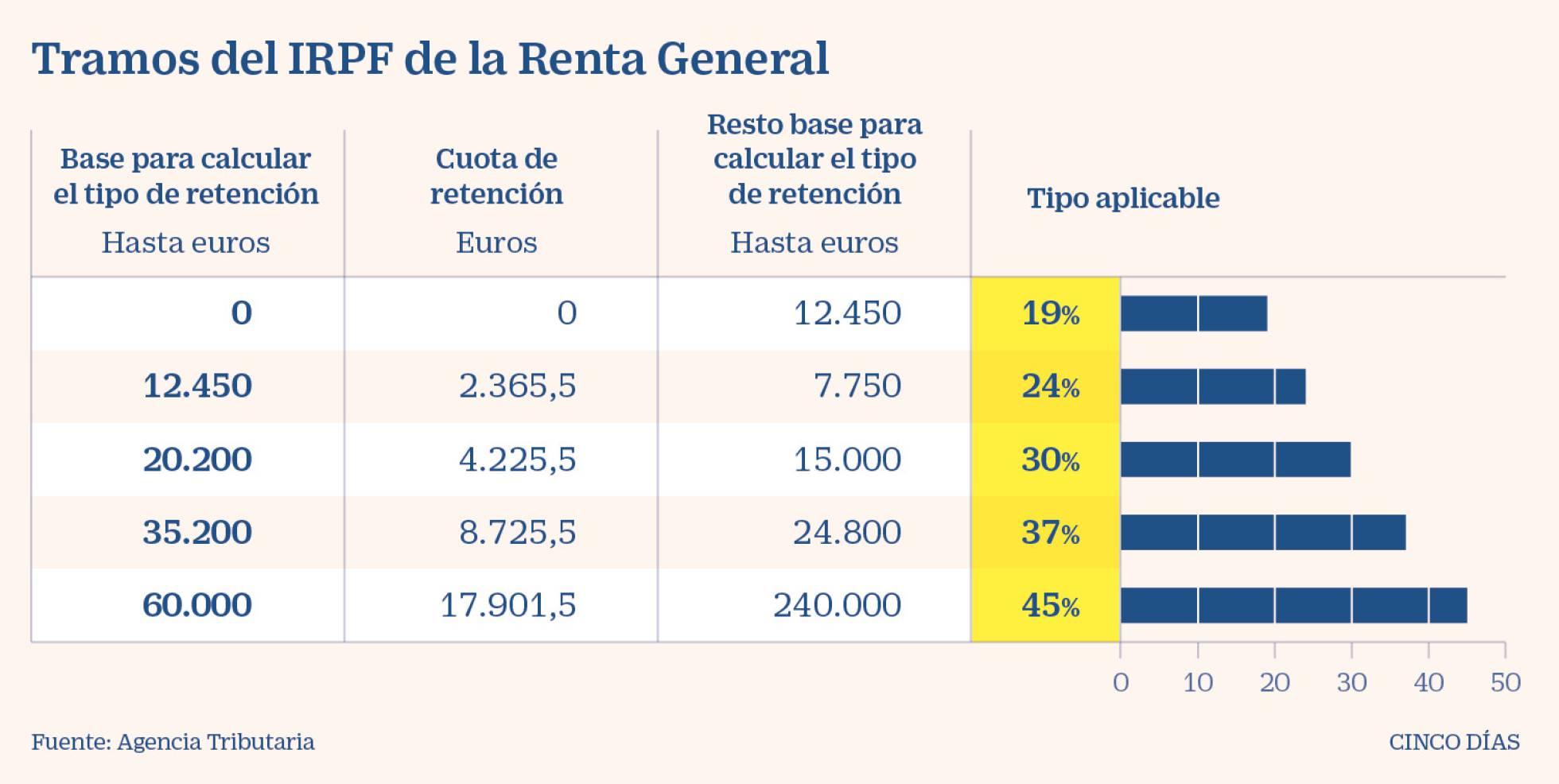

Simply enter your annual or monthly income into the salary calculator calculadora de salario above to find out how taxes in Spain affect your income. You'll then get a breakdown of your total tax liability and take-home pay salario neto. The deductions used in the calculator assume you are not married and have no dependents. You may pay less if tax credits or other deductions apply. The table below breaks down the taxes and contributions levied on these employment earnings in Madrid, Spain. Two exceptions are highlighted in the Royal Decree concerning the Spanish minimum wage. The information presented here is based on Spain's fiscal regulations. The information provided on this site is intended for informational purposes only. Please consult a qualified specialist such as an accountant or tax advisor for any major financial decisions. Yearly Monthly Weekly. Server error, please try again.

