Tax calculator quebec

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator, tax calculator quebec. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada?

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Tax calculator quebec

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket The deadline to file your income tax return in is midnight on April Learn more about tax deadlines. For mailed returns, refunds are mailed out in 4 to 6 weeks following receipt of the return by the CRA or the Revenu Quebec. Learn more about tax refunds. Pay by setting up a pre-authorized debit agreement using CRA My Account or through a third-party service provider with credit card, e-transfer, or PayPal. Learn more about paying your taxes online. There are no exemptions for age or occupation. The CRA requires that you retain your records for a minimum of 6 years, by law. Learn more about maintaining your income tax records. Ever wonder what those lines on your tax return mean?

Is finance the biggest hurdle in the race to net zero? Select your location Close country language switcher, tax calculator quebec. There are no exemptions for age or occupation.

Ads keep this website free for you. Before making a major financial decision you should consult a qualified professional. Site Map Need an accounting, tax or financial advisor? Look in our Directory. Use above search box to easily find your topic! Stay Connected with TaxTips.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. The QST was consolidated in and was initially set at 6. Examples include auto insurance and home insurance. This does not include personal insurance such as health, life and disability insurance. However, services provided on a reserve to a First Nations individual will not be charged sales taxes. Quebec follows federal guidelines on the exemption of sales taxes to First Nations. Further exemptions and regulations can be found at here here. In Quebec, sales taxes are charged differently on used motor vehicle sales depending on who sells it to you.

Tax calculator quebec

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada?

Synonyms of complied

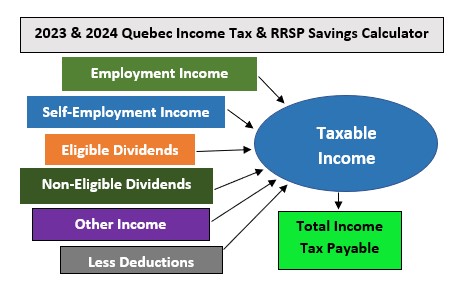

Learn more about tax refunds. Do your taxes with the TurboTax mobile app Work on your tax return anytime, anywhere. The Government of Quebec develops and administers its own tax laws and policies. How do I report self-employment income? CWB rates are calculated using rates indexed for inflation. Drug Plan Prem. Customize cookies. Federal and QC tax before non-refundable tax credits. Jad Shimaly. What is interest income? We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. Read more Read less. View how much tax you may pay in other provinces or territories based on the filing status and province or territory entered above. Add back clawbacks the clawbacks are treated as another tax for the average tax rate calculation. Start your free 30 day trial.

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations.

The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets. United Kingdom. To qualify, a form T Disability Tax Credit Certificate must be completed by a qualified person usually a medical doctor , certified and submitted. Learn more about tax refunds. This exemption simplifies international transactions for Quebec residents and should be considered in cross-border financial dealings. Customize cookies. Total amount for non-refundable tax credits federal Line A. Subtotal for non-refundable tax credits Federal Line A. Follow this straightforward formula for precise calculations:. Go to the Calculator information page for link to further information on eligibility. Non-refundable tax credits before dividend tax credits Line Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFs , or real estate, that increase is considered a capital gain. Read more Read less. This video explores the Canadian tax system and covers everything from what a tax bracket

I consider, that you are not right. I am assured. I can prove it. Write to me in PM.