Take home salary calculator new york

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. You can't withhold more than your earnings. Please adjust your. When you start a job in the Empire State, you have to fill out a Form W Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck. The new W-4 includes notable revisions.

Take home salary calculator new york

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. The redesigned Form W4 makes it easier for your withholding to match your tax liability. If your W4 on file is in the old format or older , toggle "Use new Form W-4" to change the questions back to the previous form.

The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Resident Hint: Resident Check the box if you are a resident of this location. To calculate multi-state payroll for your employees, try PaycheckCity Payroll for free.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer.

Kate Middleton has been diagnosed with cancer and is currently undergoing chemotherapy treatment, the Princess of Wales revealed in a bombshell announcement Friday. The Princess of Wales, 42, revealed on Friday that she has been undergoing chemotherapy treatment after being diagnosed with an undisclosed type of cancer. At least 40 people were killed and more than injured when five gunmen dressed in camouflage opened fire with automatic weapons at people at a concert in the Crocus City Hall near Moscow, in one of the worst such attacks on Russia in years. Two teen fugitive squatters eyed in the gruesome murder of a woman whose body was found stuffed in a duffel bag in a Manhattan apartment were busted in Pennsylvania Friday morning, police sources told The Post. Beverly Grove Place, where LeBron James just built a lavish home, has long been a coveted area for the A-list — but recently, squatters infiltrated. The Biden administration pointed the finger at Texas Gov.

Take home salary calculator new york

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount.

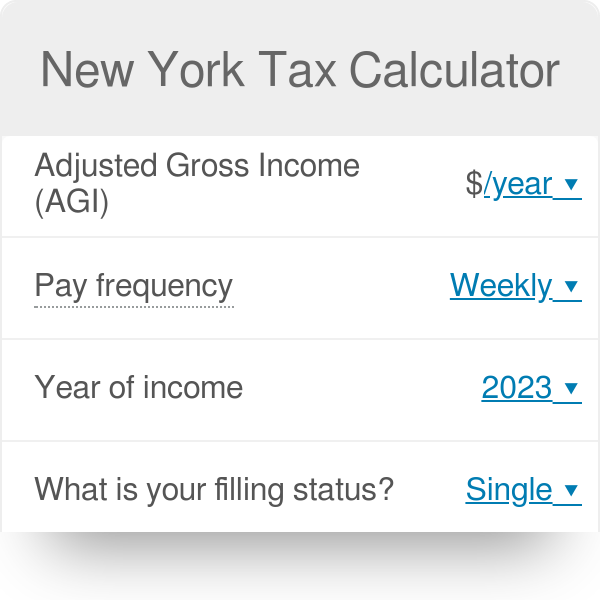

Milan ligde kaçıncı

Census Bureau Number of cities that have local income taxes: 2. You can't withhold more than your earnings. Step 3: Dependents Amount. Picking the wrong filing status could cost you time and money. Get pricing specific to your business. Learn more about multi-state payroll, nexus and reciprocity in this Multi-state Payroll guide. Pay Frequency. Hint: Pay Frequency Enter how often your regular paycheck will be issued. Additional careful considerations are needed to calculate taxes in multi-state scenarios. See how this affects your first paycheck this year!

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. Work Info. Gross Pay. OK Cancel. The money you put into these accounts is taken out of your paycheck prior to its taxation. Usually, this number is found on your last pay stub. Lastest Insights See all insights. Add Overtime. Hint: Federal Filing Status Select your filing status for federal withholding. What is the gross pay method? It should not be relied upon to calculate exact taxes, payroll or other financial data. Your estimated -- take home pay:. Step 3: enter an amount for dependents.

I can suggest to come on a site where there is a lot of information on a theme interesting you.