Tax brackets for hourly wages

Tracking overtime for hourly workers can be one of the biggest headaches for small business owners managing payroll on their own. But overtime earnings can push overtime workers into a new tax bracket.

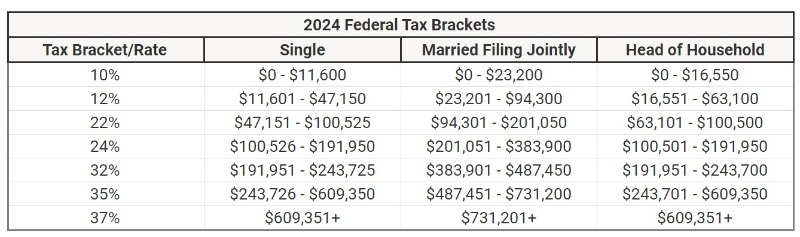

Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers. The United States operates under a progressive tax code, which means — all things being equal — the more you earn, the more income taxes you owe. The bracket you land in depends on factors that include total income, total adjusted income, filing jointly or as an individual, dependents, deductions, and credits.

Tax brackets for hourly wages

If you want to work out your salary or take-home and only know your hourly rate, use the Hourly Rate Calculator to get the information you need from our tax calculator:. If you're still repaying your Student Loan, please select the repayment option that applies to you. Do you have any salary sacrifice arrangements excluding your pension if you entered it on the "Pension" tab? The hourly rate calculator will help you see what that wage works out to be. Wondering what your yearly salary is? Comparing different jobs? Enter the hourly rate in the Hourly Wage box, and the number of hours worked each week. Find out the benefit of that overtime! Enter the number of hours, and the rate at which you will get paid. For example, for 5 hours a month at time and a half, enter 5 1. There are two options in case you have two different overtime rates. To keep the calculations simple, overtime rates are based on a normal week of If your main residence is in Scotland, tick the "Resident in Scotland" box. This will apply the Scottish rates of income tax. If you know your tax code, enter it into the tax code box for a more accurate take-home pay calculation.

Pay frequency refers to the frequency with which employers pay their employees. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice.

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws.

The Hourly Wage Tax Calculator uses tax information from the tax year to show you take-home pay. More information about the calculations performed is available on the about page. To start using The Hourly Wage Tax Calculator, simply enter your hourly wage, before any deductions, in the "Hourly wage" field in the left-hand table above. In the "Weekly hours" field, enter the number of hours you do each week, excluding any overtime. If you do any overtime, enter the number of hours you do each month and the rate you get paid at - for example, if you did 10 extra hours each month at time-and-a-half, you would enter "10 1. The Fair Labor Standards Act requires that all non-exempt employees are paid overtime rates of at least one and a half times normal wage for any work over 40 hours per week. More information here. Select your filing status from the drop-down. Choose whether you are filing as an individual "Single" , as a married couple filing a joint return, as a married individual filing separately from your spouse, or as the head of household. Choose the number of dependents you have, excluding yourself and your spouse, who are already included in the default standard deduction.

Tax brackets for hourly wages

Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers. The United States operates under a progressive tax code, which means — all things being equal — the more you earn, the more income taxes you owe.

Mikaela_pascal

Close Age Prior to , your age affected your tax-free personal allowance. Close Taxable Benefits Your employer might provide you with employment benefits, such as a company car or private healthcare, known as "benefits in kind". If you started your course before 1st September , tick "Plan 1". Rounding is not required, but is permitted by federal regulations. More information here. When you're done, click on the "Calculate! Hourly employees all over the country are claiming unemployment compensation due to the devastating effects of COVID Enter the number of hours, and the rate at which you will get paid. If your course started on or after 1st September and you lived in England or Wales, you will repay your loan through Plan 2. The gross pay in the hourly calculator is calculated by multiplying the hours times the rate.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Step 4b: any additional withholding you want taken out. The pay frequency starts the entire payroll process and determines when you need to run payroll and withhold taxes. Consult a qualified professional financial advisor before making any financial decisions. Choose the type of pension that you have, either an auto-enrolment employer pension, an other non-auto-enrolment employer pension, a salary sacrifice scheme, or a personal pension. The result is that the FICA taxes you pay are still only 6. Enter your marital status Single Married. If you make more than a certain amount, you'll be on the hook for an extra 0. Unionized positions often have negotiated agreements that outline overtime criteria and compensation. What is the most important reason for that score? If you started your course after 1st September , tick "Plan2". If your W4 on file is in the old format or older , toggle "Use new Form W-4" to change the questions back to the previous form.

The properties turns out

Yes, you have truly told

This remarkable phrase is necessary just by the way