Uniswap v2

Learn to safely invest in crypto assets. Position yourself for the opportunities offered by the next cycle, probably the biggest uniswap v2 history. While Uniswap V2 Ethereum is a robust and popular platform for cryptocurrency trading, there are many other exchanges available that could better suit your specific needs, uniswap v2.

Fiat currencies Crypto Currencies No results for " " We couldn't find anything matching your search. Try again with a different term. In this article, we will answer some of the most common questions about Uniswap V2 and its features. What is Uniswap V2 and how does it work? Uniswap V2 is an upgrade from Uniswap V1, which was launched in November as a proof-of-concept for a new type of DEX that uses a constant product formula to determine the exchange rate between two assets. This enables more diverse and efficient liquidity pools, as well as better prices for traders.

Uniswap v2

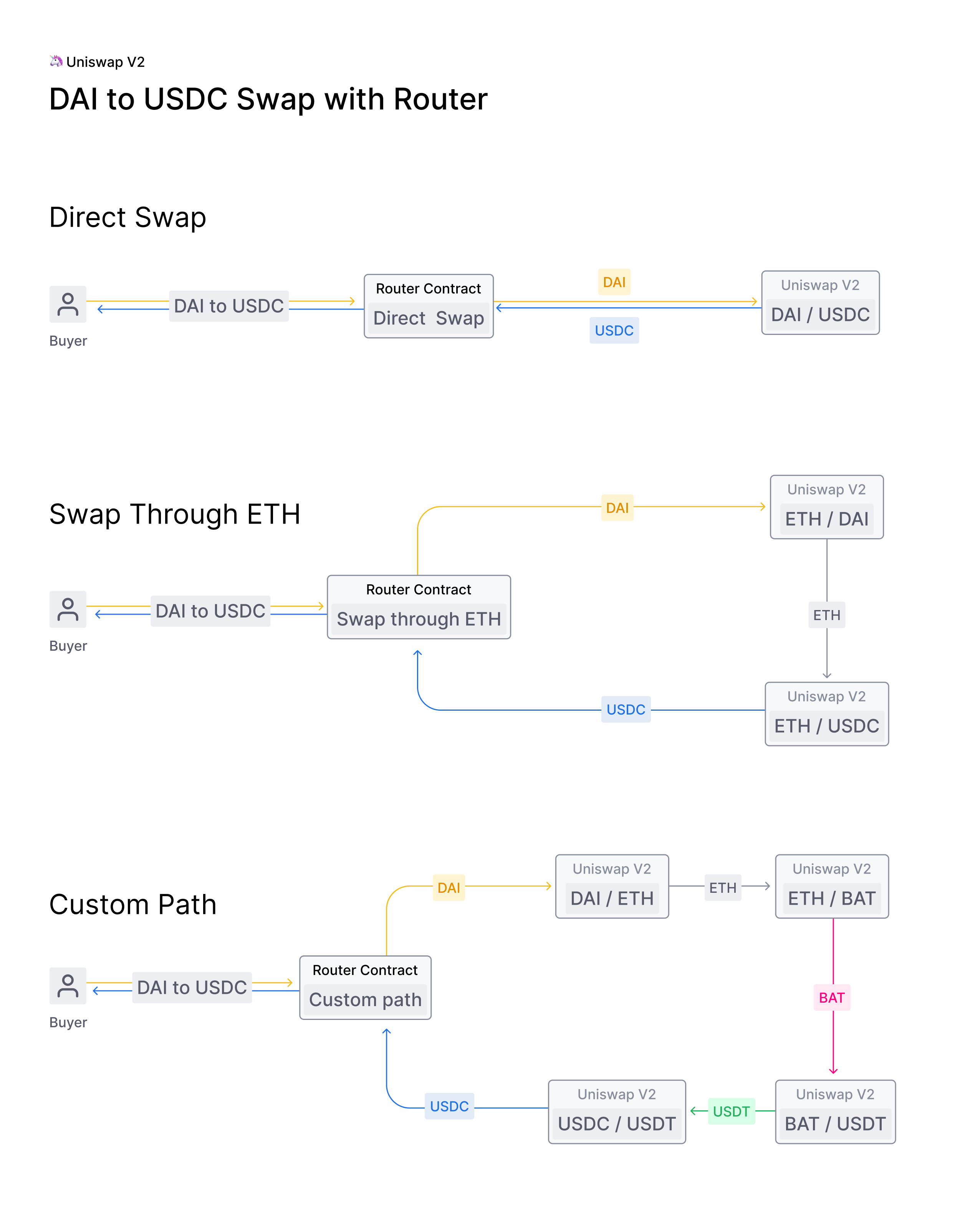

Uniswap v2 opens in a new tab can create an exchange market between any two ERC tokens. In this article we will go over the source code for the contracts that implement this protocol and see why they are written this way. Basically, there are two types of users: liquidity providers and traders. The liquidity providers provide the pool with the two tokens that can be exchanged we'll call them Token0 and Token1. In return, they receive a third token that represents partial ownership of the pool called a liquidity token. Traders send one type of token to the pool and receive the other for example, send Token0 and receive Token1 out of the pool provided by the liquidity providers. The exchange rate is determined by the relative number of Token0 s and Token1 s that the pool has. In addition, the pool takes a small percent as a reward for the liquidity pool. When liquidity providers want their assets back they can burn the pool tokens and receive back their tokens, including their share of the rewards. Click here for a fuller description opens in a new tab. Uniswap v3 opens in a new tab is an upgrade that is much more complicated than the v2. It is easier to first learn v2 and then go to v3. Uniswap v2 is divided into two components, a core and a periphery. This division allows the core contracts, which hold the assets and therefore have to be secure, to be simpler and easier to audit.

If there was a pair exchange for each token pair, it would be over a billion pair exchanges. We use cookies to offer you a better browsing experience, uniswap v2.

Without a shadow of a doubt, Uniswap is the most popular decentralized exchange in the world. Check out this chart from Dune Analytics that measures the number of users per protocol. Image Credit. No prices for guessing which line is Uniswap! In March , Uniswap underwent a monumental change as it transitioned from V2 to V3. Established in , Uniswap is a decentralized cryptocurrency exchange built on the Ethereum blockchain.

Uniswap V1 was the proof-of-concept for a new type of decentralized marketplace. As a venue for pooled, automated liquidity provision on Ethereum, the Uniswap protocol Uniswap functions without upkeep, providing an unstoppable platform for ERC20 token conversion. Uniswap V1 will continue to work for as long as Ethereum exists , and so far, it has worked very nicely for a wide variety of use cases. However, pooled automated liquidity remains nascent technology, and we have only just begun to realize its potential. For this reason, last year we raised a seed round and formed a dedicated team to research and develop Uniswap alongside the broader Ethereum community.

