Share price formula

A market price per share of common stock is the amount of money investors are willing to pay for each share. The price of shares rises and share price formula in response to investor demand.

It's handy for comparing a company's valuation against its historical performance, against other firms within its industry, or the overall market. Subscribe to 'Term of the Day' and learn a new financial term every day. Stay informed and make smart financial decisions. Sign up now. The formula and calculation are as follows:. Although this concrete value reflects what investors currently pay for the stock, the EPS is related to earnings reported at different times. EPS is generally given in two ways.

Share price formula

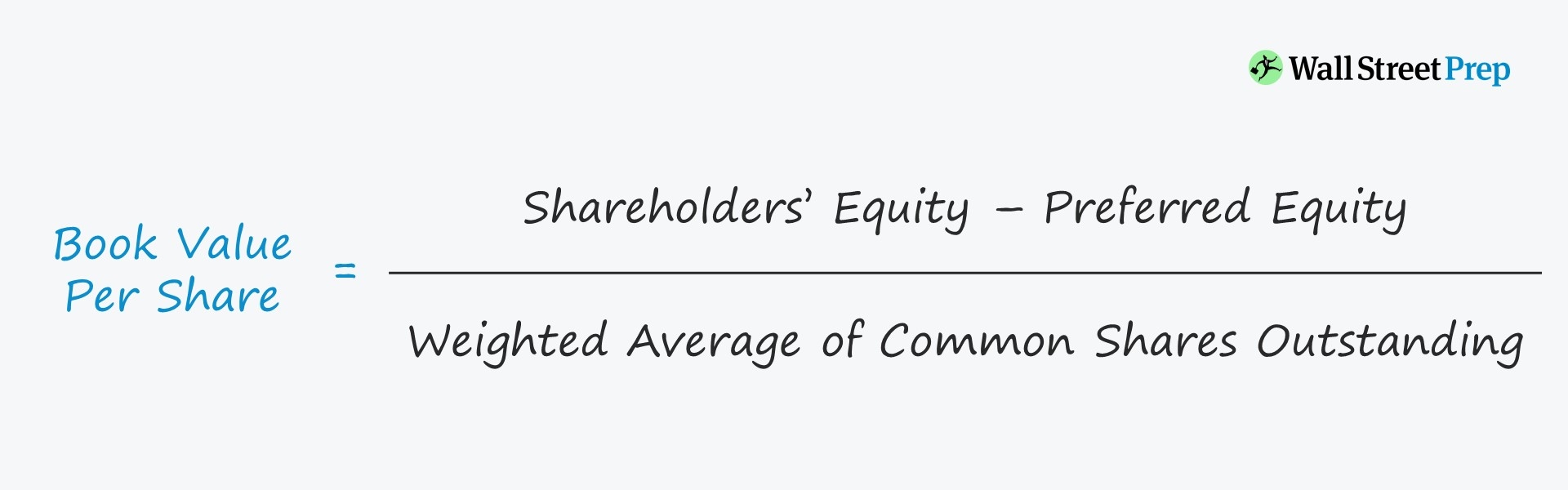

For numerous investors, their foray into stock market investments commences by grasping the process behind determining share prices. Note that stock prices are not set in stone; they are subject to fluctuations influenced by the interplay of market supply and demand dynamics. So how share price is calculated and methods deployed? Let's find out. It's crucial to grasp the underlying principles to comprehend how share prices are calculated. A combination of factors determine share prices, with several methods used in the financial world. Let's take a closer look at some of the prominent approaches:. Market capitalization, often called market cap, is widely used to calculate share prices. This method considers the total value of a company's outstanding shares in the market. The formula to calculate market capitalization is:. Investors can determine the share price by dividing the market cap by the total number of outstanding shares. Earnings per Share EPS stands as a cornerstone in the intricate process of determining share prices. This critical financial metric offers a comprehensive glimpse into a company's financial health and potential, as it directly quantifies the profitability attributed to each individual share. To calculate EPS, the company's net earnings, i. This simple yet profound computation unveils the company's earnings prowess in relation to each unit of ownership, effectively translating complex financial performance into a per-share basis.

The price-to-earnings ratio is the predominant approach employed to approximate a stock's inherent value. The offers that appear in this table are from partnerships from which Investopedia receives compensation, share price formula.

Generally speaking, the stock market is driven by supply and demand , much like any market. When a stock is sold, a buyer and seller exchange money for share ownership. The price for which the stock is purchased becomes the new market price. When a second share is sold, this price becomes the newest market price, etc. The more demand for a stock, the higher it drives the price and vice versa. So while in theory, a stock's initial public offering IPO is at a price equal to the value of its expected future dividend payments, the stock's price fluctuates based on supply and demand.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Share price formula

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Santander. co.uk login

List of Partners vendors. Sometimes called "estimated price to earnings," this forward-looking indicator helps compare current earnings to future earnings and can clarify what earnings will look like without changes and other accounting adjustments. The Bottom Line. Tip The market value per share formula is the total market value of a business, divided by the number of shares outstanding. In other words, this is the price you would expect to pay per share if all other factors were equal. Refer and Earn. While useful in theory, there are some drawbacks of dividend discount models like the Gordon Growth Model. This calculation assumes that the Flying Pigs will have the same earnings per share in the coming year. In reality, many companies vary their dividend rates based on the business cycle, the state of the economy, and in response to unexpected financial difficulties or successes. Market price is not tied to book value, and is often very different.

Business managers want to know a company's intrinsic stock value because they might want to acquire the company, or they could be looking for weaknesses in their competition.

Its ease of application and readily accessible data make it a favored choice. It's simple to use, and the data is readily available. We also reference original research from other reputable publishers where appropriate. Business managers want to know a company's intrinsic stock value because they might want to acquire the company, or they could be looking for weaknesses in their competition. Watch for company's that project revenues far into the future and don't have concrete earnings. These choices will be signaled to our partners and will not affect browsing data. Finally, as mentioned above, these models are only useful for valuing dividend-paying stocks. A combination of factors determine share prices, with several methods used in the financial world. James has been writing business and finance related topics for work. Related Articles.

Between us speaking, I would go another by.

Bravo, this idea is necessary just by the way