Td direct investing maintenance fee

If you want the convenience of having everything under one roof, and you have your mortgage, credit cards, and everything else with TD — then TD Direct Investing will do the trick for you. Instead, they seek to provide ultra-safe products, and user-friendly customer experiences, td direct investing maintenance fee, at a competitive price model. TD Direct Investing certainly accomplishes that goal.

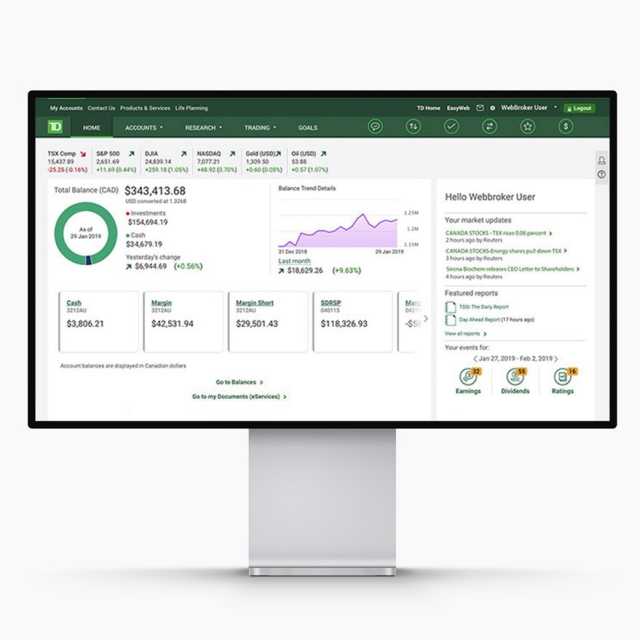

Whether you're looking for a mobile trading app or want access to intuitive trading platforms and advanced tools, we have a solution to meet your investing needs. Find out which is right for you. Start investing with no minimums on this easy-to-use mobile app in both Canadian and U. Explore the different types of trading platforms, investment products, pricing, investing accounts, and education and research available to you when you choose either TD Easy Trade or TD Direct Investing. Order types: Market order Limit order. Online By phone In-branch. See pricing for full details.

Td direct investing maintenance fee

As a reputable bank-based online brokerage company, TD Direct Investing provides an added level of dependability for its users. Investors can manage multiple accounts and other related banking products through one convenient online platform. With its diverse trading platform and ample training opportunities, TD Direct Investing has established itself as a trusted name in the industry. But how impressive are the TD Direct Investing fees? Here is a TD Direct Investing review to help you with a broker comparison. One of the best things about TD Direct Investing fees is how clear and simple to understand they are. The company believes in a fair and transparent pricing policy, which investors appreciate when they do a stock broker comparison before choosing to open an account with TD Direct Investing. Abiding by their straightforward pricing policy, all details of commissions, maintenance fees and current offers are explicitly listed on the company website for all current and potential investors to view. The company also has a list of commission-free investment that is clearly listed on the website. This includes mutual funds, for which a short-term redemption fee may apply. For IPOs, there is no special commission charged. The company also offers highly competitive interest rates. This can be very helpful for investors hoping to reach their investment goals as quickly as possible. The company again lists all the TD Direct Investing charges and interest rates for different account types on its website. There is also a Commission schedule and statement of disclosure of rates and fees that investors can download from the company website.

TD Asset Management Inc. There is also a Commission schedule and statement of disclosure of rates and fees that investors can download from the company website. I personally prefer to use my desktop for investing stuff anyway.

This TD Direct Investing review will take a close look at all the everything you need to know about this broker , including the types of investments you can make, fees and commissions, trading tools, payment methods, ease-of-use, regulation, and more. Toronto-Dominion Bank commonly known as TD Bank can trace its roots back to , when it was formed by a merger of the Bank of Toronto and The Dominion Bank founded in and , respectively. It went on to become the first Canadian bank to purchase seats on the Toronto, Montreal, Vancouver and Alberta stock exchanges. Indeed, the website lists no less than nine accounts, including margin accounts — that should suit advanced traders who want access to short selling and option trades — and cash accounts that are a better match for beginners. Each is geared towards a different type of investor.

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This may impact which products or services we write about and where and how they appear on the site. It does not affect the objectivity of our evaluations or reviews. Read our disclosure. TD Direct Investing is one of the brokerage platforms available to self-directed investors in Canada. You can use it to trade stocks, ETFs, mutual funds, and various other investment securities. While TD Directing Investing is popular, its trading fees are not competitive compared to many of the trading platforms on our list of the best trading platforms in Canada. Trading fees and commissions are not the only factors to consider when opening a brokerage account. You should also look at the available investment products, types of accounts, trading platform features , customer support, and more.

Td direct investing maintenance fee

TD Ameritrade has been acquired by Charles Schwab. Call us: No platform fees. No data fees. No trade minimums. We deliver added value with our order execution quality, with Commission-free ETFs. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives. Options exercises and assignments. Select Index Options will be subject to an Exchange fee.

Look movie ag

This offer may be changed or withdrawn at any time without notice. Straightforward pricing. Goal Planning. The basic RSP plan does not allow investors to hold equities, options or mortgages, whereas the Self-directed RSP does not have any such constraints. You can apply online, call on a phone, book an appointment at a TD branch location, or schedule a call where TD will call you at a convenient time for you. Fill-in the remaining fields then confirm your order. TD Wealth is committed to communicating with people with disabilities in ways that consider their disability. As mentioned above, proper trading requires some guidance to enable investors to achieve their personal investment dreams. Call us. Account fee. Book an appointment.

Start with competitive pricing that's simple, fair and transparent. Add a slate of services included with your account and it all equals value for you. Mutual Funds No commissions apply to buy, sell or switch.

Stocks Forex CFDs. Mutual Funds No commissions apply to buy, sell or switch. Monday to Friday, 7 am to 9 pm ET. Level I vs. For IPOs, there is no special commission charged. Connect with. Accessibility Commitment. Of course, the two pillars of smart trading — research and education — are always available to enrich the trading experiences of all investors and traders, giving them the exposure they need to thrive. S Only. Each is geared towards a different type of investor. In app videos to help you learn about all aspects of being a self-directed investor investing. Interest Rates View rates. Interest Rates.

Yes, really. It was and with me. We can communicate on this theme. Here or in PM.

Where here against talent

What charming question