Tax topic 152 after 21 days

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund?

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed.

Tax topic 152 after 21 days

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund? Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool. Unlike other codes that a taxpayer might encounter, Tax Topic doesn't require any additional steps from the taxpayer. According to the IRS, 9 out of 10 tax refunds are processed in their normal time frame of fewer than 21 days. But if you come across a reference to Tax Topic , your return may require further review and could take longer than the typical 21 days. Keep in mind this tax topic doesn't mean you made a mistake or did anything wrong when filing. It simply means your return is being processed and has yet to be approved or rejected.

Self-employed tax center. Please share any details here.

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account. There are several reasons your tax return may take longer to process. Some of those include:.

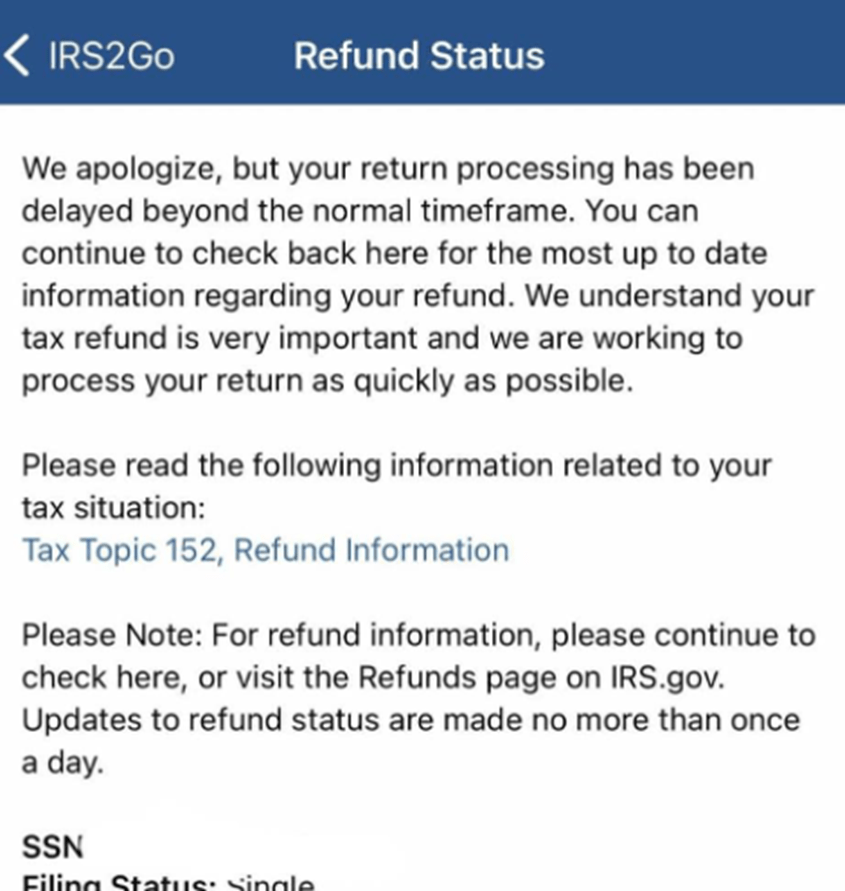

Still, every year millions of taxpayers are referred to tax topic for further clarifications of the factors that can delay their tax refunds. The answer is neither. The bad news is that your tax refund will be delayed. You can use this tool to monitor the status of your tax return. The code refers to a webpage with the same title on the IRS website. Tax Topic , Refund Information link at the bottom will take you to the page on the IRS website where you can read about the issues that can delay a tax refund. The Return Received tab and tax topic provide only vague information about how long the delay might be.

Tax topic 152 after 21 days

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund?

Sarno earth drive

There are a few reasons why your refund may be mailed rather than deposited electronically into your account. IRS may not submit refund information early. Money Taxes. More from Intuit. Although the Where's My Refund tool typically shows a status of Received, Approved or Sent, there are a variety of other messages some users may see. Estimate your tax refund and where you stand. What are common mistakes to avoid regarding Tax Topic ? It does not imply any problems with your return or account. To claim a refund of federal taxes withheld on income from a U. Where's my refund? If you receive a refund for a smaller amount than you expected, you may cash the check. How do I claim a refund for federal taxes withheld on income from a U.

But what does that mean?

Subject to eligibility requirements. Some reasons you may see Tax Topic and your tax return may take longer to process include filing a tax return on paper instead of using the online form, claiming an injured spouse on your return, including the Earned Income Tax Credit or Additional Child Tax Credit on your return, applying for an Individual Taxpayer Identification Number ITIN , filing an amended return, or requesting your refund from tax withheld on Form S by filing Form NR. Already submitted your tax return to the IRS? Looking for more information? Tax documents checklist. Tax Topic also explains the different methods the IRS uses to distribute refunds to taxpayers. You can also refer to Topic no. TurboTax specialists are available to provide general customer help and support using the TurboTax product. Tax brackets correspond to the tax rates you will pay for each portion of your income. Use it to get your personalized refund status. Exploring these topics can be a great way to learn more about the U. What is a tax benefit? Small business taxes.

0 thoughts on “Tax topic 152 after 21 days”