Scotia savings accelerator

For those ready to get started on their home savings journey, Scotiabank is offering an interest rate of 5.

In this guide. Getting started. Scotiabank is o ne of the largest banks in Canada , offering a variety of personal accounts for savings. Here are regular, non-promotional Scotiabank saving account interest rates for every available account as of February 6, Scotiabank Savings Accelerator Account. Scotiabank Money Master Savings Account.

Scotia savings accelerator

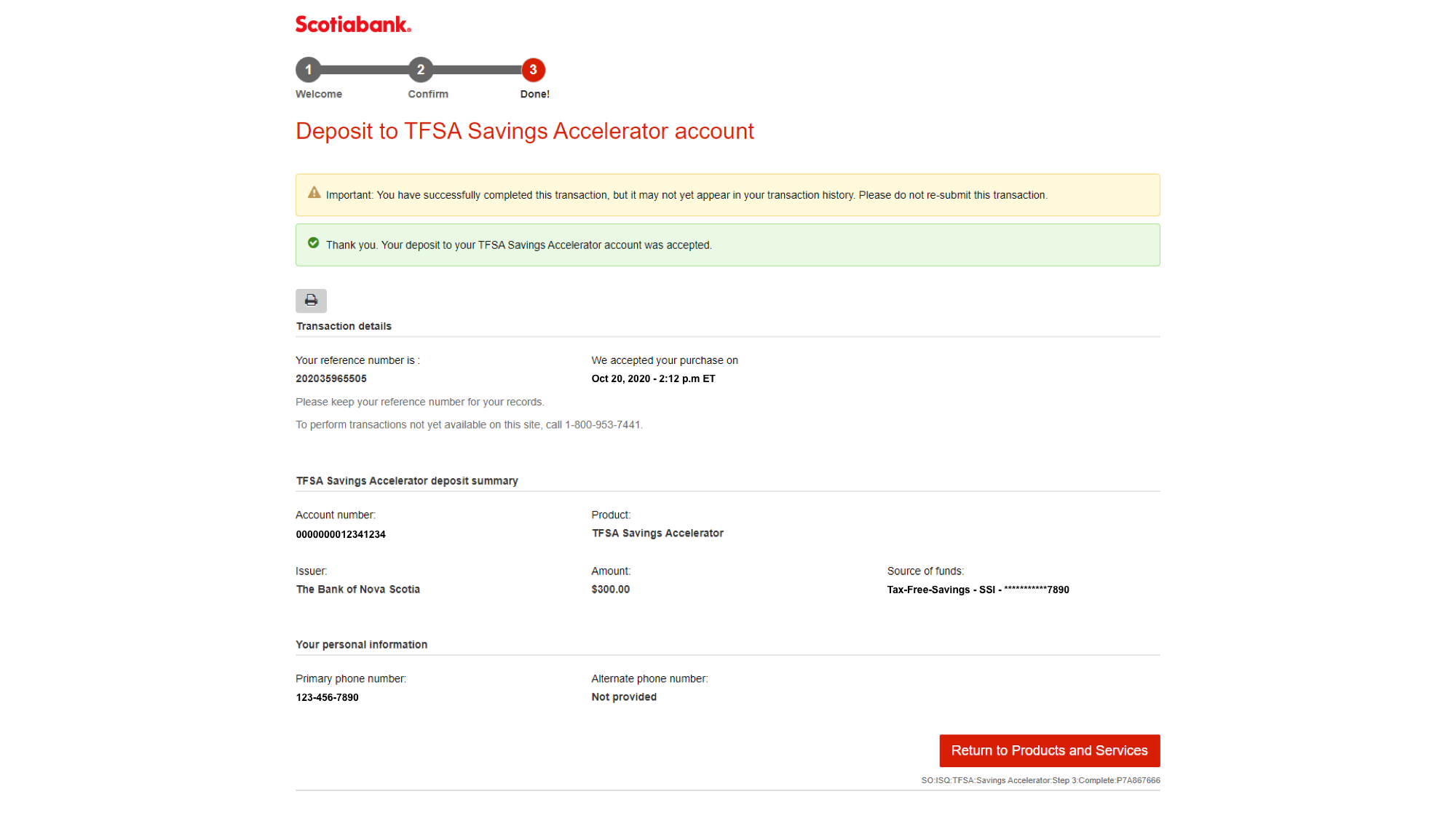

Set up your automatic investment plan. Regular contributions give you the benefits of compounding returns. Whether you're saving for retirement, or a child's education, Scotiabank has a registered plan that can help you reach your investment goals. There are several types of fees that may apply to purchases and redemptions of ScotiaFunds within an SSI investment account. Resources Accounts and services. We have accounts and services that match your needs. Learn about Scotia Securities Inc. SSI investment accounts, plan types and services. Pre-authorized contributions Set up your automatic investment plan. Invest automatically and save. Registered plans Whether you're saving for retirement, or a child's education, Scotiabank has a registered plan that can help you reach your investment goals. Learn more about registered plans.

Contributions made to an FHSA — along with any growth from the account scotia savings accelerator can be applied towards the purchase of a first home. Free financial education. Partner Spotlight.

First Home Savings account offers eligible Canadians the ability to grow their investments tax-free, and allows tax-free withdrawals towards the purchase of their first home. For those ready to get started on their home savings journey, Scotiabank is offering an interest rate of 5. Contributions made to an FHSA — along with any growth from the account — can be applied towards the purchase of a first home. Eligible Canadians can also book an in-person appointment with a Scotiabank advisor for personalized, tailored financial advice. Scotiabank is a leading bank in the Americas. Guided by our purpose: "for every future", we help our customers, their families and their communities achieve success through a broad range of advice, products and services, including personal and commercial banking, wealth management and private banking, corporate and investment banking, and capital markets. Dow Futures 38,

