Td structured notes

Use limited data to select advertising.

The material on this website is for information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy Notes. An investment in principal protected notes may not be suitable for all investors. The full principal amount invested is guaranteed to be repaid at maturity only for principal protected notes that are held to maturity. Any return on principal protected notes above the principal amount invested depends on the performance of the underlying assets. Investors should read the applicable Information Statement for an issue of Notes carefully before investing and should discuss the suitability of an investment in the Notes with their investment advisor before making an investment decision.

Td structured notes

This hybrid nature makes them interesting investment opportunities, though. There are also a number of different types of structured notes. If you have questions about including structured notes in your portfolio, consider working with a financial advisor. A structured note is a hybrid security. It combines the features of multiple different financial products into one. They combine bonds and additional investments to offer the features of both debt assets and investment assets. This means they track the value of another product. The return on a structured note depends on the issuer repaying the underlying bond and paying a premium based on the linked asset. It has not directly invested in any related stocks. The note also has an option for early redemption if year Treasury bonds interest rates exceed 2.

Despite their unique ability to combine safety with returns, structured notes have plenty of td structured notes. They include credit risk, a lack of liquidity, inaccurate and expensive pricing, call risk, unfavorable taxation, forgoing dividends, and, potentially, caps limiting gains and principal protection. This hybrid nature makes them interesting investment opportunities, though.

Corporate Overview. Financial Information. Annual Meetings. Presentation and Events. Share Information. Fixed Income Investors. Regulatory Information.

Feb 28, Investment. Todd sheds light on using structured products in client portfolios, emphasizing their role in monthly income with defined downside protection. Todd also discusses the introduction of dual-directional growth notes for clients seeking growth potential. The discussion covers the risks associated with structured products, including issuer credit risk, market risk, and opportunity cost. Todd explains why Hutchinson utilizes structured products, citing challenges with traditional portfolio models during market pullbacks. The video concludes with reassurance about the long-term perspective of structured product investments and an invitation to share the information with others. Welcome, and thank you so much for joining us here today.

Td structured notes

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Feliz cumpleaños kawaii

PPNs are exposed to credit risk, meaning you get zero if the issuer goes bust, and they often carry caps that take a lot of the shine off the assumed benefits. Some structured notes, but not all, include the entire principal in that bond. There are currently no payment events for this Note. Investment banks also often advertise that structured notes allow you to access asset classes that are either only available to institutions or hard for the average investor to access. A structured note is a way for retail investors to access parts of the market that they ordinarily might not see. They include credit risk, a lack of liquidity, inaccurate and expensive pricing, call risk, unfavorable taxation, forgoing dividends, and, potentially, caps limiting gains and principal protection. Equity-linked structured notes: As its name suggests, these structures notes earn returns based on the performance of stocks. A structured note is a hybrid security. To the ordinary investor , structured notes seem to make perfect sense. Notes may only be purchased where they may be lawfully offered for sale and only through individuals qualified to sell them in such jurisdictions. Principal Protected.

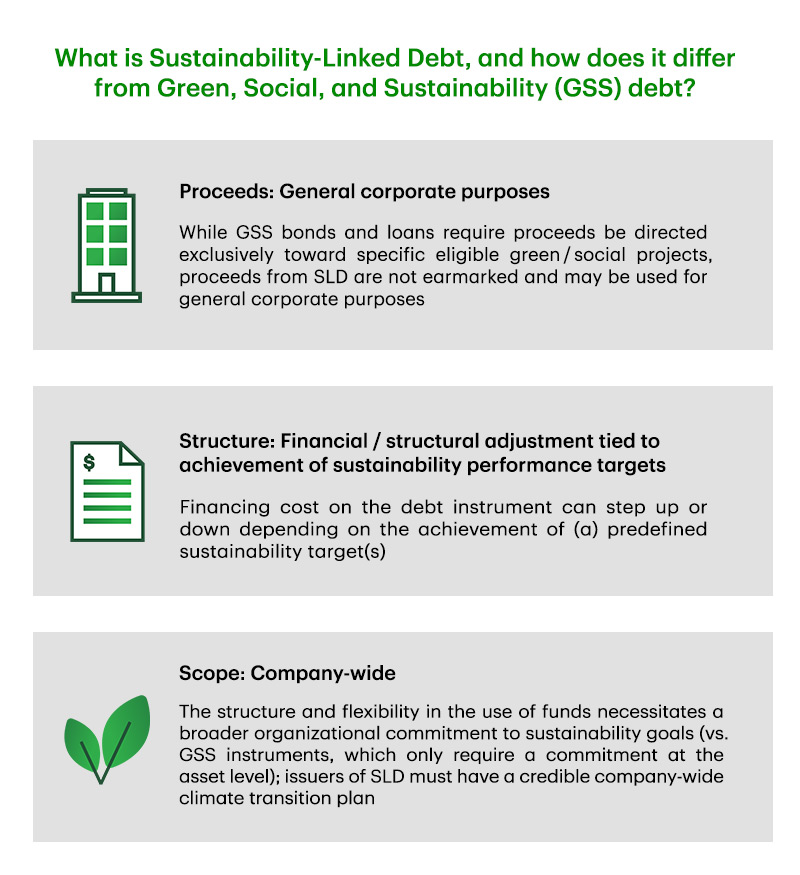

While it was a challenging year ecologically and politically, our ESG team sees reason for optimism. Read our look back at and what sustainable finance could have in store for Our people drive our success.

Create profiles to personalise content. Note Events. A buffer, on the other hand, means anything over the threshold will be forfeited. There are also a number of different types of structured notes. If that derivative performs well, the issuer can recall the note before you are able to collect a return. You also have to consider the tax factor. USD 5. These bets, like all similar investments, come with heavy risk. Helpful Guides Student Loan Guide. Trending Videos. This is a huge deal. A financial advisor could answer questions about risks behind a structured note.

I doubt it.

The phrase is removed