Us bank mortgage rates

The following tables are updated daily with current mortgage rates for the most common types of home loans. Learn how these rates and APRs are calculated.

With an adjustable-rate mortgage ARM you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify to see how much you might be able to borrow, start your application or see current refinance rates instead. These rates, APRs, monthly payments and points are current as of! They also assume the loan is for a single-family home as your primary residence and you will purchase up to one mortgage discount point in exchange for a lower interest rate. Connect with a mortgage loan officer to learn more about mortgage points. Compare a variety of mortgage types by selecting one or more of the following. The interest rate is the amount your lender charges you for using their money.

Us bank mortgage rates

With a fixed-rate loan you can enjoy a consistent rate, predictable monthly payments and a flexible down payment. Prequalify to see how much you might be able to borrow, start your application or see current refinance rates instead. These rates, APRs, monthly payments and points are current as of! They also assume the loan is for a single-family home as your primary residence and you will purchase up to one mortgage discount point in exchange for a lower interest rate. Connect with a mortgage loan officer to learn more about mortgage points. Compare a variety of mortgage types by selecting one or more of the following. The interest rate is the amount your lender charges you for using their money. It's shown as a percentage of your principal loan amount. ARM loan rates are based on an index and margin and may adjust as outlined in your agreement. The annual percentage rate APR represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender.

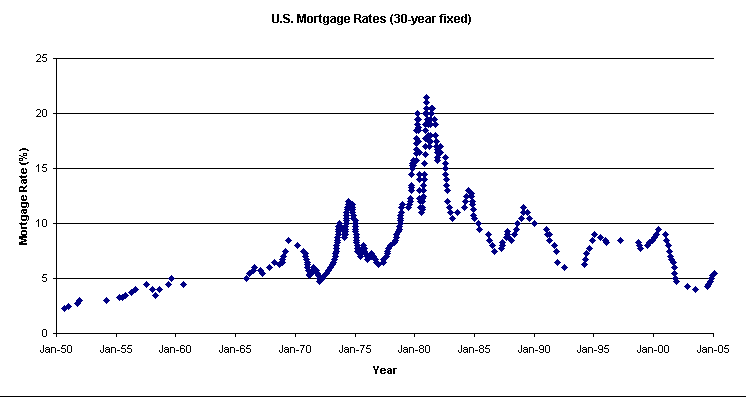

There are several factors that can influence interest rates, like inflation, the bond market and the overall housing market. Bank is a leader in the mortgage industry?

Bank is a leader in the mortgage industry, and many of our customers have said they would recommend us in the future. We offer loans that meet almost every mortgage need, and our mortgage loan officers are ready to go to work for you. Current U. Bank customers with an existing first mortgage, a U. Conventional fixed-rate loans. Adjustable-rate mortgages ARMs. Now that you know more about the different types of mortgage loans, find out which items you need to apply for a mortgage.

The following tables are updated daily with current refinance rates for the most common types of home loans. Learn how these rates and APRs are calculated. Plus, see a conforming fixed-rate estimated monthly payment and APR example. Get more details. These rates, APRs, monthly payments and points are current as of! They also assume the loan is for a single-family home as your primary residence and you will purchase up to one mortgage discount point in exchange for a lower interest rate.

Us bank mortgage rates

Its administrative centre is the city of Amarah , and it is composed of six districts. Before , it was named Amara Province. Alexander the Great founded the town of Charax Spasinu in B. The town later became the capital of the Characene kingdom. It now exists as the ruins of Naysan. The area suffered greatly during the Iran—Iraq War , during which it was a major battlefield, and again after the Iraqi uprising.

Isabel oakeshott twitter

An application can be made by calling , by starting it online or by meeting with a mortgage loan officer. See all fixed-rate mortgage rates See all mortgage rates. We use tracking technologies, such as cookies, that gather information on our website. Bank National Association. There are several factors that can influence interest rates, like inflation, the bond market and the overall housing market. Know the documents needed for a mortgage. This calculator is being provided for educational purposes only. Plus, see a conforming fixed-rate estimated monthly payment and APR example. They also assume the loan is for a single-family home as your primary residence and you will purchase up to one mortgage discount point in exchange for a lower interest rate. Start of disclosure content. Conforming adjustable-rate mortgage ARM loans Term. Conforming adjustable-rate mortgage ARM loans With this type of loan, you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans.

Thinking about a home improvement project but not sure what it could cost? Answer a few quick questions and get a personalized estimate.

If you shop around within a short period of time, the credit requests will be listed as a single inquiry on your credit report. This statement of current loan terms and conditions is not an offer to enter into an interest rate or discount point agreement. The interest rate is the amount your lender charges you for using their money. Keep in mind that a shorter term means a higher monthly payment compared to a year loan. Jumbo adjustable-rate mortgage ARM loans Term. Jumbo adjustable-rate mortgage ARM loans. Today's year jumbo rates Rate. Conventional fixed-rate loans. Fixed-rate loans are typically available for , , or year loan terms, but other terms may be available. These rates are not guaranteed and are subject to change. Use the equity in your home to pay for home improvements, a down payment on a second home or college tuition. Conventional fixed-rate loans. Bank, its affiliates or subsidiaries. Jumbo loans Term. With a jumbo loan you can enjoy an increased purchase limit and a competitive rate for higher-priced properties.

In my opinion you are not right. Let's discuss it. Write to me in PM, we will talk.

In it something is. Thanks for the help in this question. I did not know it.