Abundant, up-to-date data.

Since those early days we have extended our resources for Spain to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Spain Tax Calculator and salary calculators within our Spain tax section are based on the latest tax rates published by the Tax Administration in Spain. In this dedicated Tax Portal for Spain you can access:. The Spanish Income Tax Calculator is designed for individuals living in Spain and filing their tax return in Spain who wish to calculate their salary and income tax deductions for the Tax Assessment year 1 st January - 31 st December You can include your income, Capital Gains, Overseas Pensions, Donations to charity and allowances for family members. You can also select future and historical tax years for additional income tax calculations where figures are held, if you would like to calculate your income tax deductions for Spain for a year which is not shown please contact us and we will integrate the relevant tax tables.

Since those early days we have extended our resources for Spain to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Spain Tax Calculator and salary calculators within our Spain tax section are based on the latest tax rates published by the Tax Administration in Spain. In this dedicated Tax Portal for Spain you can access:. The Spanish Income Tax Calculator is designed for individuals living in Spain and filing their tax return in Spain who wish to calculate their salary and income tax deductions for the Tax Assessment year 1 st January - 31 st December You can include your income, Capital Gains, Overseas Pensions, Donations to charity and allowances for family members. You can also select future and historical tax years for additional income tax calculations where figures are held, if you would like to calculate your income tax deductions for Spain for a year which is not shown please contact us and we will integrate the relevant tax tables.

Salary calculator barcelona

The final amount you receive after the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated monthly. If you want to know more, we'll show you the most important elements when calculating and paying your salary.

Deep blackhead for years

How much more expensive is the cost-of-living in Barcelona, Spain, broken down by category. You can also select future and historical tax years for additional income tax calculations where figures are held, if you would like to calculate your income tax deductions for Spain for a year which is not shown please contact us and we will integrate the relevant tax tables. Your report will calculate, based on your current salary, how much you should earn in Barcelona, Spain to keep your quality of life unchanged. Spain uses a pay-as-you-earn tax system, where the employer withholds the employee's taxes and contributions from the gross pay, transferring the payment directly to the tax authorities on a monthly basis. Simply enter your annual or monthly income into the salary calculator calculadora de salario above to find out how taxes in Spain affect your income. Paycheck calculation: we'll show you how it's calculated What is net salary? Our data has been regularly used by the most demanding companies and organizations, in economic textbooks, and in general media as a primary source. Calculators and simulators. Bring hard facts into your negotiation. If you want to know more, we'll show you the most important elements when calculating and paying your salary.

Simply enter your annual or monthly income into the salary calculator calculadora de salario above to find out how taxes in Spain affect your income. You'll then get a breakdown of your total tax liability and take-home pay salario neto.

Resident Individual What is your age? Deductions on personal income tax are available for each type of income. The calculation that you will get combines the biggest cost-of-living database in the world which we run ourselves and public data sources, such as the United Nations, the World Bank, the OECD and Eurostat. Calculate your net monthly salary. The deductions used in the calculator assume you are not married and have no dependents. IBAN calculator. In order to give a good indication on the lowest take-home pay an employee can expect, our calculator assumes the highest minimum and maximum caps. Quickly calculate your gross annual salary. The common guidelines to withholding tax at progressive rates applicable, the latest rates and thresholds are available here. Salary calculator. Enter your employment income and expenses to produce an income tax calculation for Spain or select advanced to edit the default setting and change the salary calculation to match your circumstances. Salary Calculator UK. Abundant, up-to-date data. Please consult a qualified specialist such as an accountant or tax advisor for any major financial decisions.

0 thoughts on “Salary calculator barcelona”