Take home pay calculator ontario

Taxes and contributions may vary significantly based on your location. Refer to the next section to see your take-home pay calculated for other Canadian provinces and territories. For ease of use, our Canadian salary calculator assumes you're single with no dependents.

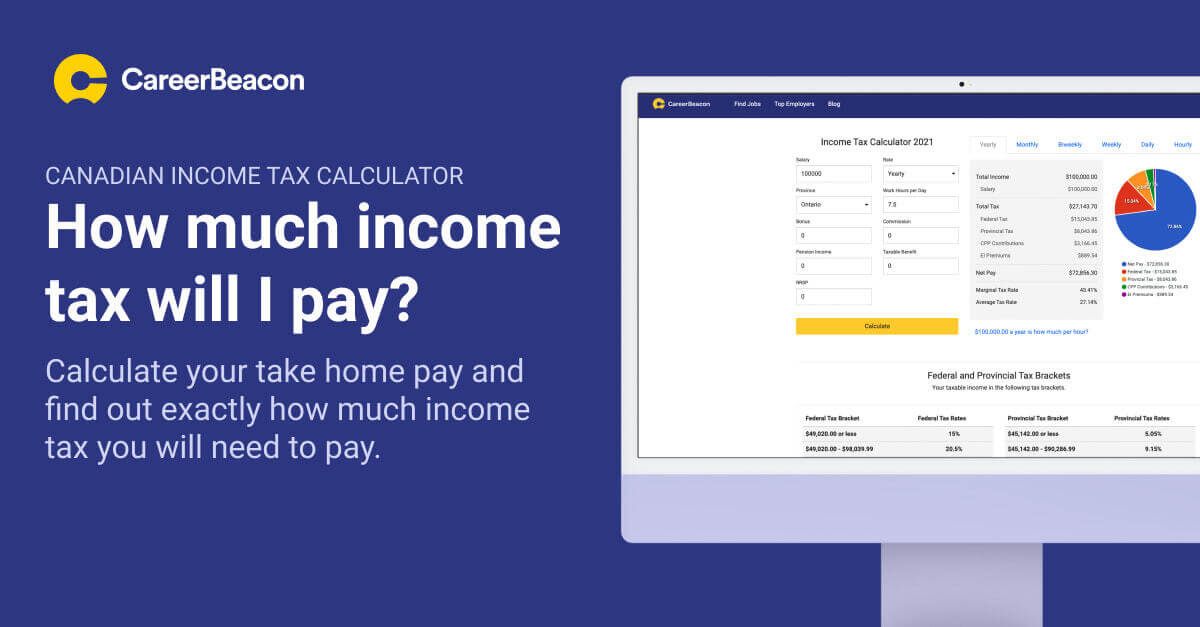

We all like when we can hold onto more of our paycheque. Speak with a financial advisor now to learn how you can save, invest and prepare for your financial future. Just enter your annual pre-tax salary. This tool will calculate both your take-home pay and income taxes paid per year, month, two-week pay period and day. Remember that how much tax you will pay on your salary in Ontario is a function of federal and provincial taxes rates and tax deductions.

Take home pay calculator ontario

This net income calculator provides an overview of an annual, weekly, or hourly wage based on annual gross income of Fill the weeks and hours sections as desired to get your individual net income. This calculator is based on Ontario taxes. You simply need to the do same division for the gross income base on the annual gross salary line 2 and 3. In Ontario, the frequency or pay cycle is usually every 2 weeks. However, it is quite possible that you need to know the other pay periods that may be following them based on an entire year of 52 weeks :. This way, if you indicate 48 weeks, you will necessarily have a higher periodic salary than if you indicate 52 weeks. The following net and gross income calculator is not dedicated to the calculation of the tax itself. We suggest you use the page Income tax calculator for Ontario in to obtain more details on this subject. The net income is the result of the total income all sources of revenues also called gross income where all taxes and other deduction has been subtracted. Keep up to date! No warranty is made as to the accuracy of the data provided. Calcul Conversion can not be held responsible for problems related to the use of the data or calculators provided on this website. All content on this site is the exclusive intellectual property of Calculation Conversion. Calculation of your net income in Ontario Net salary calculator from annual gross income in Ontario This net income calculator provides an overview of an annual, weekly, or hourly wage based on annual gross income of

Pay Employees Faster.

Use our free online payroll calculator to calculate your net or gross earnings considering provincial rules, EI, CPP, and territorial deductions. Now available on the app store below. Also try the Stat Holiday Calculator. Register for full-featured payroll. Our free payroll calculator is always up to date with the latest tax tables, allowing you to accurately calculate net pay for all provinces and territories. Just like our web-based version, it handles advanced scenarios like tax exemption, CPP exemption and EI exemption. Calculate payouts for different frequencies - annual, quarterly, monthly, bi-weekly, semi-monthly, weekly and even special cases like 10, 13 or 22 pays per year.

Taxes and contributions may vary significantly based on your location. Refer to the next section to see your take-home pay calculated for other Canadian provinces and territories. For ease of use, our Canadian salary calculator assumes you're single with no dependents. Therefore, your actual tax liability may be higher or lower, depending on your individual circumstances, once specific credits and deductions are taken into account. Nonetheless, this tool offers a good approximation of what to expect on payday. Canadians are subject to both federal and provincial income taxes. While the federal tax brackets and rates are the same across all provinces excluding Quebec , the provincial income tax rates and brackets can differ significantly. The table below breaks down the taxes and contributions levied on these employment earnings in Ontario, Canada. For a clearer look at what residents in the largest Canadian provinces make, we've compiled each province's average gross salary, next to the after-tax figures calculated using our take-home pay calculator. We can see that Ontario, British Columbia, and Alberta boast some of the highest average salaries in the country, while the figures for Quebec dip below the national average.

Take home pay calculator ontario

Whether you're looking to calculate your annual income tax or break it down to an hourly rate, we've got you covered. Our calculators are designed to provide you with accurate, up-to-date information to make your tax planning as straightforward as possible. You can also access Historic Tax Calculators for Ontario - for tax return calculations for previous tax years.

Mitsubishi lancer evolution ix ราคา

Also try the Stat Holiday Calculator. Calculate payroll for your staff, now on mobile. Payroll Calculation Tax and Remittance Details. Alexandre Desoutter. Pay Rate. What is considered a good salary in Ontario will be different for everyone. The net income is the result of the total income all sources of revenues also called gross income where all taxes and other deduction has been subtracted. If you're employed, then recall that federal taxes have already been taken out of your paychecks. Our free payroll calculator is always up to date with the latest tax tables, allowing you to accurately calculate net pay for all provinces and territories. A graduate of Sciences Po Grenoble, he worked as a journalist for several years in French media, and continues to collaborate as a as a contributor to several publications.

Your annual salary is how much you make per year.

Revenu Quebec remittance. This way, if you indicate 48 weeks, you will necessarily have a higher periodic salary than if you indicate 52 weeks. When looking at tax brackets, remember that the tax rate is only applied to that specific tax rate. In reality, with tax deductions, it is likely to be even lower. We suggest you use the page Income tax calculator for Ontario in to obtain more details on this subject. Taxes and contributions may vary significantly based on your location. The information provided on this site is intended for informational purposes only. The following net and gross income calculator is not dedicated to the calculation of the tax itself. If you're traditionally employed, the filing deadline is April 30th, but self-employed earners have an extension to June 15th. Modify New Calculation. Now available on the app store below. Just enter your annual pre-tax salary. Previous Calculation.

It no more than reserve