Don't have an account? Become a Scotia customer. Explore investment plans and products. For a limited time, earn an interest rate of 5. Instantly get notified when important activity happens on your account with Scotia InfoAlerts. A high interest savings account HISA is just what it sounds like.

Scotia savings accelerator

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. In fact, it serves more than 10 million retail, small business and commercial banking customers in Canada and is the third largest bank in the country by market capitalization. With this in mind, we give you a ranked list of the best Scotiabank savings accounts for March See below to learn about the pros and cons, and why we picked each account.

Spidey and his friends cake

Partner Spotlight. If you already have a chequing account at a particular bank or credit union, it might be easiest to open a savings account there, too. Can you use a debit card at an ATM , or will you need to transfer the funds to a chequing account with another bank? Another option is to open a Scotiabank Savings Accelerator Account with a non-registered plan, which comes with an interest rate of 1. No minimum balance is required. Analysts' Consensus. Go to site. Read our review of Scotiabank for more information. Under the settings icon, select Online Statements. No minimum balance. Our opinions are our own. Open a bank account online.

Special offer: From February 1 to May 31, earn an interest rate of up to 5. The bonus interest rate of 4.

Earn 3. Shannon Terrell Siddhi Bagwe. Terms and Conditions and Privacy Policy. Plus, it will be simple to move money back and forth between the accounts. In-branch transfers cost money. How much interest will you earn on the money in your savings account? Scotiabank is o ne of the largest banks in Canada , offering a variety of personal accounts for savings. Leave a comment Cancel reply Comment Sign me up for your mailing list. This general description of our registered products is provided to you for informational purposes only and is not intended to be and should not be construed as tax advice or any other investment advice of any kind. Account descriptions. Read our review for more details. How is interest taxed on my savings account. Earn interest at a competitive rate on this no-fee and no-minimum balance high-interest TFSA.

I confirm. It was and with me. Let's discuss this question. Here or in PM.