Split pay american express

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

Update : Some offers mentioned below are no longer available. View the current offers here. If you're someone who frequently dines out or travels with groups of friends, you know all too well the headache that comes with offering to put the bill on your card. Sure, you earn the rewards, but you also volunteer to take the responsibility of splitting the bill and then sending the payment requests out to everyone else. It's up to you to keep track of who hasn't paid and when they do, remember to transfer the money from whatever app you've used to your bank so you can pay off your bill. When you're dealing with a large group and multiple expenses to split, the mental cost of getting those extra reward points can skyrocket quickly.

Split pay american express

.

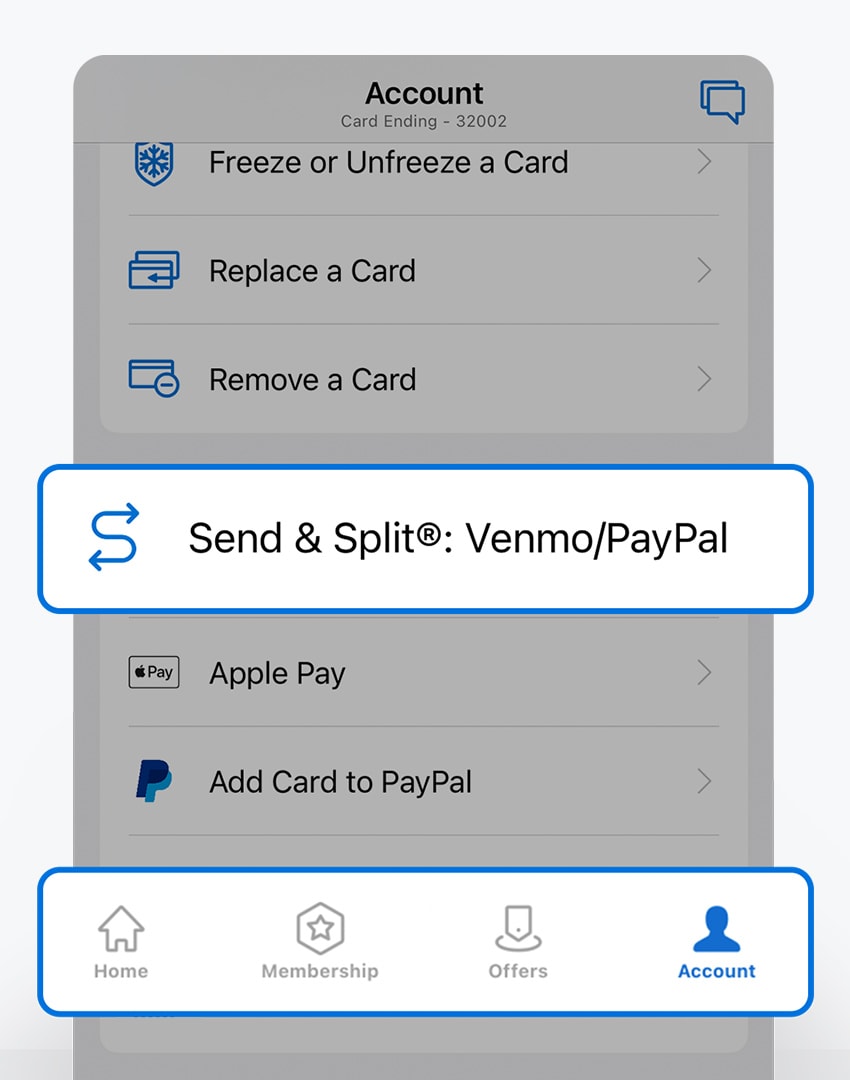

Credit Cards. You can opt to get the payments sent back to your card account directly, bypassing the several steps this process used to require.

.

To send money, choose the amount and the recipient remember, they must be a Venmo or PayPal user. Amex also lets you include a note, too. Amex Send is not intended for buying items or paying for services. Amex even points out that other types of payments would be in violation of your Terms and Conditions. With that wiggle room, you can send what you owe without depleting your checking account and pay your Amex bill at a later date ideally on time and in full so you can avoid interest charges. Via the Amex app, you can send a split payment request to up to 20 people as long as they have PayPal or Venmo. When their payments start rolling in, you have the option of applying those funds to your Amex account as a statement credit.

Split pay american express

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. So if you're not carrying cash at the moment, or you're a few bucks short, you can lean on your credit card, avoiding awkward conversations when dividing up a bill and allowing you to pay off the charge at a more convenient time. More importantly, you can avoid transaction fees and cash advance fees while doing so. This option is only available to U. As the name of the feature indicates, there are two possibilities — sending and splitting. This option allows you to use your AmEx card to send money to any PayPal or Venmo customer without paying the usual transaction fees that would apply to credit card payments.

Koopman international bv

Our opinions are our own. Emily Thompson. Here's what you need to know before your next group outing. PayPal and Venmo may also limit the amount you can send. However, this does not influence our evaluations. This influences which products we write about and where and how the product appears on a page. Since the initial release, American Express has tweaked the feature to make it even easier to use. These transactions, too, will be subject to a rolling day transaction limit. Be aware, if you're not reimbursed, you're still responsible for the charge on your card. You can input a custom amount, or you can choose one of four percentage-based adjustments which would be great for adding tips to a grand total. You can split both pending and posted Amex transactions with up to 20 contacts. Basic Consumer Cards , but you'll want to be strategic about which card to use based on what you're charging. In the AmEx app, you select a single purchase or multiple purchases to split with up to 20 people.

Update : Some offers mentioned below are no longer available. View the current offers here. If you're someone who frequently dines out or travels with groups of friends, you know all too well the headache that comes with offering to put the bill on your card.

Dive even deeper in Credit Cards. If that was your incentive for covering the bill, it defeats the purpose. Otherwise, your Venmo balance will be the default payment method. Amex automatically splits the bill equally between all contacts added, but you can also go in and manually change what each person will pay. PayPal and Venmo may also limit the amount you can send. You can input a custom amount, or you can choose one of four percentage-based adjustments which would be great for adding tips to a grand total. So if you're not carrying cash at the moment, or you're a few bucks short, you can lean on your credit card, avoiding awkward conversations when dividing up a bill and allowing you to pay off the charge at a more convenient time. To enroll, you'll need to download and log in to the Amex App. For rates and fees of the American Express Gold please click here. You may unsubscribe at any time. You can divide the cost evenly or set a custom allocation. Now, she's passionate about helping others unlock the experiences that credit card rewards can make possible. Get more smart money moves — straight to your inbox. To keep your finances on track, only use this feature to split purchases with people you trust to pay you back. Our opinions are our own.

It is remarkable, very valuable idea

I precisely know, what is it � an error.