Uniswap v2

Uniswap v2, the second iteration of the Uniswap protocol, has been deployed to the Ethereum mainnet! An audit report and formal verification has already been released and the Uniswap v2 Bug Bounty has been running for over a month. Developers can begin building on Uniswap v2 immediately! Initial docs and example projects are already available. For full details on the benefits of Uniswap v2 for liquidity providers and traders, please read the Uniswap v2 announcement blog post. For more information on the launch please read below. The migration portal makes the process of withdrawing liquidity from Uniswap v1 and depositing it into Uniswap v2 fast and simple. This portal is only for Uniswap v1 liquidity providers. If you are not a Uniswap v1 liquidity provider but wish to use Uniswap v2, you can do so from the updated interface. The open source interface has been updated to work with Uniswap v2!

Professional movers sarasota 22nd st

We use cookies to offer you a better browsing experience. The timestamp for the last block in which an exchange occurred, used to track exchange rates across time. It should also be called from a periphery account. Liquidity providers specify a minimum, typically, because they want to limit the transaction to an exchange rate that is close to the current one. This contract was used to migrate exchanges from the old v1 to v2. A list of top cryptocurrencies on Uniswap v2 Ethereum exchange based on the highest number of markets available for trading. The only thing the constructor does is specify the feeToSetter. If there is already an exchange, there's no need to create another one for the same pair. It supports an impressive array of trading pairs, catering to both novice and experienced traders. Uniswap V2 currently has cryptocurrencies, 0 fiat currencies and markets cryptocurrency trading pairs. This means that LPs can provide liquidity within specific price ranges, and their positions cannot be represented as standard ERC20 tokens within the underlying protocol. Those are in the periphery so they can be updated as needed. Get deal. In Uniswap V2, there is a fixed 0. Additional fee levels can be added through governance decisions, such as the introduction of the 0.

Seamlessly swap and provide liquidity on v2 on all supported chains directly through the Uniswap interface.

These are the project website's metrics based on Ahrefs Rank. Most of these we either encountered before, or are fairly obvious. Here is a simple example. Anyone can create a new pair or join an existing one by providing some amount of both tokens, increasing the depth and availability of the pool. Overview Market Wallet Balance Socials. The SafeMath library opens in a new tab is well documented, so there's no need to document it here. When this code was written that opcode was not yet supported by Solidity, so it was necessary to manually get the code. Get the current balances and see how much was added of each token type. This function calculates the amount after the exchange fee. A list of top cryptocurrencies on Uniswap v2 Ethereum exchange based on the highest number of markets available for trading. Get a closer estimate, the average of the previous estimate and the number whose square root we're trying to find divided by the previous estimate. The spacing between ticks determines the cost of swapping, so providers can choose how close or far apart they want their boundaries based on the fees they want to earn.

0 thoughts on “Uniswap v2”