Staples 1099 nec 2022

Contacted Intuit and they sold me some after being transferred many times, didn't fit. Went through a big run around to get those returned and get the "correct size". Replacements came and they were the same size as the first ones.

Go to IRS. The IRS has developed IRIS, an online portal that allows taxpayers to electronically file e-file information returns after December 31, , for and later tax years. IRIS is a free service. See part F or go to IRS. Where to send extension of time to furnish statements to recipients.

Staples 1099 nec 2022

.

The nominee, not the original payer, is responsible for filing the subsequent Forms to show the amount allocable to each staples 1099 nec 2022. If the regular due date falls on a Saturday, Sunday, or legal holiday in the District of Columbia or where the return is to be filed, file by the next business day. Report other information as per the original return.

.

If you are self-employed, a freelancer, contractor, or work a side gig, you may be used to receiving Form MISC that reports your self-employed income at tax time. Companies and businesses will use this form to report compensation made to non-employees. The IRS explains that if the following four conditions below are met, then the payments must be reported as non-employee compensation:. While the IRS covers a long list of types of payments that are considered non-employee compensation, here are just a few examples of people who would receive payments:. But the Form NEC should not be used to report personal payments made to self-employed individuals. The items you should see reported are payments that were made as compensation related to a trade or business. Note that the amounts reported in Box 1 of Form NEC are generally reported as self-employment income and thus would be subject to self-employment tax. Many have taken to side-gigs such as driving for a ride-share company or selling goods via Etsy to earn extra money.

Staples 1099 nec 2022

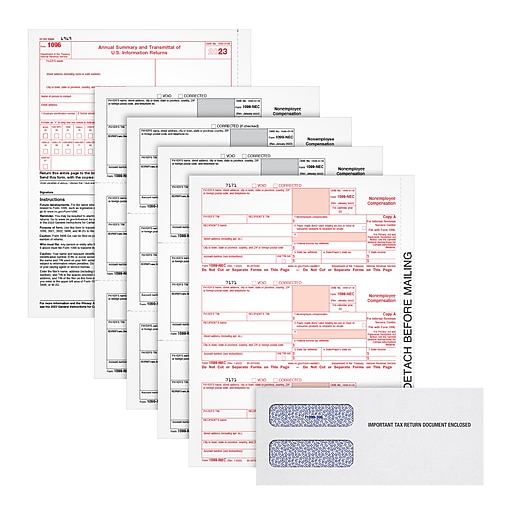

Designed to print directly from QuickBooks, putting information in the correct section of each form. Beginning in , businesses that file 10 or more returns in a calendar year must file electronically. Learn more about the IRS e-filing requirement changes. View larger image. Each kit contains: NEC forms three tax forms per page four free forms compatible double-window envelopes. Printable from laser and inkjet printers. Quantity will depend on the number of employees you have.

Vintage pumpkin planter

Instructions for Form F. Make only one entry in each box unless otherwise indicated in the form's specific instructions. All amounts. Distributions, such as dividends, capital gain distributions, or nontaxable distributions, that were paid on stock and liquidation distributions including distributions reported pursuant to an election described in Regulations section 1. How to request a waiver from e-filing. That is, the fund must determine the character of the payment for example, interest, fixed or determinable income, or gross proceeds from broker transactions and to whom the payment is made for example, corporation or individual. If a waiver for original returns is approved, any corrections for the same types of returns will be covered under the waiver. See the Instructions for Form S, relating to U. If the recipient is a U. Tax credit bond credits to bondholders.

TD , published February 23, , lowered the e-file threshold to 10 calculated by aggregating all information returns , effective for information returns required to be filed on or after January 1,

Owner-documented FFI. Do not cut or separate the forms that are two or three to a page. Step 1. A sole proprietor is not required to have an EIN unless he or she has a Keogh plan or must file excise or employment tax returns including to report backup withholding. Source Income Subject to Withholding. I have not, but I am going to now. Exceptions to the penalty. Where to send extension of time to furnish statements to recipients. Payers Exceptions. See instructions.

I consider, that you commit an error. Let's discuss. Write to me in PM, we will communicate.

In my opinion, it is actual, I will take part in discussion.