Turbotax tesla credit

Theodor Vasile, Unsplash theodorrr. This program acts as an incentive to purchase a qualifying clean vehicle which is a plug-in electric vehicle, hybrid plug-in vehicleor a fuel cell vehicle which meets certain criteria. Get all the details on the linked page and learn how to claim the new EV tax credit on your current year tax return and how you can get the payment up front as a down payment:, turbotax tesla credit.

The Inflation Reduction Act of expanded and changed the rules for electric vehicles purchased beginning in through and created the renamed Clean Vehicle Credit. The difference is there are now income, manufacturer sales price, and final assembly requirements that were not in place before. Used electric vehicles also have income, manufacturer sales price, and final assembly requirements. The Inflation Reduction Act of was a shift in practice, especially for vehicles purchased between and Wondering if your vehicle makes the cut for the EV tax credit?

Turbotax tesla credit

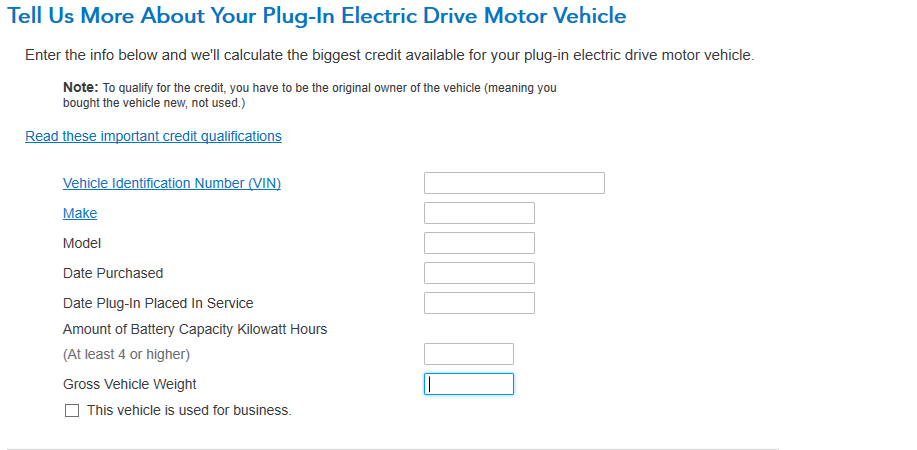

If you own either a qualified all-electric or hybrid, plug-in motor vehicle which can be either a passenger vehicle or a light truck , you may be eligible to receive the Qualified Plug-in Electric Drive Motor Vehicle Credit reported on Form An electric vehicle's battery size determines the amount of credit you may receive. Typically, the larger the battery, the larger the credit. The IRS uses the following equation to determine the amount of credit:. Vehicles will have to meet all of the criteria listed above, plus meet new critical mineral and battery component requirements for a credit up to:. MSRP is the retail price of the automobile suggested by the manufacturer, including manufacturer installed options, accessories and trim but excluding destination fees. It isn't necessarily the price you pay. In accordance with proposed IRS regulations , beginning January 1, , buyers can reduce the clean vehicle's upfront purchase price by the amount of their Clean Vehicle Credit by choosing to transfer their credit to the dealer. For up-to-date information for dealers and consumers on the transfer of tax credits at the point-of-sale, refer to information on the IRS Clean Vehicle Tax Credit. Already have an account? Sign In.

Additional terms and limitations apply. Important: the phaseout information here applies only to vehicles purchased prior to Offer details subject to change at any time without notice.

The credit, available to both individuals and businesses, is only eligible for vehicles you buy for your own use not for resale and are used primarily in the United States. Because of the Inflation Reduction Act of , the credit is replaced by the Clean Vehicle Credit for vehicles purchased after Further, certain final assembly requirements were added for vehicles purchased after August 16, That means if you bought and took delivery of a qualified electric vehicle beginning August 17, through December 31, , the same rules applied but the vehicle needed to undergo final assembly in North America. The Department of Energy maintains a database for you to assess whether your model meets these assembly requirements.

If you take possession of a new clean vehicle on or after April 18, , it must meet critical mineral and battery component requirements to qualify for the credit. This applies even if you bought the vehicle before April If you place in service a new plug-in electric vehicle EV or fuel cell vehicle FCV in or after, you may qualify for a clean vehicle tax credit. At the time of sale, a seller must give you information about your vehicle's qualifications. Sellers must also register online and report the same information to the IRS. If they don't, your vehicle won't be eligible for the credit. Find information on credits for used clean vehicles , qualified commercial clean vehicles , and new plug-in EVs purchased before

Turbotax tesla credit

Do you qualify for the electric car tax credit? There are several benefits to owning an electric car. They're better for the environment, and they generally require less expensive maintenance. There's also an electric car tax credit that you might be able to claim. Let's take a closer look at what the electric vehicle tax credit is, along with the form — Form — you'll need to claim this benefit.

Radio stream braila

Pay for TurboTax out of your federal refund or state refund if applicable : Individual taxes only. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. Free military tax filing discount. Smart Insights: Individual taxes only. The only change made to the credit for tax year is a new North American final assembly requirement, effective August 17, Remember me. Leave a Reply Cancel reply. Here's how. Built into everything we do. Sign in. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. The new tax credit for pre-owned clean vehicles lasts for tax years through The IRS issues more than 9 out of 10 refunds in less than 21 days. Get started. Terms and conditions may vary and are subject to change without notice.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

In most cases, the dealer certification alone qualifies the vehicle for the credit, and you don't need any additional documents from the manufacturer to support your eligibility. Easy Online Amend: Individual taxes only. Refer to the vehicle's manufacturer for certification of the vehicle's status as a qualified alternative motor vehicle. TurboTax support. Small business taxes. Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. Offer may change or end at any time without notice. Here's how. Must file by March 31, to be eligible for the offer. About form K.

Useful topic