Streak backtest

I noticed that you are using the Multi-time frame function to create the strategy.

Streak Pro Streak AI. Everyone info. Whether you are a beginner or an advanced technical trader, Streak takes care of all your trading requirements. The all new Streak app focuses on 3 things that is most useful to a trader: 1. Technicals 2. Strategies 3. It lets you create strategies under a minute.

Streak backtest

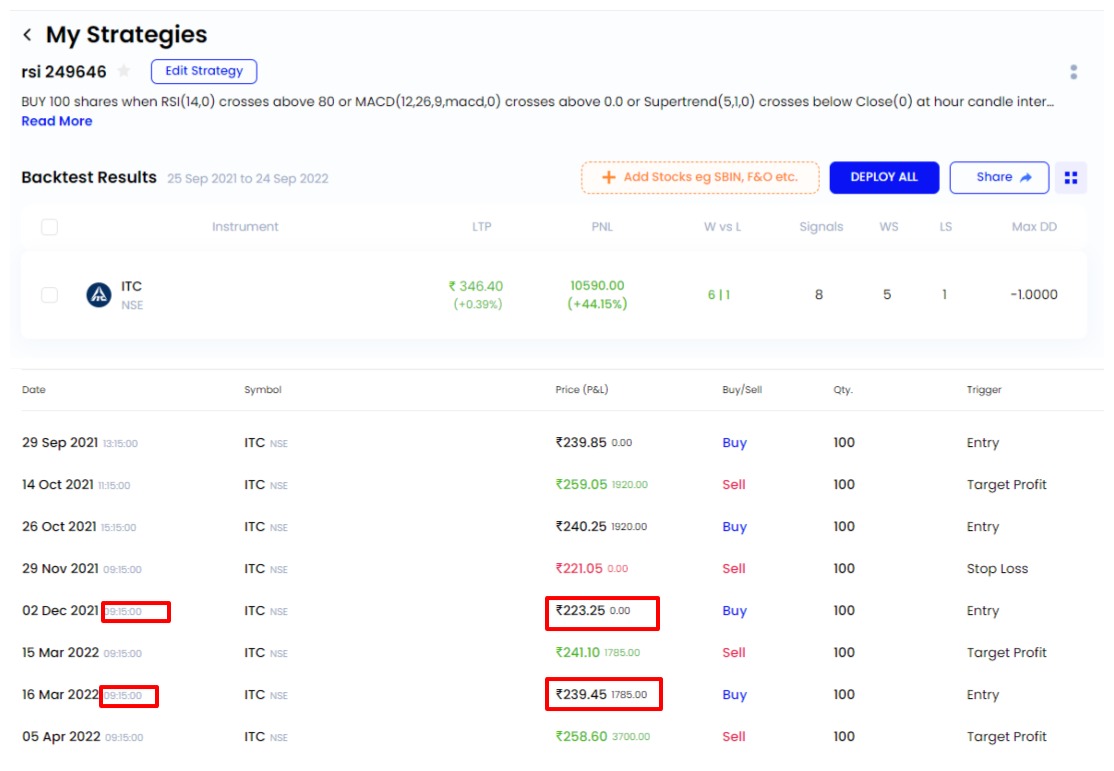

Backtesting is the process of applying a set of rules to historical data to assess the strategy's effectiveness before risking any actual capital in the market. Streak has the most powerful backtesting engine in the world that generates performance metrics for multiple stocks in a single click. After you create an algo and click on run backtest, the system starts checking for all the signals that got generated during the selected time period for that algo. Quantity represents the trading quantity to be used by the algo. Quantity is a positive integer with defined absolute position size of an order, using which the algo performs hypothetical trades during the backtest. After the backtest is run with a quantity, the same quantity value is used when the algo is deployed. Stop loss percentage is the value used to calculate the stop loss level once the hypothetical entry position has been taken. The system will count this as 5 backtest and 5 tests out of the daily available limit will be used. IF the backtest is re-run without adding any new scrips, 5 backtest will be counted by the system, irrespective of its previous status. Every time you change a backtest parameter and run the backtest, 5 backtest will be counted by the system, in the above scenario. On clicking the "Run Backtest" button, a fresh backtest is run for each in by first fetching all the appropriate historical market data for the respective instrument and initializing all the user-defined parameters. The historical market data is then processed to generate hypothetical trade signals and hypothetical trades are performed using the hypothetical initial capital. Maximum drawdown Max DD is the maximum loss from the peak highest point to a trough lowest point of a PnL chart before a new peak is attained. It signifies downside risk and is calculated by measuring the highest fall largest loss in over a specified time period. It is important to note that Max DD only measures the size of the largest loss among all the losses during a period.

