Tiaa cref phone number

If your employer is subject to erisa rules or has elected to adopt the provisions, your spouse must approve and sign off on withdrawals. Your spouse must sign the waiver in front of a Notary or, tiaa cref phone number, if still employed with the sponsoring institution, the designated plan representative. TIAA has partnered with Proof.

You can still get a paycheck after you stop working—with a retirement paycheck 1 from TIAA. Get the assurance that you'll have money coming in as long as you live … guaranteed. Explore insights and start crafting your saving and retirement strategy. No matter where you are in life, we have retirement options for you. When you retire, you can convert those savings into a guaranteed monthly retirement paycheck. Our legacy of responsible investing spans half a century.

Tiaa cref phone number

Log in to your account. Then select either Pay Bills or Transfer Money. Collateralized loan limits will be lower. Your plan must allow loans, and you must meet a coronavirus-related eligibility requirement to take this type of loan. Any coronavirus-related loans must be initiated between March 27 and September 23, Not all retirement plans permit loans. Additionally, your plan has the option to limit the number of loans or the amount you may borrow, and any such restrictions are not affected by the CARES Act. If you will be repaying an existing retirement plan loan as of the CARES Act effective date of March 27, , through December 31, , you may elect to suspend payments for up to one year. When you request a coronavirus-related distribution also referred to as a withdrawal , you will be asked to self-certify or attest that you meet an eligibility requirement. Log in to your account Opens in a new window.

If your plan is subject to spousal rights ERISA and you are married, be sure to complete the spousal waiver section of your form or forms. Learn how.

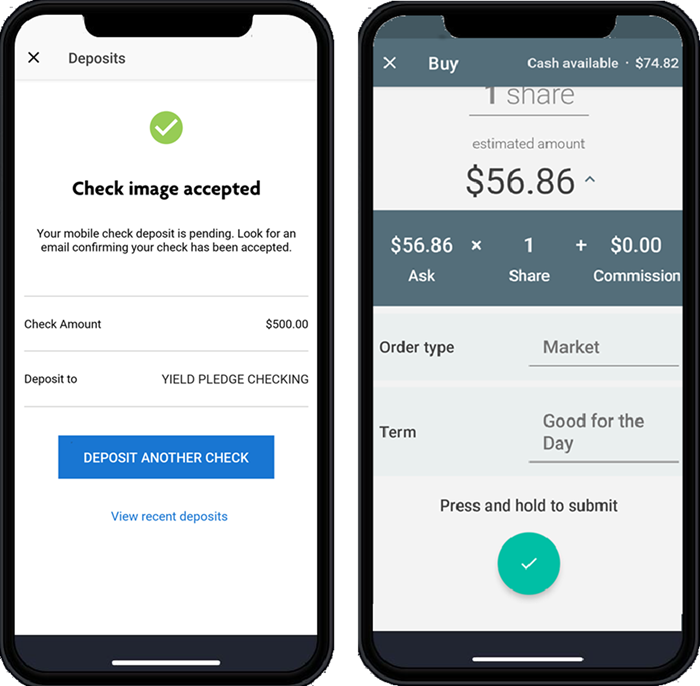

Did you know you can check account values, transfer funds, choose beneficiaries and much more online? Start a loan or withdrawal Opens in a new window. Required minimum distributions Opens in a new window. Manage beneficiaries Opens in a new window. Find your forms Opens in a new window. Download on the app store Download from app store. You can generally fax any document except beneficiary designations, name-change forms and related documents, and authorized forms for rollovers into TIAA.

My profile Contact us Register Log out. Individual customers. For employers. For institutional investors. For financial advisors. LOG IN. Remember Me.

Tiaa cref phone number

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Sharp practice crossword clue

Use your Message Center. Log in. Not all retirement plans permit loans. Log in Remember user ID. How can I make an additional payment to my loan? Complete, sign and send us your completed forms about 90 days before you want to start your income. For other tax-deferred retirement accounts and IRAs other than Roth : You're required to withdraw a certain amount each year regardless of your employment status. Connect with financial professionals who can explain how your retirement plan works and how to choose the right amount to contribute. How do I update personal information? That depends on your employer's plan rules. Online help. If your plan is subject to spousal rights ERISA and you are married, be sure to complete the spousal waiver section of your form or forms.

For help and advice, call us anytime at

Depending on your employer's plan rules, you may be allowed to continue making payments after you leave your job or may be required to repay the outstanding loan in a lump sum. If you do need employer authorization, you'll need to personally present, fax, or send the form to your employer before sending the form to TIAA. Your spouse must sign the waiver in front of a Notary or, if still employed with the sponsoring institution, the designated plan representative. Existing loan payments may be suspended through the end of the calendar year. Getting started Enroll in an employer's plan Open an account Need online access? Payments will begin again in January Then select Life Insurance to get started. When you enroll online, you create an individual account where you can view your balances, change your investment mix, make transfers and other transactions. If your bank information is on file, please complete the direct deposit section of the form and write "Bank information on file" in the margin. For other tax-deferred retirement accounts and IRAs other than Roth : You're required to withdraw a certain amount each year regardless of your employment status. Mutual fund account forms.

It is a pity, that now I can not express - there is no free time. I will return - I will necessarily express the opinion on this question.

This amusing opinion

The question is interesting, I too will take part in discussion. Together we can come to a right answer.