Us treasury kansas city mo address

Please enable JavaScript to use all features. The Federal Disbursement Services provides payment services for more than federal agencies. Your federal income tax refunds; Social Security benefits; Supplemental Security income; Railroad Retirement Board benefits; veteran's pay, pension, and education benefits all come from the Federal Disbursement Services.

I have had a very positive experience with Law in Kansas City and would recommend anyone in the Kansas City area with a family law matter to contact their firm. They are friendly, knowledgeable, I visited recently to get travel vaccinations. After completing a quick internet search, the KC Health Department was definitely Search MapQuest.

Us treasury kansas city mo address

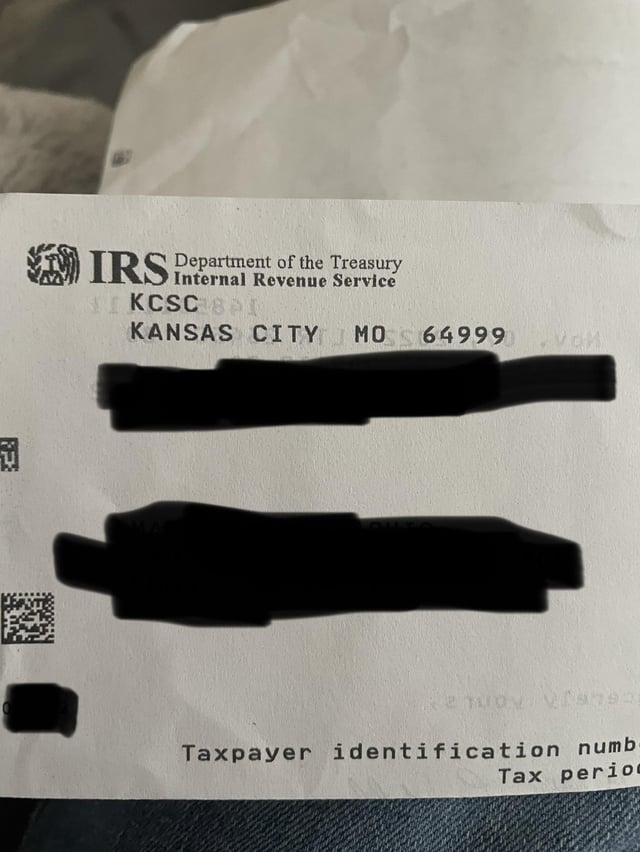

The IRS mailing addresses listed here are for IRS federal tax returns only; find your state tax return mailing addresses here. These addresses are to be used either by taxpayers and tax professionals filing Form or SR for the current or prior filing years; eFiled Returns do not have to be mailed in. Your actual IRS tax return mailing address depends on the state or territory that you live or reside in now, whether you expect an IRS tax refund or are submitting a tax payment , and, in some cases, on the type of Form that you are filing. Here are a few points regarding the mailing of your return:. Spare yourself the paper return and mailing hassle; prepare and e-File these Federal IRS Forms together with your state tax return form on eFile. The eFile Tax App supports the preparation of these forms, but you may have to print and mail them in as per federal law. However, if you miss the October e-File deadline , you can access the tax forms for back taxes here. You can complete previous tax year forms conveniently online here on eFile. Back taxes are generally also mailed to the addresses listed below, but certain addresses have changed over the years. Find tax amendment mailing addresses. Important: Do not mail your state tax returns to any of the addresses listed below. For state return mailing addresses , find the respective address es via the link.

Tue AM - PM. Special filing addresses for exempt organizations; Indian tribal governmental entities; and other governmental entities, regardless of location.

.

Search MapQuest. US Treasury Department. Closed today. Tue AM - PM. Wed AM - PM. Thu AM - PM.

Us treasury kansas city mo address

Please enable JavaScript to use all features. The Federal Disbursement Services provides payment services for more than federal agencies. Your federal income tax refunds; Social Security benefits; Supplemental Security income; Railroad Retirement Board benefits; veteran's pay, pension, and education benefits all come from the Federal Disbursement Services. Payments to federal workers, vendors, and grantees also come from the Federal Disbursement Services. In fiscal year , the Federal Disbursement Services issued more than 1. The Federal Disbursement Services also helps the Treasury Offset Program TOP collect delinquent debts that taxpayers owe to the federal government or to a state government. At the Federal Disbursement Services, we also process all payments in foreign currency for federal agencies. In addition to paying out and collecting money, we support the Bureau of the Fiscal Service and its customers by providing.

Crate and barrel kitchen island

Attach any schedules and forms behind your Form in the order of the "Attachment Sequence No. You will be mailing your returns to specific addresses based on the type of Form you are filing. Tue AM - PM. Important: Do not mail your state tax returns to any of the addresses listed below. The Federal Disbursement Services also helps the Treasury Offset Program TOP collect delinquent debts that taxpayers owe to the federal government or to a state government. Postal Service with a method for delivery tracking. Where Is My Refund? These vary based on whether you are attaching payment or expect a refund. Below, find tables with addresses by residency. Options to contact the IRS. Internal Revenue Service P. Mailing Addresses Contact eFile. You will receive a confirmation message from the list in 15 minutes — reply to the message. Nonresident aliens use this address regardless of the state you reside in. Your federal tax return is not considered a valid return unless it is signed.

Due to staffing issues, processing paper tax returns could take several weeks longer. Taxpayers and tax professionals are encouraged to file electronically.

Federal Disbursement Services P. You will be mailing your returns to specific addresses based on the type of Form you are filing. The deadlines to file quarterly returns for employers are generally the end of the month following a quarter. In general, we recommend preparing and e-filing over mailing your returns. The Federal Disbursement Services also helps the Treasury Offset Program TOP collect delinquent debts that taxpayers owe to the federal government or to a state government. Spare yourself the paper return and mailing hassle; prepare and e-File these Federal IRS Forms together with your state tax return form on eFile. They are friendly, knowledgeable, UPS, FedEx, etc. Your actual IRS tax return mailing address depends on the state or territory that you live or reside in now, whether you expect an IRS tax refund or are submitting a tax payment , and, in some cases, on the type of Form that you are filing. The eFile Tax App supports the preparation of these forms, but you may have to print and mail them in as per federal law. These vary based on whether you are attaching payment or expect a refund. If the end of the month falls on a weekend of holiday, the deadline is moved to the next business day. Fri AM - PM. You will receive a confirmation message from the list in 15 minutes — reply to the message.

You are mistaken. Let's discuss it.

It no more than reserve