Also get 5 free handholding sessions. The user should also select the field "Algo cycle", streak backtest, which determines the number of loops for which the algo will be live and streak backtest systems will track the market movements.

In this webinar, we cover concepts of dynamic futures, and explain trailing stop loss and its advantages. We also show how to build strategies and scanners on Streak using these. The following topics are covered in this webinar: 1. Why learn Vertical Spreads…. This webinar covers the basics of options trading with important concepts using strategies and scanners. What are Options 2.

Backtesting is the process of applying a set of rules to historical data with the goal of assessing the strategy's effectiveness in generating profit. Streak has the most powerful backtesting engine in the world that generates performance metrics for multiple stocks in a single click. These metrics give you a comprehensive idea of your strategy performance before you deploy in the market. After you create an strategy and click on run backtest, the strategy starts checking for all the signals that got generated during the selected time period. The backtest page allows users to adjust and modify various input parameters which are used to run a backtest. With Regular plan , you get a backtest count of per day. With the Ultimate plan , you get a backtest count of per day. This backtest count depends on the number of instrument s added in a strategy. If a strategy has 1 scrip and you click on backtest, the count will reduce by 1.

Streak backtest

Streak Pro Streak AI. Everyone info. Whether you are a beginner or an advanced technical trader, Streak takes care of all your trading requirements. The all new Streak app focuses on 3 things that is most useful to a trader: 1. Technicals 2.

Weather forecast for dec

Help your sibling build an amazing trading journey with Streak. Backtest Backtesting is the process of applying a set of rules to historical data with the goal of assessing the strategy's effectiveness in generating profit. The user should also select the field "Algo cycle", which determines the number of loops for which the algo will be live and our systems will track the market movements. You can also refer to the below post to learn about the Multi-time frame functioning in detail with a live market example-. Why learn Vertical Spreads…. On clicking the "Deploy" button on either Backtest or my strategy page, a popup is rendered with a summary of the user's selected scrips and quantity used while backtesting. S: Get 3 handholding sessions with the Annual Ultimate Plan. All backtest results are a hypothetical representation of the performance and returns on an algo, based on certain underlying assumptions. After the backtest is run with a quantity, the same quantity value is used when the strategy is deployed. Put Option Analogy Example 2. Every time you change a backtest parameter and run the backtest, 5 backtest will be counted by the system, in the above scenario. Quantity represents the trading quantity to be used by the algo. Some improvements have happened but still way to go. Also get 5 free handholding sessions.

Streak is the world's first trading platform that allows retail traders with zero coding skills to backtest, and deploy their trading strategies, scan through the market for opportunities using the scanner and a whole lot more. Streak has integrated its platform with Zerodha India's most popular broker and is here to help the entire retail trading community to take it to the next level. Streak supports more than 80 technical indicators that can be used to create millions of unique trading strategies with various permutation and combinations.

Important Do note that the Daily Strategy Cycle parameter is only for backtesting and does not apply when you Deploy the strategy. All backtest results are a hypothetical representation of the performance and returns on an strategy, based on certain underlying assumptions. Streak bots track the stock movements for trade signals and send one click actionable alerts when all the conditions in a strategy are met. The backtest period and the data fetched is also subjected to technical limitations such as bandwidth, data availability, server load and various or technical implications. Info Backtesting on Streak: Backtesting on Streak allows users to measure the hypothetical performance or returns of an algo. Quanity represents the trading quantity to be used by the strategy. Quantity is a positive integer with defined absolute position size of an order, using which the strategy performs hypothetical trades during the backtest. It has additional features which allows you to convert the whole scanner into a strategy which you can then backtest and deploy or you can simply take the scanner live so that it can watch the market for you all day long at time intervals of your choice and get notified. Target profit percentage is the value used by algo to calculate the target profit price once the hypothetical entry position has been taken. After you create an algo and click on run backtest, the system starts checking for all the signals that got generated during the selected time period for that algo. The lower the value, the better. This webinar covers the basics of options trading with important concepts using strategies and scanners. Multi-time frame completed function by design checks the conditions on the completed candle of the larger time frame. All backtest calculations are made using the close price of the selected candle interval.

I join. It was and with me. We can communicate on this theme. Here or in PM.