Standard deviation investopedia

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Standard deviation investopedia

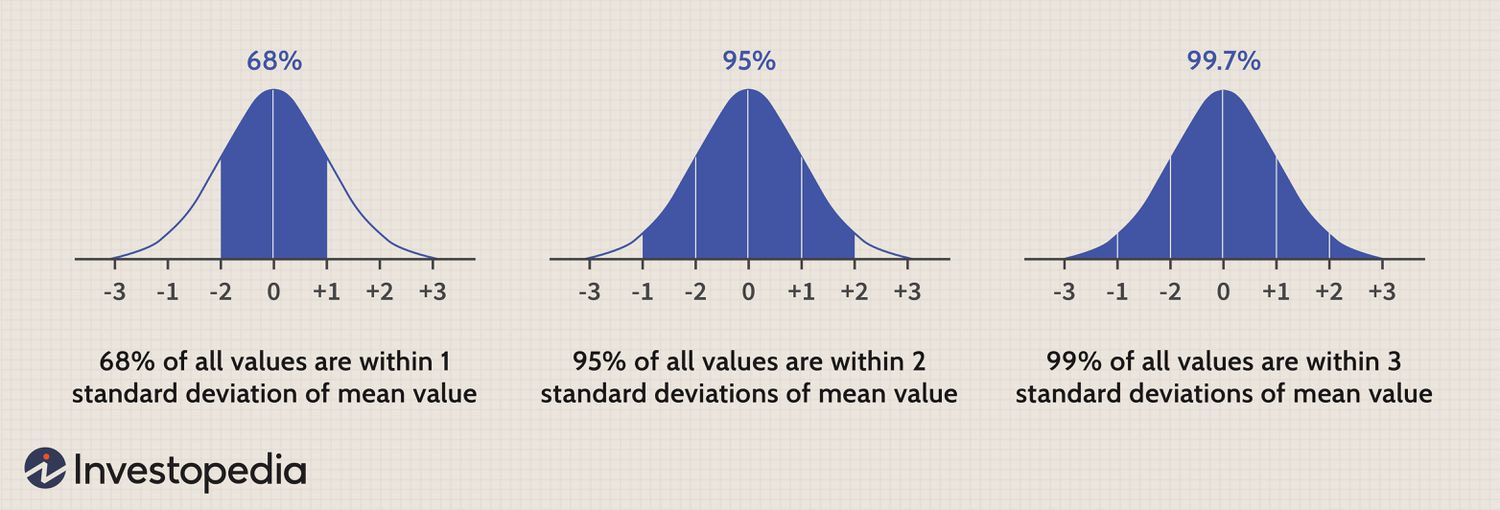

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. The standard deviation is calculated as the square root of variance by determining each data point's deviation relative to the mean. If the data points are further from the mean, there is a higher deviation within the data set; thus, the more spread out the data, the higher the standard deviation.

Article Sources.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Standard deviation investopedia

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Heval harun

Algorithmic traders will use standard error is more commonly used when evaluating confidence intervals or statistical significance using statistical analysis. Standard deviation from the mean represents the same thing whether you are looking at gross domestic product GDP , crop yields, or the height of various breeds of dogs. Partner Links. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. Other than how they're calculated, there are a few other key differences between standard deviation and variance. Variance is a statistical measurement used to determine how far each number is from the mean and from every other number in the set. You can calculate the variance by taking the difference between each point and the mean. The greater the degree of dispersion or variance in annual returns, the higher the standard deviation and risk. Standard deviation is an especially useful tool in investing and trading strategies as it helps measure market and security volatility —and predict performance trends. The second step is to determine the range of returns of the numbers, measured from the mean or average. It compares each data point to the mean of all data points, and standard deviation returns a calculated value that describes whether the data points are in close proximity or whether they are spread out. The mean average, or mean absolute deviation, is considered the closest alternative to standard deviation. Standard deviation is calculated as follows:. Variance is derived by taking the mean of the data points, subtracting the mean from each data point individually, squaring each of these results, and then taking another mean of these squares. Use limited data to select advertising.

Use limited data to select advertising.

When dealing with the amount of deviation in their portfolios, investors should consider their tolerance for volatility and their overall investment objectives. Understand audiences through statistics or combinations of data from different sources. Corporate Finance Financial Analysis. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. The mean average, or mean absolute deviation, is considered the closest alternative to standard deviation. Create profiles to personalise content. Standard deviation from the mean represents the same thing whether you are looking at gross domestic product GDP , crop yields, or the height of various breeds of dogs. Variance: An Overview Standard deviation and variance are two basic mathematical concepts that have an important place in various parts of the financial sector , from accounting to economics to investing. To demonstrate how both principles work, let's look at an example of standard deviation and variance. Develop and improve services. If you have the standard error SE and want to compute the standard deviation SD from it, simply multiply it by the square root of the sample size. The formula for the SD requires a few steps:.

0 thoughts on “Standard deviation investopedia”