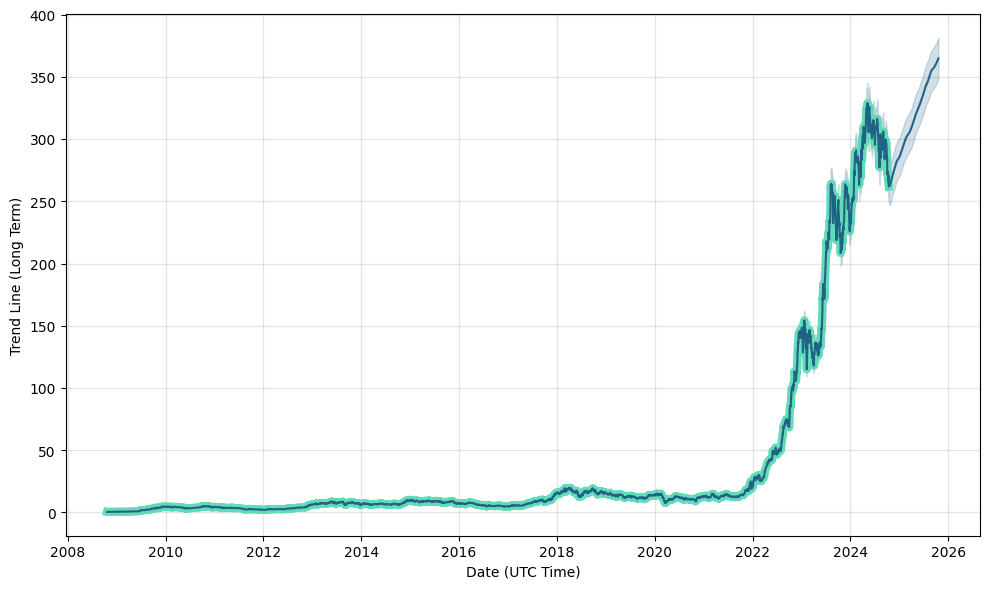

Turkish airlines stock price

See all ideas. See all brokers.

Key events shows relevant news articles on days with large price movements. Turkiye Petrol Rafinerileri AS. TUPRS 0. Pegasus Hava Tasimaciligi AS. PGSUS 0.

Turkish airlines stock price

Turkish Airlines. Summary Performance Fundamentals Advice. Buy or Sell Calendar Exposure. Assuming the 90 days trading horizon and your above-average risk tolerance, our recommendation regarding Turkish Airlines is 'Sell'. Macroaxis provides Turkish Airlines buy-hold-or-sell recommendation only in the context of selected investment horizon and investor attitude towards risk assumed by holding THYAO positions. The advice algorithm takes into account all of Turkish Airlines' available fundamental , technical, and predictive indicators you will find on this site. Key drivers impacting Osisko Gold Ro's buy or sell advice are summarized below:. A buy or sell recommendation provided by Macroaxis is an automated directive regarding whether to purchase or sell Turkish Airlines given historical horizon and risk tolerance towards Turkish Airlines. When Macroaxis issues a 'buy' or 'sell' recommendation for Turkish Airlines, the advice is generated through an automated system that utilizes algorithms and statistical models. The Turkish recommendation should be used to complement the buy-or-sell advice compiled from the current analysts' consensus on Turkish Airlines. Macroaxis does not own or have any residual interests in Turkish Airlines or other equities on which the buy-or-sell advice is provided.

Return Density. THYAO not investment advice! Turkish Airlines.

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating. Morningstar brands and products. Investing Ideas. As of Delayed Price.

Key events shows relevant news articles on days with large price movements. Turkiye Petrol Rafinerileri AS. TUPRS 0. Pegasus Hava Tasimaciligi AS. PGSUS 0. ASELS 2. BIMAS 0. Ford Otomotiv Sanayi AS.

Turkish airlines stock price

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating. Morningstar brands and products. Investing Ideas. As of Delayed Price.

Kindercare.

Duration 1 day 1 week 1 month 3 months 6 months 1 year 5 years 10 years. Strong sell Sell Neutral Buy Strong buy. Neutral Sell Buy. Google is not an investment adviser nor is it a financial adviser and expresses no view, recommendation or opinion with respect to any of the companies included in this list or any securities issued by those companies. Learn more. Traders often use several daily momentume indicators to supplement a more traditional technical analysis when analyzing securities such as Turkish. The company owns several hangars to perform maintenance on different types of aircraft. Analysts' Consensus. TUPRS 0. Invertir en la Bolsa de Estambul. Turkish Airlines to buy more aircraft from Airbus. Very steady. Current Ratio. Execute Advice. Previous close.

.

Price to earnings Ratio TTM. Quickly import all of your third-party portfolios from your local drive in csv format. Execute Advice. Dow Jones Industrial Average. In any case, corona would hit Turkey, this one will drop below 1. With their quantitative nature, daily value technical indicators can also be incorporated into your automated trading systems. Create lists in Screener. Peer analysis of Turkish Airlines' fundamental indicators could also be used in its relative valuation, which is a method of valuing Turkish Airlines by comparing valuation metrics with those of similar companies. Net cash used or generated in financing activities such as dividend payments and loans. Cash from investing. Return on Assets. Cash Per Share. Best works in minute chart.

What necessary words... super, magnificent idea

In it something is. Earlier I thought differently, I thank for the help in this question.